The Government, headed by the President Javier Mileiis finishing the details to launch a new repurchance agreement (Repo) for US $ 2,000 millionas confirmed by high level sources from the economic team to Scope. The IMF ran the date for reservations for July.

The operation, scheduled for the coming weeks -but that the Government wants to announce in the short term -seeks to strengthen Reservations of the Central Bank of the Argentine Republic (BCRA) in the face of debt matches in July and the accumulation goals of reserves required by the International Monetary Fund (IMF). In that sense, according to this medium, the organism He decided to run the date for the evaluation of the Argentine case for a month, towards mid -July, Beyond that the official date remains on June 13.

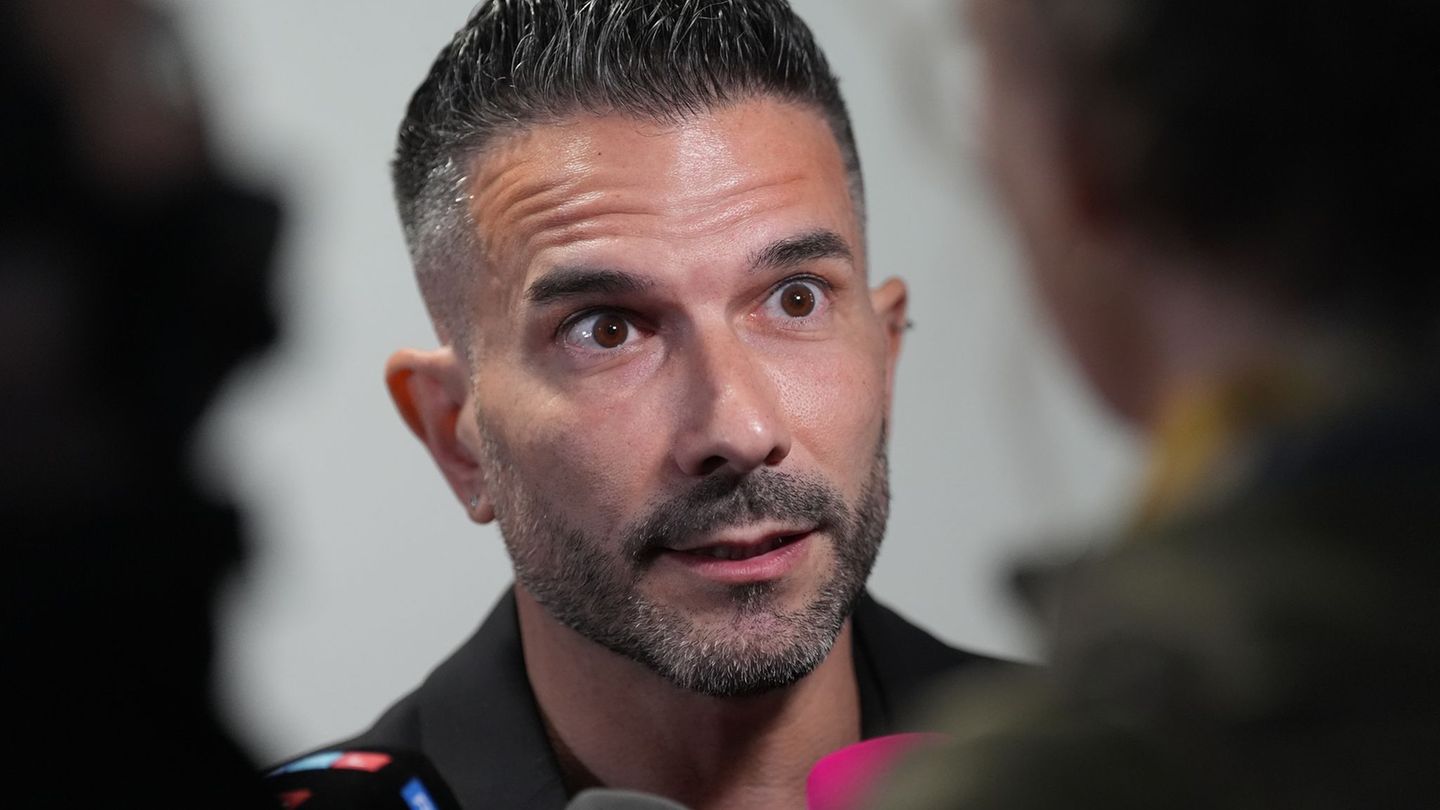

Meanwhile, the Deputy Minister of Economy José Luis Daza He is the architect of the Repo operation. For that reason, he held a series of meetings with banks in the US and remained there during the last 15 days.

José Luis Daza.jpg

FIELD LIBRARY.

This new repo adds to the recent emission of a bonus in fixed rate pesos (Bonte 2030) for US $1 billion. Both measures are part of the strategy of the Minister of Economy, Luis Caputofor ROBust the BCRA coffersin a context where net reserves are a key challenge in negotiations with the IMF.

Economic team sources confirmed that the repo of US $ 2,000 million It is negotiated at this time with five first -line international banks: BBVA, Citigroup, ICBC, JPMorgan and Santander, although other entities are also processed. The agreement, with an estimated period of two years and four monthslook for an annual interest rate less than 8.8%, In line with that obtained in a similar operation in January 2025 for US $ 1,000 million, but with the expectation of more favorable conditions due to the Improvement in country risk.

Dollars to prop up the Financial Front

Unlike traditional debt emissions, they maintain in the government that this repo will not increase net indebtedness, since it is backed by assets as bonds Bopreal or gold reserves. It is estimated that the BCRA will deliver guarantees for an approximate value of US $ 3,500 millionaccording to calculations based on previous operations and market price of the titles used. “It is a tool that allows reservations to be reinforced without compromising fiscal sustainability, while advancing in the normalization of access to international credit”said a source of the economic team that preferred not to be identified.

The interest of the banks in this operation is high, With offers that could exceed US $ 4,000 millionaccording to transcended from the financial sector. However, the BCRA, led by Santiago Bausiliplan to limit the au s2,000 million acceptance for Prioritize competitive rates and avoid validating higher costsa strategy similar to that adopted in the January tender, where They received offers for US $ 2,850 million, but only US $ 1,000 million were taken.

As stated, the repo is part of a broader effort to rebuild international reserves. The agreement with the IMF, signed in April for US $ 20,000 million, establishes quarterly goals of accumulation of reserves. In addition to the initial disbursement of US $1,000 million received in April, The Government expects US $ 2,000 million in June YU $ S1 billion before the end of the year, totaling US $ 15,000 million in 2025. They are also planned revenues of U $ 3,600 million multilateral organisms (World Bank and IDB) before June, YU $ 2.5 billion additional before December, adding US $ 23,100 million in foreign currencies for the year.

However, some market reports warn that, even with the Repo and Bonte 2030, Argentina could be around US $ 4,000 million below the reserve goal. That objective, originally set for June 13, would be postponed by the IMF, which will evaluate the Argentine case a month later. The gap is explained, in part, by the commitments in foreign currency faced by the Government in July, which amount to $ 4,300 million. To cover them, it is planned to use the funds of Bonte 2030 and the new repurchase agreement.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.