In this sense, a prestigious political scientist summarized The four key dates that the market should take into accountbefore the Buenos Aires Battle (September): July 9 and 19, closure of alliances and lists in Buenos Aires, respectively, and August 7 and 17, closing of alliances and national lists, respectively. What he advised to look is how Lla and Pro the novel ends, which struggles for the seal and the benches, and how the PJ goes to the elections. A legendary man on the market slid a thought aloud in relation to the topic CFK: History is not always repeated, but teaches that gaining elections having proscribed to the opponent can be at the end of a shot in the foot. That is why he stressed that today the projection of this judicial issue is very political.

Reservations, bonds and IMF mission

To loosen the atmosphere, two well-known economists-consultants, one of them former official, agreed that The bonds could sleep quietly because the government already has the dollars to face the expiration of July. Of course, from a financial bunker of “Private Banking” they emphasized that the clients from abroad celebrate the entire economic path, but they want to see that the BCRA accumulates more reservations, at least, that it is on its way to that. Today net reserves are 1% of GDP and you should aspire to at least 15% of GDP, that would be more than US $ 90,000 million, something that today sounds impossible in the short term, but the government should show that it is able to go on that route. But as always there is an “old Vizcacha” another former official stressed that for that the exchange rate must be adequate, leaving some questions.

bcra-dolar-reservas.png

A lot of noise around the movements of the BCRA and the Treasury in pursuit of refining the numbers of a repo (after the directory of the monetary entity approved the “request for proposition” and was sent to the participating banks) and the stock of reserves before the arrival of the arrival of the Next technical mission of the International Monetary Fund (IMF) In just over a week. It is estimated that the repo would barely add about US $ 600 million to the reserves according to the IMF criteria.

Also expectation to see how the conditions will finally be of the new bopreal that arouse speculations and suspicions, especially between commercial debtors and dividend accumulators, for the delay of the BCRA. Apparently the official doubt is how much to issue this new series of US $ 3,000 million.

Electoral trading

With respect to “Electoral trading”from an ex-formeristile emblematic of the ’80s, they advised customers, many of them institutional and large fortunes, in the dollar segment, prioritize the middle and long section of the sovereign curve such as the Global 2035 and 2041, but for those less lovers of volatility and political risk, in that case the Breop Treasury. Fixed income operators emphasize that the greatest prominence of “electoral trading” now impacts the dynamics of sovereign debt.

While, in the peso menu, the preferences continue to concentrate on the short stretch of the curve at a fixed rate, extending the duration via medium -term cer bonds such as the Treasury Bonus Cupón Zero March 2026. In good romance, said one of the main local “boneros”, “Carry Trade” to die, redoubled the commitment to deflation and exchange stability.

DOLLAR DOLLAR MARKETS BONOS Actions ADRS

A no less fact, another colleague contributed, in this scenario the gradual low of nominal interest rates catapult the real rates by propitating the stability of the exchange rate. For those who risk a little more and look at the long term, the attractiveness is to migrate from the 2026 dual bond to Boncap 2026.

In a counterpoint between financial consultants, the reopening of the international market was weighted after seven years with Bonte 2030 but knowing that sustainability is not yet insured, therefore, this only works in the short. They wielded that, so the result of the placement was not held, since a rate of 29.5% annual nominal for a 2 -year bonus, extensible to 5 years (the rescue option at two years is the buyer) is very high if inflation in 2026 is sprayed as bet the Casa Rosada.

In this regard, from a bunker very punished by the ruling party for its cautious prognostic and continuous warnings about the economic scheme they explained that the official carrot for banks to spit dollars, served, at least in April, so that together with the end of the Blend, financing the strong treasury of the people.

It happens that the April data has generated a lot of noise, not only because in the middle of the month phase III was launched, but because More than 2,000 sticks bought by people without restless stocks. A super official economist recommended, at the proposal of people from the tourism business, that the statistics of the exchange balance for tourism should be improved because travel expenses are intermingled with imports. The aforementioned “Bonero” pondered the debut of Bonte 2030 that in its first wheel made investors more than 5%, in dollars.

Where the “electoral trading” was very commented on was in the exclusive Cohen event at the Duhau Palace, especially in the Coffee Break, which brought together three market referents: Ricardo Arriazu, José Siaba Serrate (the legendary Gordon Gekko in the field) and Adrián Rozanski of 1816who discussed the economic scenario of the country and the world, in the already traditional Summit for financial advisors.

