After a strong growth of the credit to the private sector in real terms, Moody’s warns that the Argentine financial system faces pressures that could affect the profitability of the entities.

In a context of macroeconomic standardization, credit to the private sector in Argentina experienced a remarkable rebound, growing 90% year -on -year in real terms until February 2025, according to the latest local Moody’s report. This rebound marks a change of trend after years of retraction of productive financing and reflects a Reconfiguration in the allocation of financial system assets.

The content you want to access is exclusive to subscribers.

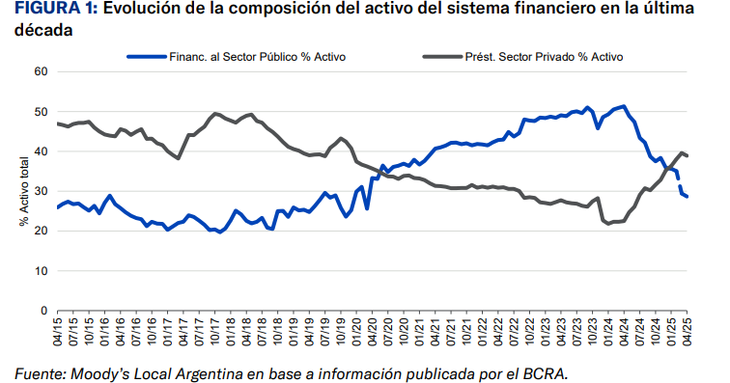

Throughout the last year, the proportion of loans to the private sector on the total bank assets climbed from 23% to 40%, at the expense of a significant contraction in financing to the public sector. “The growth in loans did not translate into a substantial increase in the total size of the assets of the banks, which barely grew 11% year -on -year,” the report highlights.

Screen capture 2025-05-08 192316.png

Throughout the last year, the proportion of loans to the private sector on the total bank assets climbed from 23% to 40%

Increase credit, but still with low penetration

While evolution is positive, Credit still has low penetration with respect to the internal gross product (GDP). Having touched a 6.6% floor in 2023, loans as a percentage of GDP were 10.9% in 2024 and they are expected to reach 13% this year. However, that figure remains much lower than that of neighboring countries, although it approaches the levels observed in Argentina between 2016 and 2018.

The risks that the sector will cross, according to Moody’s

The new exchange regulations implemented in April promoted the dollarization of deposits, which could enhance intermediation in foreign currency, especially for exporting companies. It is projected that the energy, oil, gas and agricultural sectors lead the demand for corporate credit, While for individuals, consumer and mortgage loans will predominate.

The countercara of this dynamism will be the pressure on bank margins. Moody’s warns that the strong competition for capturing deposits – which grow at a rate of 16% year -on -year, below credit growth – will generate tensions about the passive rate and will reduce the profitability of the sector.

Despite the growth of the credit, the system maintains a relatively contained delinquency. This indicator is expected to pass from 2% in 2024 to 3% in 2025. Although greater breaches have been observed in consumption loans aimed at non -banking sectors, the default is historically low.

On the other hand, he points out that the change in the composition of assets, with fewer public titles and more loans, implies that capital and liquidity levels – which reached maximum in 2023 – will tend to decrease. It is projected that liquidity is reduced from current levels of 30% -40% in pesos and 65% in dollars, although it will remain adequate. For its part, the capitalization of the system will fall from 40% registered in early 2024 to an estimated range between 15% and 20%.

Since the last quarter of 2024, the banks resorted more intensely to the capital market as a source of financing, with more than 40 emissions of negotiable obligations for a total exceeding USD 1,500 million. Moody’s anticipates that this trend will be consolidated in 2025 as a key anchief.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.