The economic team had already stopped a bank debt issuance. As he said, some companies had found a road to gambetear the restrictions that are still in force and turned dollars abroad.

The Central Bank reinforced one of the current limits of access to the exchange market to stop a maneuver that some had found companies To gambetear the stocks and send foreign currency through corporate debt operations. Specifically, What the BCRA did was extend the access to the official dollar for the repayment of negotiable obligations (ON) from 6 to 18 months.

The content you want to access is exclusive to subscribers.

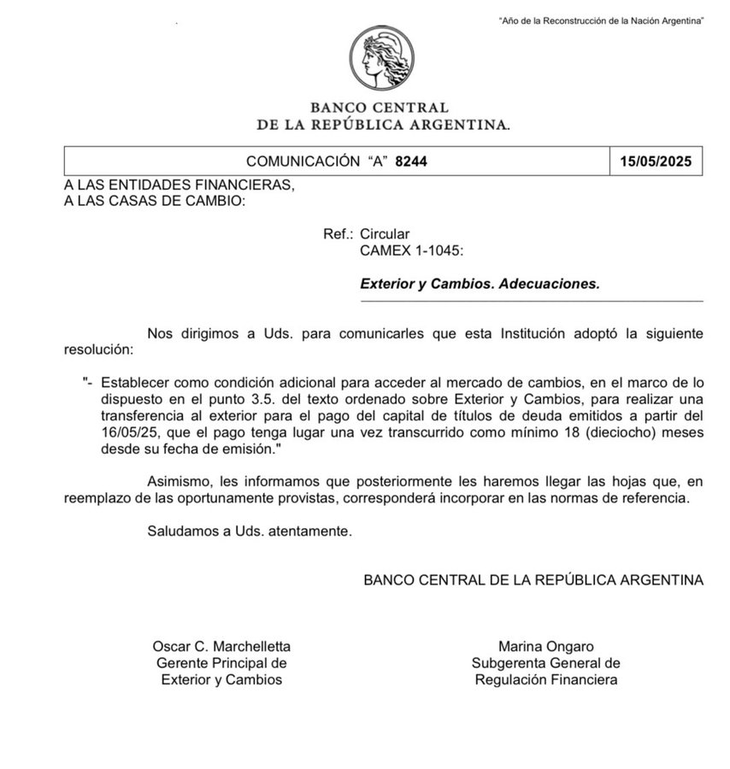

This was established by the monetary authority through the “A” 8244 communication, sent on Thursday to regulated entities, which determined this extension of the capital repayment period of corporate debt for emissions made from this Friday.

image.png

The stock, the ruling and the causes of the BCRA decision

The BCRA measurement comes to break a rul that made importers and other companies to avoid the restrictions of the exchange rate that remain in force for companies.

As he said Scope days ago, last week the market was surprised at a series of Colocations of banks with 0% rates linked to the need for some signatures of turning dollars abroad and that, with Current regulations cannot do. It happens that companies that Currencies rotate via cash with liquidation (CCL) lose access to the official market for ninety days.

By subscribing on a zero rate, the firms can avoid the cross restriction: that is, they send their dollars abroad and do not lose access to the official market.

A first background of this Thursday’s measured days, when The central suspended a Supervielle broadcast. The operation sought to capture US $ 100 million in two sections (pesos and dollars), with liquidation abroad. The placement had high demand since it offered access to the financial dollar at the “cheap” exchange rate. In the previous weeks, Galicia and Orange had already made similar emissions.

El Copo and El Bopreal 4

In addition to cutting this ruling, the decision to harden this restriction of the stocks seeks Push companies that need to turn currencies abroad to subscribe the new Bopreal 4that the BCRA will launch in the next few days.

It happens that Companies look sideways at the conditions of Bopreal 4 for stocks still. On the one hand, by extension: The bonus will only be paid in October 2028 in a single amortization. On the other, because it accrues a interest rate of 3% annual, which some consider limited.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.