Global markets

The start was in charge of being in dialogue with Martín Polo on the impact of leadership of Donald Trump On the global order. “Trump was willing to install a new international order, but the only thing he achieved was a great disorder,” he said and in that line, was worried about the deterioration of global trust and warned about the fragility of the system if a new crisis occurs. However, he stressed that Trump would love to apply new tariffs, but that is no longer viable. The institutions will not stop, the market will do it.

2025-04-03-TRUMP-TARIFFS.JPG

Then “Jota Jota” Vázquez together with Rozanski discussed phase 3 of economic policy, his opportunities and risks. Focus was made on the official strategy mainly focused on deflation rather than the accumulation of reserves and despite the fact that the IMF demands specific goals, he commented that he has focused on quickly reaching political success. He said he gave him the impression that it is not the decision that others had made, but if the government believes that the only thing that matters is to deflate, even here it is going well.

He also valued the elimination of the fiscal deficit and other indices, but pointed out that the true concern lies in how the international market perceives this policy and the possible tensions with the objectives of the IMF, which could generate uncertainty. As a gold brooch, Arriazu spoke about decisions in times of uncertainty who spoke about euphoria and lack of certainty in the Argentine economy. Although he highlighted the enthusiasm for the agreement with the IMF, he spoke about the uncertain global context: “We are in a solid situation, we lack a lot of reforms, but the greatest danger we have is an international crisis or politics in Argentina. But, if we maintain the macroeconomic balances, only avoiding negative damage, Argentina doubles the growth rate.”

In a palace reserved, the landing of Jorge Morgenstern (EXHSBC) was commented on in Marcos Buscaglia, Alberdi Partners, as Managing Director. In that reserved, they estimated that the expiration of July would compose more than US $ 2,100 million of private offshore, US $ 1.7 billion of local private ones, about US $ 500 million of the ANSES FGS and the rest of the BCRA.

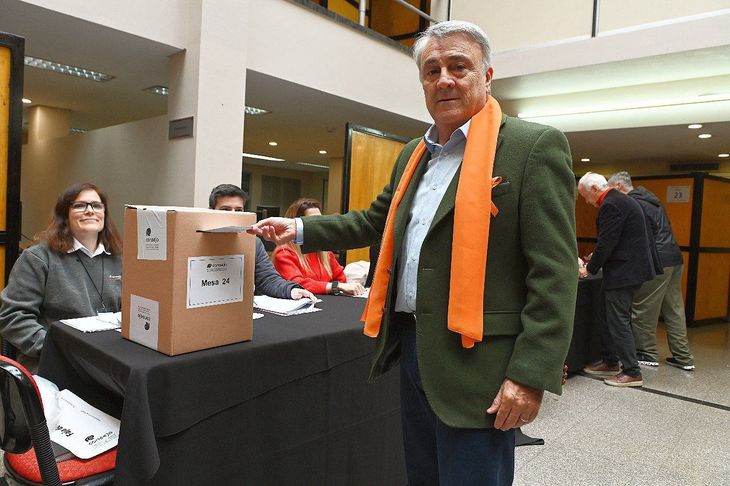

In another meeting close to Jockey Club, a group of libertarian economists lamented by the electoral result in the Professional Council of Economic Sciences where a front led by the conduction of the Faculty of Economic Sciences of the UBA was imposed: the orange embroidered by Gustavo Diez. Violeta de Roberto Destéfano (11%) and the rest was for the green list led by Eric Rosenberg.

Gustavo Diez.jpg

Financial roast among strong hands of the local market with plans to participate in a mega event crypto in Las Vegas as a good excuse for a cheap dollar escape. An asset operator of the CD business (Credit Default Swap) of 10 years, commented the case of Colombia: that contract, today is negotiated +/- 80 basic points above that of Brazil that has a debt rating much lower than that of Colombia, which means that the market is convinced that several decreases in the country’s credit rating are coming.

The countercara is implies that the country will have to use a greater proportion of the budget to pay the interests of the debt, and because it increased the cost of doing business in Colombia and could increase even more, with consequences on employment and poverty. They said Gustavo Petro was like a weapon of mass destruction.

Some diners came from participating in the Annual Pershing event insite 2025, organized by Bank of New York Mellon in Maryland, where a lot of the US Treasury bonds and opportunities in the region were talked about. In this regard, one of them commented on a PAPER of the IMF that analyzes the impact of stress on the banking sector on the sovereign risk of a country, using as a witness case the collapse of Silicon Valley Bank in March 2023 as a shock to study the transmission of the risk of banks to sovereign debt.

The Paper suggests that there is a strong transmission of the credit risk of the banking sector to the sovereign in the United States, as well as in other important economies, before adverse shocks to the banking sector. The results suggest that investors consider that the tensions of the banking sector are particularly economically expensive for these countries.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.