The global debt market

Werning’s fears are grounded. It happens that the American treasure bonds started June with the left foot, with the yields of the titles to 30 years near the psychological level of 5%, all in the middle of the resurgence of concerns about the Donald Trump’s tariff policies.

The long -term bonds led the losses in Monday’s session, as the yields of the titles at 10 years came to rise more than six basic points to an intradiary maximum close to 4.47%, while the 30 -year -old exceeded 5%for a few minutes. The differential between the yields at five and 30 years was extended to touching the 100 basic points, A level that did not exceed at the close since 2021.

BCRA.PNG presentation

Presentation of the Vice President of the Central Bank (BCRA), Vladimir Werning.

This happens in a context of persistent deficits and high inflation And while investors are closely, if the US Congress approves a budget project that could further increase the Deficit of that countrywhich would further boost the premium for term, which is the extra profitability that investors demand to assume the risk of maintaining their immobilized money.

The situation is not very different in Japan. Where the government returns to seek financing this week with two debt tenders. This becomes relevance after Two phyanous auctions last month that unleashed a wave of sales and in question the ability of the Japanese government to finance their growing debt without generating instability.

And is that after years of mass intervention of the Bank of Japan, which today has more than half of the debt in circulation, the market tries to recover against returns that begin to reflect a more genuine adjustment of financial conditions. The Japanese bonus at 30 years, which exceeds 3.18% – its highest level since its creation – now operates about 2.93%, while the 10 -year bonus remains around 1.5%.

Why not the Argentine country low?

On this point, the investment advisor, Gastón Lentini Explain in statements to Scope that, under his vision, The international conflict does not influence so much, nor the problems of Japan, nor the US deficit On the loss of country risk, as Werning states. For the renowned strategist, the real obstacle is the history of Argentina: “The problem is our own record record”, Judgment.

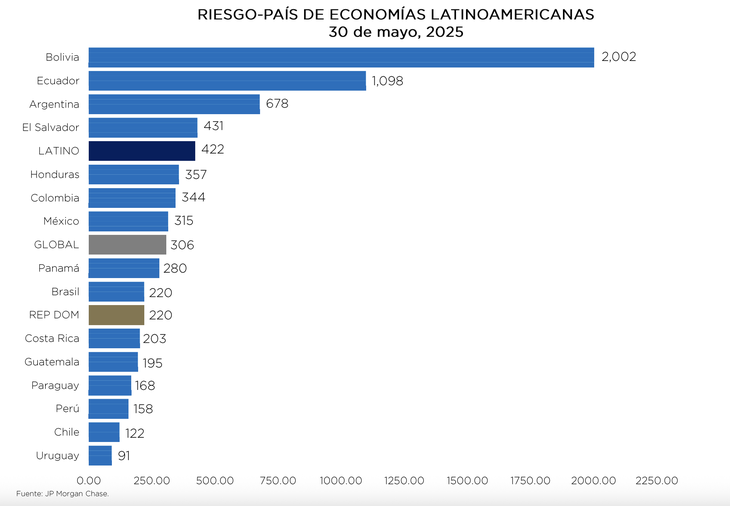

When comparing Argentina with countries such as Chile, Uruguay or Paraguay, it is observed that they have a considerably lower country risk, although they also face Fiscal deficitWhile Argentina maintains a surplus, says the analyst. “This indicates that the main difference lies in investor confidence and market perception”, Warns Lentini.

Argentine country risk

Risk country of Latin American economies. Source: JP Morgan.

In this context, the strategist is clear and concludes that the international panorama will have a limited impact on Argentina, since it estimates that what will really influence the future will be internal decisions: “maintaining the surplus and getting a good electoral result in October that allow the ruling party to consolidate a significant amount of benches in Congress.”

And is that for Lentini, The election and positive perception of the government are key variables. Beyond the hard numbers, the confidence of the electorate and the market in the continuity of a plan that maintains the surplus, promotes investments and promotes deregulation over the next two years, “will be fundamental.” This would not only boost country risk, but also the arrival of direct foreign investment, The analyst raises.

The Argentine road to return to the international market

In the same line of Lentini it is expressed Alan Mac CarthyCEO of FRont Investments: “Argentina must demonstrate that it has once again been a reliable country. To achieve this, the government seeks to strengthen the confidence of both Argentines in the system and international investors.This process is the famous economy re -existence”, He explains.

Mac Carthy analyzes that the executive works for people to deposit Your dollars in bankswhich would increase liquidity and boost credit. And recognize that in that context, “The performance of American bonds would determine the global cost of capital. Although the international situation is not ideal, Argentina has already negotiated and has the support of its main creditor, the International Monetary Fund (IMF), ”he says.

As for a possible return to the international debt market, Mac Carthy states that the ideal would be that the rates of American bonds are low to facilitate access to external credit. However, as there is still a long way to achieve that scenario, the Government has time to work on obtaining a good result in the mid -term elections and going out to look for that financing only in 2026.

Finally, the expert indicates that the ruling party It must continue with the reduction of unnecessary expenses and the increase in reservesat the same time that is strengthened as a political party on the national stage, which gives it the confidence of the Argentines. “Milei and his team must make the market perceive that this process, which barely begins, has the support of the popular vote and Congress. In addition, it is key that reserves grow thanks to the activation of sectors such as field, mining, oil and other thriving industries,” concludes Mac Carthy.

T-Bills pressure on local bonds

Pablo Lazzati, CEO of Insider Financehe comments that although it rises in the yields of the T-Bills, it exerts some pressure on the local bond curve, its impact on the Argentine country risk is limited.

Lazzati is clear and in line with the other strategists consulted, he argues that to resume the decrease in the index that measures JP Morgan, The government must maintain the current course: “Zero deficit, deregulation, commercial opening and political consolidation in the elections”At the same time, it indicates that the BCRA needs to increase reserves.

T-Bills.png

Treasuries, Source: Bloomberg.

And he concludes: “From Insider, we consider that the recent novelties of the international financial context have a very limited effect on the Argentine Economic Plan, whose objective is to converge towards rates more consistent with emerging markets.”

Thus, for Argentina to reduce its country risk to levels comparable to those of its most stable neighbors, it is not enough that the international context improves or with the support of multilateral organisms. LA true anchor is internal credibility. As analysts coincide, the key challenge is to sustain an orderly fiscal trajectory, consolidate reservationsadvance in structural reforms and – fundamentally – to achieve broad political support that guarantees the continuity of the economic program.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.