A BCRA signal caused strong movements in the common investment fund industry. For example, the FCI Money Market suffered multiple bailouts in recent days in the expectation of a decline in their future yields. Where do these flows migrate?

The recent one Announcement of the Central Bank (BCRA) on the possibility of a rise in bank lace for paid accounts generated strong movements in the industry of the Common investment funds (FCI). Although the measure still It was not effectivehe already caused Important bailouts at FCI Money Market –that use many virtual wallets to remunerate balances, such as Mercado Pago or Ulá- in the expectation of a decline in their future yields.

The content you want to access is exclusive to subscribers.

In front of this panorama, Lecaps begin to capture flows as an alternative to channel liquidity with a better rate and controlled duration.

The official objective is match the Lords of Money Market funds with those of the rest of the depositswhich would imply an increase of 16% on the current level. The measure is part of a broader strategy to stretch the duration of the liabilities of the financial systemin line with the disarmament of the Lefis and the impulse to tenders of short -term LECAPS. In addition, the BCRA anticipated that it could intervene in the secondary market to liquidity to these instruments.

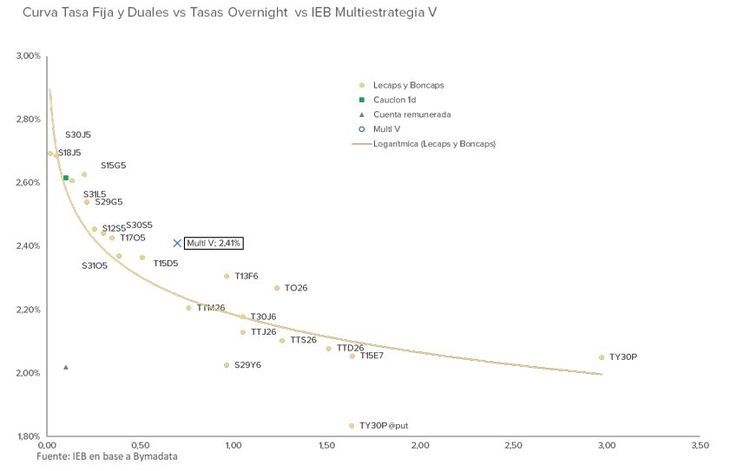

GRAPHIC IEB.JPG

From IEB (invest in the stock market) They warned that, although Money Market funds could offer some somewhat greater performance in the short term -for the “overnight” rates and the fall in their assets under administration-,, Once the lace rise is completed, a substantial fall is projected in their yields.

Given that scenario, IEB advisers recommend rotating funds investing in Lecapslike him IEB Multiethgege vwhich currently shows a 0.70 durationaccrue a rate higher than the transactional funds and presents compression potential If the inflationary decline continues.

“With the fixed deadlines, surrendering around 2.87% monthly and the paid accounts averaging 2.02% -level that would fall if the new lace is applied -, the curve of yields in pesos could continue to compress,” They pointed out from the firm led by Juan Ignacio Abuchdid.

Today, Money Market funds concentrate approximately the 40% of the stock of private deposits in pesosso any regulatory reconfiguration on them has a Direct effect on the financial system. In this context, the funds of Lecaps arise as a more attractive and efficient vehicle for those who seek performance and greater predictability.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.