The relationship of Argentine young people with money is increasingly active, but is still far from being solid in terms of financial inclusion and economic knowledge. This is demonstrated by the report “Youth, money and future: a look on the link of young people with personal finances in Argentina”prepared by the Finance Research Center of the Torcuato Di Tella University In alliance with BBVA Foundation, in November 2024.

The study, based on a national survey of people between 16 and 24 years old, shows revealing data: 80% manage their own money and more than half (53%) manages to save, which reflects a growing financial autonomy at an early age. However, only 15% declare investments, and less than 17% use formal channels to save, which demonstrates an important gap between economic capacity and financial inclusion.

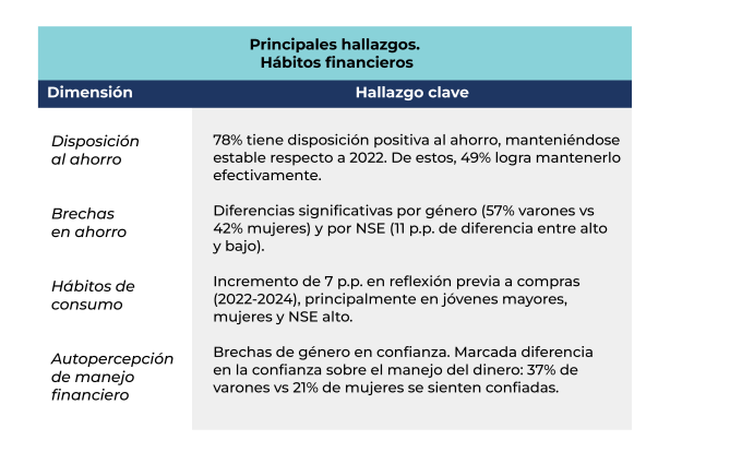

Screen capture 2025-06-08 133732.png

The use of virtual wallets grew, such as the means of payment most used by young people

The majority of the young people who save do it outside the banking system. The most common methods are Save money at home (effective) or use Virtual wallets with a balance without investingwhile there are very few who turn to savings accounts, fixed deadlines or common investment funds. This informality leaves them more exposed to inflation and limits their possibilities to generate yields.

According to the report, More than 80% of young people believe that “everyone must earn their own”and the 71% already manages their income independently. Many work, they make changas, or receive a table, but even those who depend on others to obtain income – such as their parents – claim to make their own financial decisions.

Financial Education: The great absent

One of the critical points that the study reveals is the Lack of structured financial education. Only 2 out of 10 young people received specific training at school about how to manage money, save or invest. Instead, The majority learned on their own or with the help of their family environment or friendships.

Access to financial information is unequal and, in many cases, is based on nearby experiences rather than technical knowledge. The report proposes to incorporate these contents in secondary education and facilitate access to financial tools adapted to the needs and capacities of this population.

In young people, distrust of banks predominates

He use of digital platforms It is widespread: 72% use virtual wallets and bank appsespecially to make payments or transfers. However, this does not necessarily translate into greater inclusion or use of financial products. Only a minority access credits, insurance or formal investmentsand many They distrust banks or do not understand how financial instruments work.

Emotional relationship with money

The money is also loaded with emotional meaning: for many it represents Independence, freedom, tranquilitybut also Stress, frustration and anxiety. Almost 60% of respondents expressed concern for not reaching the end of the month or for not being able to meet your goals in the future. This ambivalent relationship influences the decisions and expectations they have about their financial life.

The report proposes Four key action lines To improve the financial inclusion of youth:

-

Formal Financial Education from high school.

-

Simple, accessible and reliable financial instrumentsadapted to their realities.

-

Digital channels with better accompaniment and guidance.

-

Awareness campaigns that strengthen the link between youth, financial planning and future.

In BBVA, “we consider that education is essential to improve financial health, reduce inequalities and promote inclusion. As a strategic priority, we develop initiatives that provide tools to make informed decisions, promote planning and strengthen the economic well -being of people. Support Institutional BBVA in Argentina.

On the other hand, from Di Tella, it was Key starting point to understand their habits, concerns and aspirations in the world of money.

Screen capture 2025-06-08 133748.png

Di Tella stressed that this is the first time that a study of this range is carried out with exclusive focus on young people

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.