David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.

Menu

From euphoria to replication: JP Morgan’s double speech with Argentine titles

Categories

Most Read

The market’s expectation at the time of the elections: in standby mode and with an eye on Washington

October 25, 2025

No Comments

Argentina validates the dollar, which tends to be displaced by gold

October 25, 2025

No Comments

From consensus to immobility: collective bargaining in the face of the challenge of modernization

October 25, 2025

No Comments

The republic of carry trade: how JP Morgan discovered a hedge fund with a flag and shield in Argentina

October 24, 2025

No Comments

Breaking ceilings, building routes: why we see few female CFOs at national companies

October 23, 2025

No Comments

Latest Posts

Formula 1: marshals run in front of Liam Lawson’s car

October 27, 2025

No Comments

PierceI am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five

There is already euphoria in the markets due to LLA’s electoral failure: ADRs fly up to 16% on Wall Street

October 27, 2025

No Comments

October 26, 2025 – 9:50 p.m. Before the result was known, after 9 p.m., Argentine ADRs were already beginning to gain strong bullish momentum this

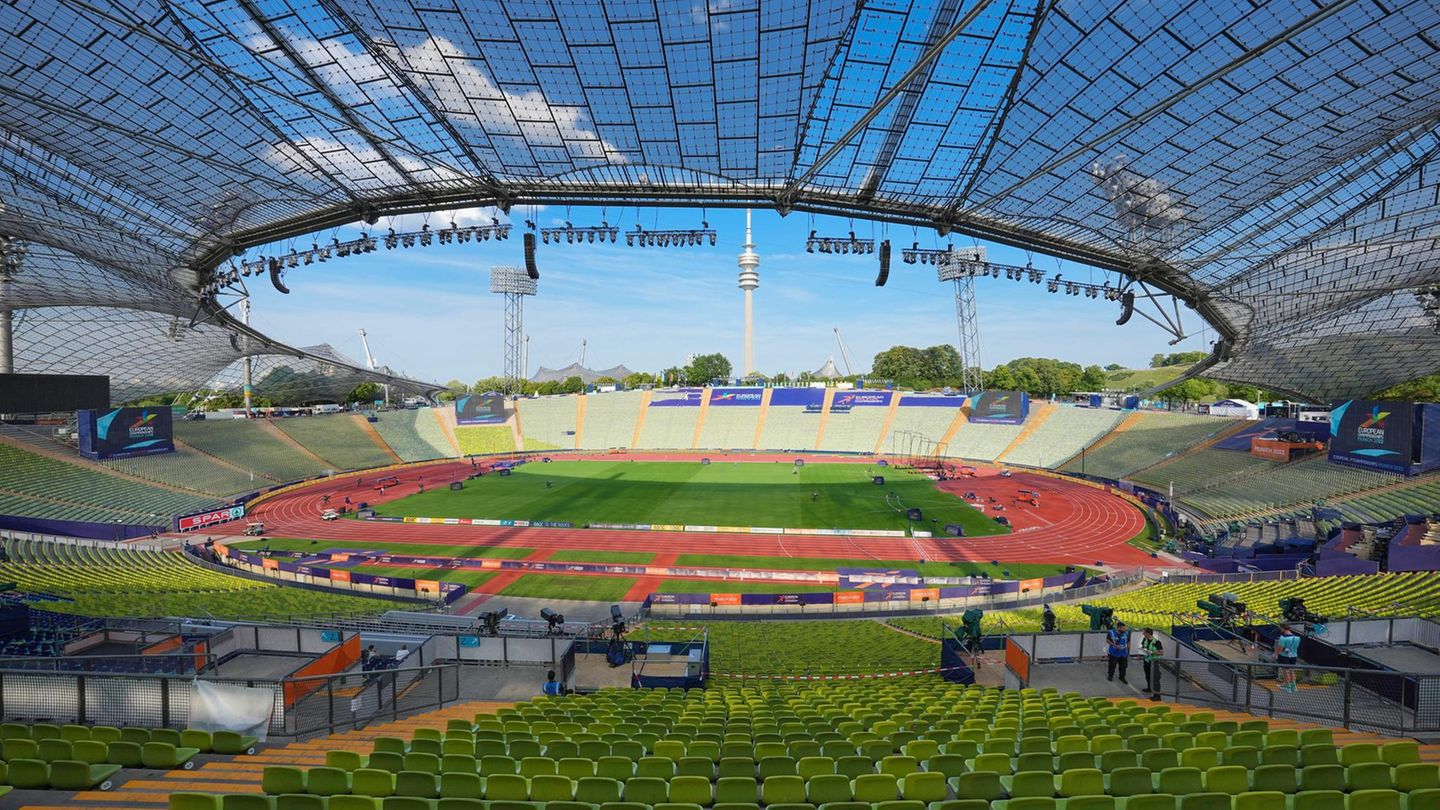

Munich: Citizens vote for Olympic bid in 2036, 2040 or 2044

October 26, 2025

No Comments

Citizens’ decision Munich votes for Olmypia application Listen to article Copy the current link Add to wishlist There was record participation in the Munich referendum

24 Hours Worlds is a comprehensive source of instant world current affairs, offering up-to-the-minute coverage of breaking news and events from around the globe. With a team of experienced journalists and experts on hand 24/7.