External financial conditions entered into a stress zone for the first time since March 2022when war broke out between Russia and Ukraine. On this occasion the disruptive event was the tariff boom that decided to apply the president of the United States, Donald Trump to the rest of the world.

This Monday the consultant Econviews and the Argentine Institute of Finance Executives (IAEF) They published a new fact of the Financial Conditions Index (ICF), corresponding to April 2025. The referential fell 39 points, to 12 units, which was what it was the worst month since October 2023.

Trump’s tariffs shook the world’s economies

The fall was explained by the external subscript, which sank to the negative figure of -7.3 after the global trade war that exploded on April 2 With Trump’s surprising adswhich contemplated surcharges to US imports from 10% to 50%, depending on the commercial result in force with each country.

image.png

This shock caused a 12% collapse in the S&P 500 Wall Street in less than a week, although then the bag recovered almost everything lost from Trump’s arrangement to renegotiate tariffs. However, Econviews and the IAEF highlighted that “The relative optimism of markets for bilateral agreements contrasts with the high frequency indicators of international trade“

“The Vizion Containers tracker reported a 64% collapse in US imports in the first week of Aprilthe worst from the pandemic. The PBI Nowcast of the Federal Reserve shows a growth of 2.2% annualized for the second quarter, although at the last policy meeting, its president Jerome Powell said inflation and unemployment risks had increased“They said.

The two worst variables of the external subscript in April were the volatility of US actions (VIX) and emergingthat in -11 units they entered into a zone of severe stress for the first time since June 2020. The casualties in commodities prices were also relevant, especially the oil that fell below US $ 60 a barrel, and the spred libor -ois for the fluctuations of the fees.

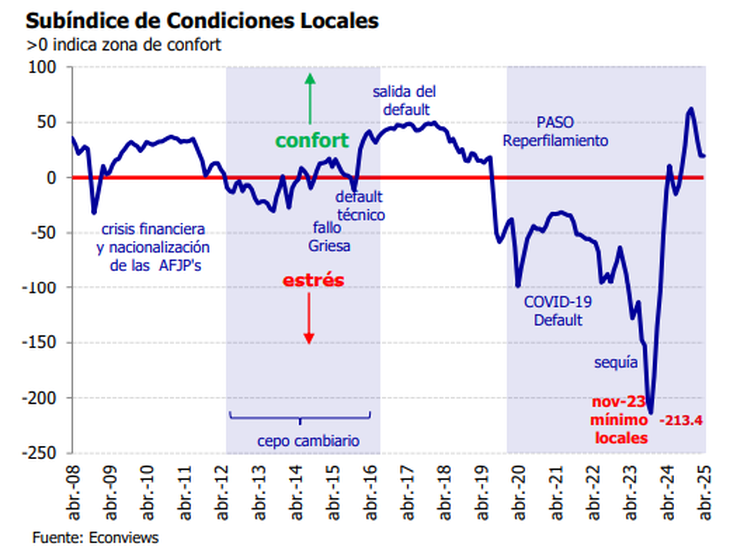

Financial conditions in Argentina were stable in April

The local subscript of financial conditions remained almost stable in April, in the 19.6 units (against March 19.8). The entities that build the indicator expressed in their report that the International Monetary Fund (IMF) cleared some doubts, but not all. As for the exchange, They stood out as an achievement that the devaluation generated after the flexibility of the stock has been lower than that expected, although they underlined concern about the accumulation of reserves.

image.png

“As the ICF measures monthly averages, April was a particular month, since He interspersed two weeks of great volatility, before the agreement with the IMF, and two others of strong recovery“They clarified. Within the improvements at the domestic level, those of the shares and the reduction in the exchange gap highlighted. On the contrary, the main deterioration were seen in the confidence of the banks (due to the fall of deposits in dollars) and in the interest rate.

“For Argentina, the agreement with the IMF cleared the most urgent fears, but the variables to be monitored did not change. The program sets a goal of accumulation of reserves for the second quarter of US $ 4.4 billion YU $ S8.9 billion in all 2025 and the Government has already implied that it will not fulfill it. Since they do not want to take new debt this year (nor is it possible at risk between 600 and 700 points) The question is how they will deal with the maturities of 2025 and 2026, which add up to almost $ 26,000 million between IMF, multilateral and private“Econviews and IAEF warned.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.