A report reveals that Argentine parents combine savings in dollars with digital tools such as paid wallets. When investing, they prioritize common funds, yield and, to a lesser extent, properties such as family legacy.

On Father’s Day, a private consultant conducted a study to know what Argentine parents save and invest. The results reveal a marked balance between attachment to traditional practices and the incorporation of digital tools.

The content you want to access is exclusive to subscribers.

When saving, the 37% of parents prefer to do it in dollarswhile 31% opt for digital wallets with paid accountsan option that gains ground thanks to its simplicity and performance. Further back they are located Fixed deadlines (20%) and Gold (12%)which maintain their appeal as defensive assets, according to Focus Market next to Orange X.

“Many parents continue to choose the dollar as a value shelter. It is an almost cultural behavior: inflation memory weighs more than the short -term indicators,” explains Damián Di Pace, director of Focus Market.

What instruments are the most chosen to invest

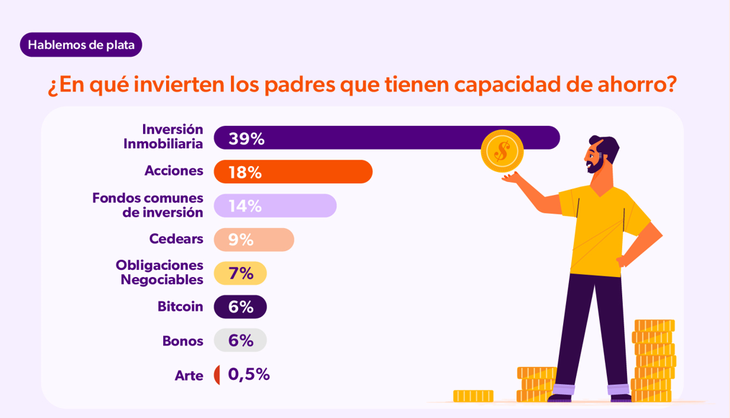

The study also investigated investment preferences. In this field, the Common investment funds lead with 40%followed by the Yield (31%)instruments that allow access to foreign actions from the local market. Then they appear Actions (14%), Negotiable obligations (9%) And, to a lesser extent, The real estate sector (6%).

While the brick no longer leads the financial investment ranking, continues to occupy a symbolic and patrimonial place In the minds of many parents.

“The property offers something that today is worth as much as profitability: security. It is a tangible, stable investment, which is perceived as a family legacy,” says Di Pace.

image.png

Although the brick no longer leads the ranking of financial investments, it continues to occupy a symbolic and patrimonial place

How young parents invest

Younger generations tend to get away from the traditional investment model. Liquidity, diversification and flexibility gain ground against more structured options such as the purchase of real estate.

“The new parents prioritize mobile platforms, low entry costs and the possibility of adapting their strategy according to their family economy,” adds the economist.

The report also warns that The age of children is a key factor in financial decision making. When they are small, liquidity and low risk prevail. But as they grow, The vision of the parents becomes more patrimonialthinking about long -term projects. “Decisions change deeply according to the life stage. A family with a child can bet on a long -term project, while those who have several children tend to diversify their savings more,” concludes Di Pace.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.