Ecuadorian bonds shot on Tuesday and led the increases between emerging markets after its Minister of Economy anticipates A possible return to markets in 2026. In Argentina, the president Javier Milei and Minister of Economy, Luis Caputo,They also maintain that goal in the radar, even with closer aspirations. The case of Ecuador can be an advance of what could happen to the Argentine debt?

For now, the Minister of Ecuadorian Economy and Finance, Sariha Moya, affirmed in the last hours that the Andean country He plans to return to international markets in 2026, with the support of multilateral organisms. The announcement, made during an interview with the Teleamazonas channel, He strongly propelled the entire sovereign curve: the expiration bonus in 2030 climbed 2.3 cents and quoted about 81 cents per dollar, its greatest advance in almost a month, According to Bloomberg.

Moya did not provide details, but the only gesture of will was enough to excite investors, who were already betting on Ecuadorian debt. Bonds accumulate a 14% yield so far this year, one of the best among emerging countries, motorized by the president’s economic program Daniel Noboa, which points to clean up public accounts and reactivate growth in a dollarized economy.

Ecuador Bonos.jpeg

“This is creating a climate conducive to a greater appetite for Ecuadorian bonds,” They pointed out from Stonex, although they warned that the government must be prepared for shocks as an eventual decline in the price of oil.

To specifythe placement would be the first since 2019, beyond the exchange of debt by nature of US $ 1 billion that Ecuador made in 2023 with the support of the Inter -American Development Bank (IDB) and the International Financial Corporation for Development (DFC) of the US.

Ecuador also maintains a Agreement for 48 months YU $ S4.4 billion with the International Monetary Fund (IMF), and faces maturities for about US $ 15,000 million in global bonds in the coming years.

Return to markets: Can Argentina follow?

The Ecuadorian case does not go unnoticed in the Argentine financial market. Last week, the treasure made the broadcast of the Bonte 2030subscribable in dollars and payable in pesos, aimed exclusively at non -resident investors. It’s about The first placement of this type in global markets after seven years.

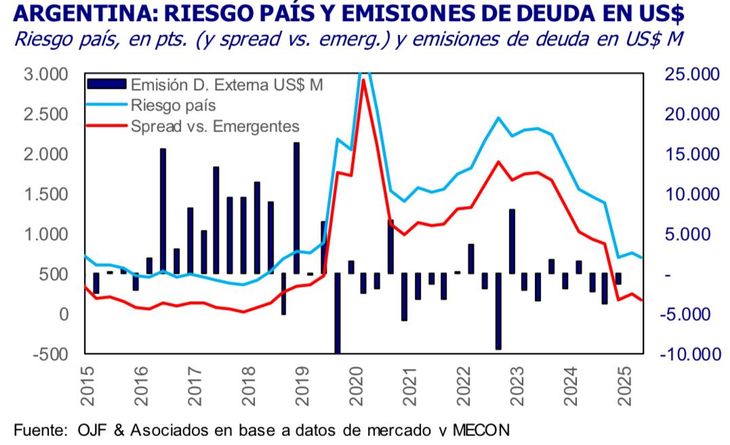

The placement, for the equivalent au $ s1,000 million, showed A good demand level (Offers for US $ 1.7 billion), although the cutting rate was high (29.5% in pesos). “The most relevant is not the rate, but the return to the radar of international markets,” indicated a report of Orlando J. Ferreres & Associateswhich also highlights that this opening is key to The sustainability of the economic program.

The size of the local financial market is very small, so The global market is needed to facilitate the administration of public debt, They highlight in the City.

The Government is confident that the fiscal order, the fall in inflation (several consultants project that in May it drilled 2%) and the support of the IMF allanen the path for new emissions. Although there are no precise dates, Milei and Caputo already expressed their willingness to return to volunteer markets, even this year if the conditions allow it.

“The agreement with the IMF should help compress the country risk, which in turn will allow Argentina to recover access to markets,” Caputo argued last March, emphasizing that the government’s objective is to stabilize the economy and improve financing conditions for the country.

Ferreres Risk Debg.jpg

Unlike the 2016 opening scenario, the current international context is more adverse: interest rates in the US are around 5% and risk aversion is higher. However, in the market they believe that if the Argentine macro continues to improve, The price of the bonds could rise and enable new placements at a lower cost.

Beyond this, Since mid -April, the financial landscape for Argentina showed substantial improvements, both external and internal factors. Internationally, the emerging debt spreads were compressed -in particular in the CCC & Lower credits segment, with a decline of more than 150 basic points -while At the local level, the exit of the exchange rate dissipated part of the macro uncertainty and caused a strong country risk compression, which fell around 200 basic points since then.

This change allowed the Argentine debt to begin to differentiate itself from the worst global credits, such as Angola, and approached countries with B-, such as Egypt or Nigeria, according to Delphos Investment report. While the country still did not achieve a formal improvement in its qualification, Analysts consider that step is imminent. In turn, They project an additional compression of at least 100 basic points in the country risk, which would open space for additional appreciation in sovereign titles.

Along the same line, Matías Waitzel, partner of AT investorshe was optimistic about the route that sovereign bonds could still have: “There will be a strong rebound when the political scenario is more aligned with the ruling party. There we can see a country risk compression of the order of 500 basic points, with long bonds yielding between 8 and 9%, which would imply a rises of 20% in those titles.”

In this context, Delphos recommends a double exposure strategy within the Hard-Dollar curve: in the short term, The GD30 stands out for its good recent performance and its sensitivity to a more positive slope of the curve. For investors with greater risk tolerance and longer horizon, GD38 (or AE38, according to legislation) It remains an attractive alternative, both for its duration and for the potential for convergence with higher rating credits.

Just as Ecuador lit a positive signal in the radar of global investors, The recent Argentine play could be the first step of a broader return. Everything will depend on whether the economic program manages to sustain and gain credibility, waiting for Concrete signals regarding accumulation of reserves, a favorable electoral result for the ruling party and, consistent with it, the implementation of various structural reforms.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.