The stock market bond is a guaranteed short -term financial operation with negotiable values. In it, a participant (the policyholder) deposits assets in guarantee and receives funds from the placerwith usual deadlines of 1, 7 or 30 days. Due to their guaranteed nature and short duration, these operations have a very low credit risk and are a widely used tool to place liquidity surpluses, both for banks and common investment funds and by individual companies and investors.

Like other alternatives in pesos – as paid accounts, fixed deadlines or LECAPS – the bond rate usually moves in line with the monetary conditions of the market. However, on the wheel of July 10, 2025, the bond rate one day collapsed to the lowest level of the last five yearslocated below the rest of the local currency placements.

Screen capture 2025-07-11 at 16.18.46.png

Historical evolution of the bond rate at 1 day

Why did the rate fall?

The collapse of the rate responds to a key change in the monetary scheme. Exactly one month ago, the BCRA and the Ministry of Economy announced a new package of measures with the aim of strengthening international reserves and controlling monetary aggregates. One of the most relevant measures entered into force just July 10: the Central Bank stopped offering fiscal liquidity letters (Lefi) To the banks.

The Lefi were debt instruments to one day, with attractive yields – TNA of 29% and ASD of 33.6% – and they worked, in fact, as Floor for very short -term interest rate. Its elimination is forcing banks to redirect their excess liquidity towards other instruments: ciones, lecaps or even loans. This reallocation explains the drop in rates in short -term instruments. Consequently, the yields that banks can offer for deposits will also fall, which will negatively affect fixed installments, common funds and bonds at variable rate.

Screen capture 2025-07-11 at 16.18.54.png

The extinction of Lefis lowers short -term instrument yields

A new scenario: free rate and more volatility

From the beginning of the Phase 3 of the economic programthe BCRA aligned with a classic scheme of monetary aggregates as a nominal anchor. In this context, the government chose to administer monetary aggregates, letting the interest rate and exchange rate be determined by the market endogenously. Under this logic, the elimination of the Lefi looks reasonable: it is no longer appropriate to set a monetary policy interest rate. In addition, if the decline in the interest rate we observed yesterday is extended over time, there are the government would achieve lower credit favoring economic reactivation.

However, just three months after the presidential elections, the chosen moment is not attracted. The combination of lower rates and the expected monetary injection after the expiration of the Lefi – which operates on July 17 – could exercise Alcista pressure on the exchange ratejust when the flow of foreign exchange for exports begins to weaken. In fact, the exchange rate already accumulates a rise in 6.2% in the last monthand forward, Flotation bands will be key to containing devaluation expectations. As long as these bands remain credible and the interest rate exceeds 1% monthly (the band’s roof adjustment speed), there will be incentives so that investors liquidate dollars and position themselves in pesos. In this way, the government bets that the assembly of positions of Carry Trade Avoid a disruptive jump in the exchange rate without using your own dollars to intervene.

What to do with the portfolio?

In this new context of lower rates, we prefer to maintain a DOLARIZED POSITIONwaiting for better entry points in pesos (closer to the band’s roof) to return to strategies of Carry Trade. Among our preferred alternatives in hard currency we highlight the CO32 bonus. It is a recently issued bonus by the province of Córdoba, expiring in 2032.

Córdoba maintains primary fiscal surplus since the end of 2019, occupies the second place in the PPI credit quality ranking and the recent broadcast improved its expiration and liquidity profile. With a performance close to 10% annual and a modified duration of 4.4 years, CO32 offers An attractive rise potential If the provincial country risk is reduced. Under an optimistic scenario where provincial bond credit spreads recover the yields achieved in 2017, this bond could generate a performance of 16% in dollars in a yearonly surpassed by the province of Buenos Aires, although the latter faces major fiscal and political challenges.

For investors in pesos, we see opportunities in Long closed bondspromoted by three factors:

- Minor expected real rates,

- Inflation Breakevens that could rise to the recent exchange weakness and political noise generated by the laws recently approved in Congress by the opposition, and

- Historically low low between cer bonds and dollar bonds.

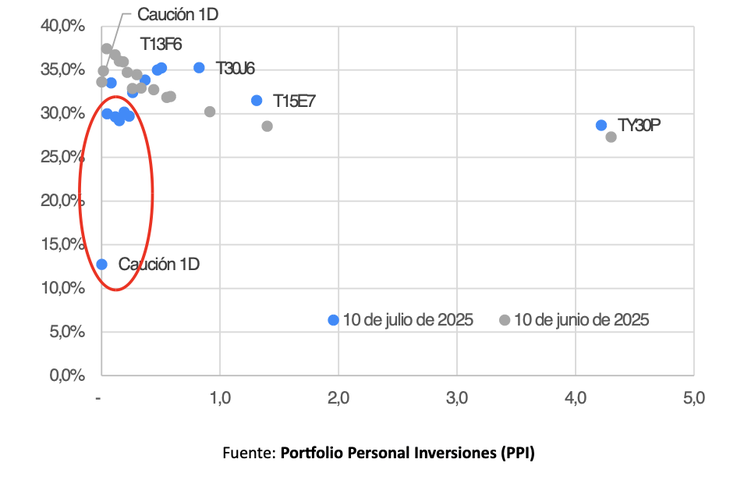

Finally, for those who seek performance at a fixed rate, we believe that It is worth lengthening duration. For example, a Lecap expiring in June 2026 yields 35% per year, some 5 points more than short -term LECAPS. That implies one 40% per year forward rate Between October 2025 and June 2026, much higher than current rates. In this sense, we prioritize bonds with expiration in 2026 or posterior (T30E6, T13F6, T30J6 or the recent TY30P) against short lecaps or dual instruments.

Conclusion

The abrupt fall in the bond rate marks a regime change in Argentine monetary policy. The BCRA’s decision to abandon direct control of fees, in favor of an aggregate -based scheme and exchange bands, raises opportunities and risks. For investors, The context requires recalibrating walletswhere we recommend lowering exposure to exchange rate, take advantage of opportunities in provincial bonds in dollars, ensure for long terms attractive returns of the Cer and arbitrate the bond curve at a fixed rate by positioning us in deadlines greater than 3 months.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.