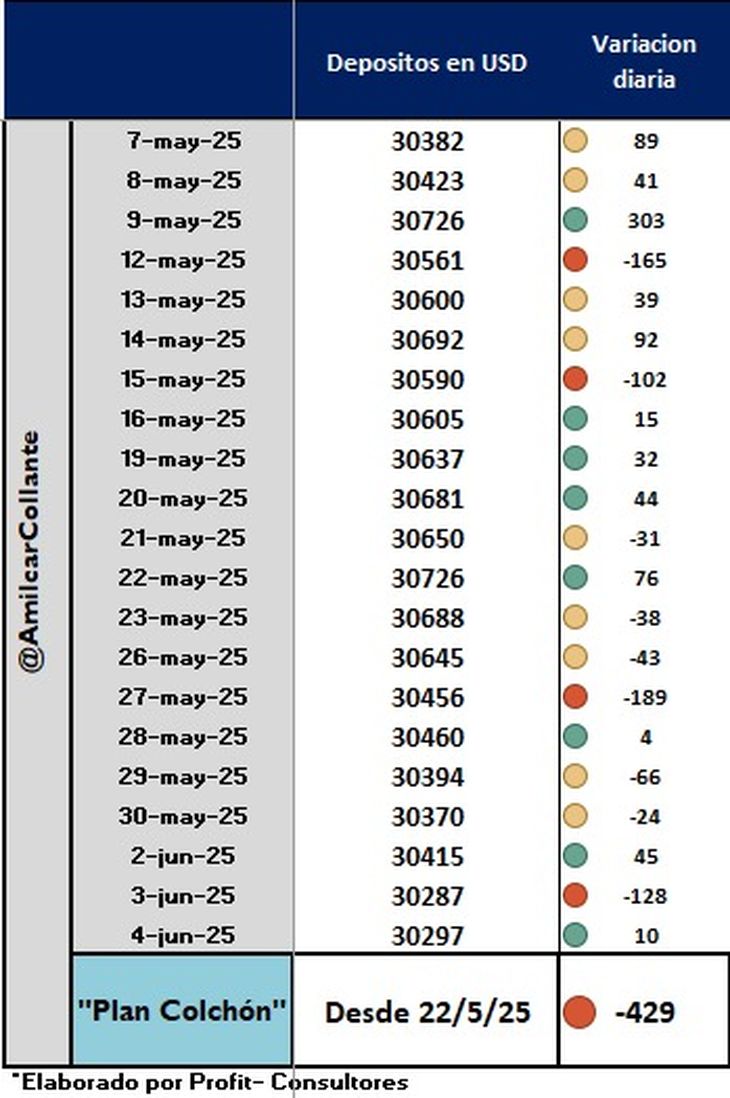

Since May 22, dollars in dollars retreated more than US $ 400 million, while security boxes do not register new highs or withdrawals. The “endogenous dollarization” continues with delays.

Despite the Official ads And the presentation of the bill that seeks to shield savers, the “mattress plan” follows green. According to sources consulted by scope, Neither private security boxes nor those of financial entities record movements after ads. While it was not expected that “endogenous dollarization” is a rapid process, the truth is that even here there is a reverse dynamic of Fall of deposits in dollarsdespite incentives.

The content you want to access is exclusive to subscribers.

According to a survey of economist Amílcar Collante, by Profit Consultores, since May 22 the dollar deposits not only did not grow, but fell US $ 429 million. “The movement is more related to laundering last year, and today there are no tax incentives so that saved dollars return to the system. It is a marginal contribution that can be expected in 2025,” he explained. In addition, he pointed out that a good part of those dollars They are currently allocated to pay services abroad, especially tourism. In other words, consumption would be turning towards an activity that generates an unbalance to the Central Bank.

Whatsapp image 2025-06-09 at 9.57.35 am.jpeg

The deposits go down, despite the incentives

In tune, from the LCG consultancy they warned that The impact of the “dollars of dollars” will be limited, mainly focused on those who access currencies through exporters. For its part, the consulting firm Econviews had anticipated that the effect of these measures would be more visible in the long term: “most of those who have dollars continue to use them as an instrument of savings, and it is unlikely that they go to consumption or deposits that then feed the credit,” they highlighted.

Dollars: Without dynamism in banks or safety boxes

The physical protection circuit of the tickets does not show signs of dynamism either. From three of the main Banksbefore the consultation of Scope, They coincided: “There are no movements in safety boxes”. In fact, one of them, which integrates the top 10 by client volume, stressed that “They neither open or close boxes, we are at historical levels”. They even highlighted that there are above available.

The same panorama is observed in the private signatures that offer safety boxes. From Hausler, his Chief Marketing Officer, Ignacio Serrano, said the service has been growing in the last five years, but not for the return of dollars to the system, but for reactivation in the real estate sector. “We do not detect a behavior change. Even so, our perspectives are optimistic, ”he said.

Distrust, history and mattress dollars

What prevents savers from looting the dollars from the mattress? María Paula Véliz, expansion tax manager, identified three main factors: the ignorance of the risks involved in keeping cash, distrust of the financial system and tax uncertainty. “Although the current government raises clear objectives, many remember setbacks in the past and prefer to wait to see if the changes are sustainable over time,” he explained.

In parallel, from the Central Bank, the director Federico Furiase He stressed that this attitude of the savers was expected. “An immediate turnaround is not expected to the formal circuit”. However, he insisted that this process “can allow further growth, more collection and help sustain the fiscal surplus.” For now, The dollars are still under seven keys.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.