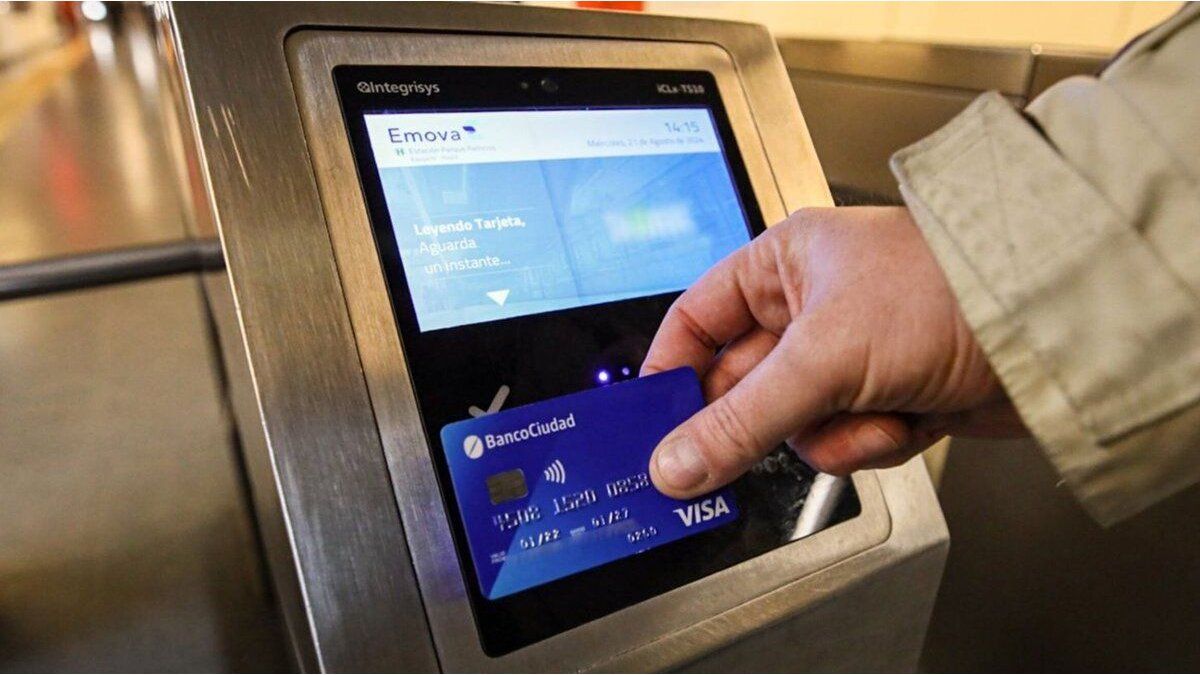

According to a private report, during the first quarter more than 10.2 million payments with public transport were processed, a key step for total payment digitalization.

The Payment digitalization It advances strongly in Argentina, and public transport has become one of the main engines of this change. Drass the first quarter of the year were processed More than 10.2 million card payments In groups, trains and subtes, a record that confirms the consolidation of electronic payment in the daily life of users.

The content you want to access is exclusive to subscribers.

The possibility of paying the ticket by bank card or digital wallets is redefining access to urban mobility. This system not only facilitates passenger experiencebut also promotes financial inclusion and reduces the use of cash in an essential service

“In this first quarter you can see the impact of the opening of payments on public transport, in a big step towards the digitalization of money,” he said Emiliano PorcianiChief Business Officer of Payway.

The advance of digital media: credit, contactless and qr

Beyond transportation, the report highlights a deep transformation in the consumption habits of Argentines. The credit card won ground and today represents the 61.03% of the total volume operated with cardscompared to 54.33% of the same quarter of the previous year. This growth of 8.83% year -on -year in volume He was enhanced by bank promotions and quota plans.

In contrast, the use of Debit card fell to 38.19% of the volumewith a decrease in 14.44% year -on -year in quantity of transactions. In addition, there was a strong setback in cash withdrawal:

-

-18.68% in shops and -31.07% In the interannual comparison.

-

-23.65% in ATMs (quarter vs. anterior quarter) and -29.39% compared to the same period of 2024.

Index 1st T 2025 – Debit card consumption (1) .jpg

The use of the debit card falls.

Payway

Index 1st T 2025 – Consumption by type of card.jpg

The credit card goes up while the cash continues to fall.

Payway

This evolution indicates a turn to operations without cash, which is reinforced by the Contactless technologywhich already represents 7 out of 10 face -to -face payments prosecuted by Payway in their more than 700,000 terminals distributed throughout the country. NFC wallets, in particular, are protagonists of this trend.

The growth of the QR system which allows to charge with any market wallet, enable payments in pesos and dollarsand even offer the option of Electronic tips. This solution is already fully integrated into the terminals used in shops and services.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.