Bag markets.jpg

The S&P Merval, with red numbers.

From Delphos Investment They give relevance to political noise and state that the abrupt fall of the Argentine “equity” during yesterday coincided with the moment when the deputies gave Quorum, which shows “The persistent influence of political factors on the behavior of local markets“

“For example, in 2024, Merval’s volatility increased until the session in which the Base Law was definitively sanctioned. From that moment on, Volatility began to descendtrend that remained until the end of that year. For 2025, volatility stabilized, although at a level higher than that registered in 2023, to the eve of the exit of the exchange rate, which then brought some calm, “exemplifies the broker.

Balances season at the City

Last week ended the balance sheet season with the presentation of results of local banks. Beyond the nuances and particularities of each bank, there are several points in common that highlights the IEB group. The stock market synthesizes the results and “states that it was not a good quarter“For financial entities, the bet redoubles:”Moreover, it was a quarter in which situations were clarified that, we believe, will impact the contributions of the sector’s actions”

IEB states that there is a stagnation in the growth of loans and deposits, as well as a pause in reducing exposure to the public sector. “The little dynamism of credit is a bad sign, since the 2024 bank rally relied on the expectation of a strong credit expansion, which still does not concrete,” slides.

And he warns that although loans grew from 8% to 11% of the internal gross product (GDP) compared to 2023, the advance is slow and remains far from regional levels. Factors such as high active rates and electoral uncertainty contribute to this situation.

Merval.png

Also the margins of interest (NIM) and current roes “make it difficult to justify high valuations (P/BV> 2x), since the returns projected by 2025 (8%-15%) do not support it,” he says. For the broker, The market begins to assume that credit reactivation could be postponed until 2026.

In that same line is expressed Matthew ReschiniHead of Research of INVIUin statements to Scope and who is somewhat surprised by the dynamics of the Porteña square. “From my perspective, the current behavior of Merval reflects some weakness, particularly in the energy sector, whose recent punishment is difficult to justify according to the foundations,” says the strategist.

On the contrary, Reschini finds the correction of banks more understandable: “The sector had a significant rally last year, promoted more for expectations than for specific results, and today is adjusting part of that movement”, He says.

However, the expert rescues that this first semester in negative field is also influenced by external factors, which cannot be ignored, either in aligned with IEB. However, it also puts in context what happened in 2024, when the market had an “exceptionally bullish performance, at times disconnected from real variables”. In that sense, what happens in the local square is now a rearrangement of value and expectations, which forces investors to recalibrate the stage forward, reschini sentence.

In a comment sent to customers this Thursday, the investment advisor, Gastón Lentini, addressed the dynamics of the Argentine Variable Income and commented that: “The Merval It shows weakness and reached a key level. Why is it important? Because he broke, pierced and closed below the 200 -day mobile averagewhich in the graph appears as a blue line. This had already happened in April, during the rates crisis in the US, and at that time the index reacted with rising, “he explained.

S & p merval.jpeg

Graphic courtesy of Gastón Lentini.

What remains for the S&P Merval in 2025

“Today we see the Merval again on that same level. If you fail to hold it, the next support is between a 5% and 6% belowwhich coincides with the minimum registered in April. Therefore, for those who are already positioned, the recommendation is have patience. And for those who seek opportunities, you have to be attentive to rebound point That allows us to add more positions, “Lentini recommended.

As to YPFwho suffered a very marked fall, the strategy remains firm: “En the U $30 area we are buyers againbut without hurry. It is a company with good future prospects. The same applies to Pampas: They are companies with high volatility, yes, but with solid fundamentals in the long term. These corrections are a natural part of the market, “Lentini added.

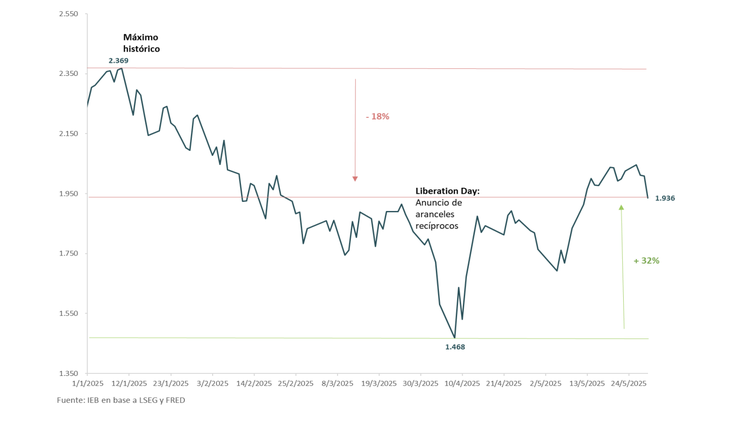

Juan Bialet, Personal Finance Manager of SBS groupholds in talk with this medium that, despite having risen 34% from April 8 prior to the length of the stocks, the S&P Merval measured in dollars still operates 18% below the historical maximums achieved last January 7.

“While this first part of the year was marked by unprecedented volatility never seen in international markets with tariff threats by Trump, the performance of the Argentine variable income was poor in front of other markets,” says the strategist.

And, for example, neighboring Brazil rises 22% in 2025 and the S&P 500 index does it by 2%. For Bialet, this decouple can be “perfectly attributed to the fact that in 2023 and 2024 the Merval beat all records with rises of 65% and 127% respectively,” he says.

Looking ahead to the end of the year, the market will start operating at the rhythm of the surveys, the analyst clarifies with their peers. “If the dynamics in favor of the ruling party already seen in CABA continues at the provincial level in September and national in October, Argentine assets could quietly return to the maximum seen at the beginning of the year,” Vaticina Bialet.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.