The chances of a low rate in the short term

The probability that the Fed resumes the loss of rates in the short term is getting smaller. After starting a sequence of cuts last year, the Central Bank reduced its projections by 2025: He went from anticipating a cut of 100 basic points in September to only 50 points in December. This more conservative turn generated an immediate correction in the markets, with a 3% decrease in the S&P 500.

The reasons behind that caution have to do with the fear of reviving inflation. The combination of stricter immigration policies, high tariffs and eventual fiscal stimuli – such as those raised by Trump – could generate new pressures on prices. According to the minutes of the last meeting, that risk led Fed officials to hold the current level of fees.

Pedro Siaba Serratesenior analyst in Personal investments portfolio (PPI), explains in dialogue with Scope that, a priori, No Changes in the interest rate are expected this week, but all the attention will be set at Powell’s press conference.

Fed 1.jpeg

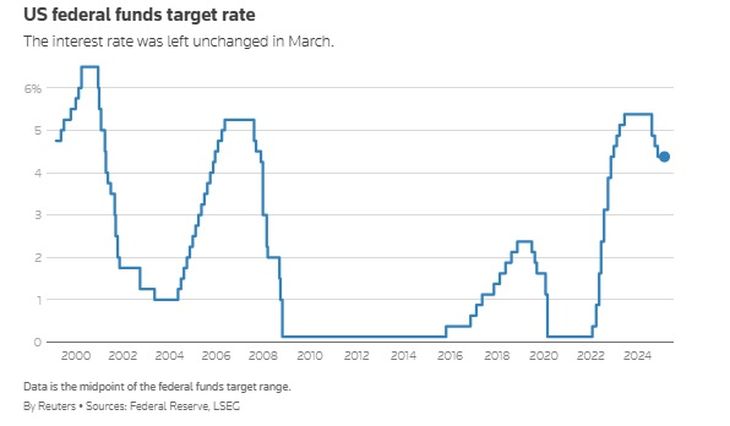

Without immediate return to prepaymia levels (0-1%): unlike the previous crises, the market does not expect a return to ultrabajas rates. Source: Reuters.

“The focus will be in your vision about the main fear of the market: A recession derived from Trump’s commercial fluctuations “. For the strategist, the republican agenda caused a “staniflation shock, comparable to that of the COVID in terms of volatility” and that challenges the economic paradigm of the last 50 years.

The analyst indicates that although Trump was democratically elected, today his electorate rejects the economic consequences of these policies. “The fall in consumer confidence of the University of Michigan It is the strongest in three months since the 1990 recession “. If Serrate also emphasizes that unlike other crises, this time the US market reacted as an emerging: “There was no refuge in treasure bonds“, he says.

And this lack of shelter reveals that Trump’s discursive moderation coexists with a growing political cost. In parallel, a gap between soft and hard data persists: while confidence rates collapse, “purchasing managers index” (PMIS) slow down and upload the inflation expectation, employment data, the employment data They still do not reflect the same deterioration.

What the analyst refers to is that the implementation by Trump of the most severe tariffs in a century weakened the confidence of consumers and companies. The manufacturing sector was beaten by an early wave of imports that was so large that the Gross Domestic Product (GDP) of the United States contracted unexpectedly in the first quarter of the year. In that context, American companies such as McDonald’s, General Motors and Applethey already warned of the impact on their profits due to the increase in tariffs, which raise costs and discourage spending.

What to expect at the next Fed meeting

The nine consecutive running streak of the S&P 500 rates – the longest in more than 20 years, according to FACTSET data – occurred after Trump softened his position on Powell on April 21. Although part of the rebound is attributed to advances in commercial negotiations,

However, that optimism could be oversized. According to the CMM Fedwatch tool, investors allocate a 99.5% probability that the Federal Reserve keeps its reference rate in May, although they continue to discount three cuts before the end of 2025. For their part, the prediction markets in real time as Polymarket They reflect a similar expectation: 98% probability that there are no modifications at this week’s meetingcompared to just 1% for both 50 basic points and for a 25 -point rise.

If there is no cut in May, investors will pay attention to any indication that there may be in June. Nevertheless, If the Fed expects to see if there are effects of tariffscould postpone the decision until the 90 -day tariff truce ends in July, which would push the cut even later.

Matías Waitzelpartner of At investments, It coincides with the look that the market expects the Fed to maintain the unchanged rate this week, with a possible cut in June, “although that probability was reduced after the latest solid employment data,” slides.

And is that as explained Waitzelthe American economy is still strong: inflation slows down, the labor market remains firm and many companies presented positive results in this season of balances. “However, a cut will only happen if more robust macro indicators begin to deteriorate, something that could be accelerated if commercial tensions increase within the framework of the current tariff war driven by the US,” he says.

Fed 2.jpeg

The graph illustrates how Fed cuts rates in times of crisis and recessions, and rises when there is a risk of inflation. Source: Reuters.

For its part, Pedro Moreyradirector of Capital Guardianclarifies with the other analysts and argues that there will be no change in monetary policy on this occasion. Its projection is based on the last speeches of Powell and other leaders of the agency they marked “A caution scenario before the current situation“

For Moreyra, the commercial war injected volatility in the markets and in the value of the assets, and as the Fed always operates with a long -term perspective, “They will wait to see how current events are developed and what implications are finally for the macro, before acting“

In addition, remember that Fed has an ace under the sleeve: as they did not make more cuts they have flexibility to act. Therefore, they are likely to see how the scenario develops, to “perhaps” in the second semester, start “a little more flexibility.”

Finally, the expert points out that Wall Street arrives at the FOMC appointment after a month of extreme volatility and correction. However, it emphasizes that in recent days the S&P 500 recovered part of the lost terrain from the “Liberation Day of April 2 “.

The independence of the Fed

From his first mandate, Trump It maintains a tense relationship with Powell marked by constant criticisms and questions to the independence of the Central Bank. Now, Trump submitted him to public escarnio for not cutting interest rates to the rhythm he considers necessary to stimulate the economy and strengthen financial markets.

These statements generate urticaria in investors, since They suggest a possible political interference In monetary policy. In rigor, experts warn that the president’s pressure could undermine the credibility and independence of the bank, key elements for economic stability.

Despite the pressures, Powell maintains a firm position, emphasizing the need to base monetary policy decisions on economic data and not on political pressures. At the next meeting of the Fed, Powell is expected to reiterate the importance of maintaining the independence of the Central Bank and acting cautiously to current economic uncertainties.

Thus, this week’s meeting will also be marked by the tension between the White House and the Fed. While it is almost a fact that There will be no feat cut this weekthe focus will be on the signals that Powell can give about the next steps of the Central Bank.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.