After a 2024 stellar, the Argentine financial markets They have entered a correction phase in 2025, challenging the official achievements of fiscal balanceinflationary deceleration and economic recovery. He S&P MERVAL INDEX, Sovereign bonds and country risk have shown Erratic performancereflecting a growing skepticism among investors on the sustainability of Economic reforms. This change of trend marks an abrupt contrast With the enthusiasm of last year, raising the question of whether this pause is a healthy correction or an indication of deeper structural concerns.

Six months of pause after a historic rally

In 2024, Argentine markets lived an unprecedented boom, promoted by the reforms of the government of Javier Milei and expectations about economic standardization. S&P Merval, the main stock market index in the country, shot a 122% in terms of dollarsbacked by optimism generated by fiscal consolidation. Sovereign bonds also rose, and the country risk, measured by the emerging market bond index (EMBI) JPMorgantouched a minimum of 559 basic points on January 9, 2025, reflecting renewed investor confidence.

However, that impulse has faded. Since January, Merval has lost 25% in dollars. Banks such as Banco Galicia and Banco Macro They have fallen between a 18% and a 28%while his American depositary reepts (ADRS) that quote on Wall Street have registered losses of up to a 33%. YPFa reference of the local market, has retreated 21% in the domestic market and 26% in its ADR. Sovereign bonds, such as AL30 and GD35they have also shown a bearish trend, despite the income and amortization payments made by the Government. The country risk, meanwhile, climbed up to almost 1,000 basic points in April, and then stabilized in a volatile range of 670 to 730 points.

Reservations and exchange policy: the heart of the problem

A key factor in the mood of the market has been the exchange policy of the Central Bank of the Argentine Republic (BCRA) and its impact on international reserves. In 2024, purchases of dollars by the BCRA fed optimism, since the increase in reserves correlated with a country risk fall.

BUTTELER MARKETS.JPG

Source: Buteler with BCRA and Market data

In 2025, however, the change from BCRA to net sales of dollars in the first months – motivated by the perception of a overvalued weight and a possible modification of the exchange scheme – he co -conceived with a strong country’s risk. April’s decision to abandon strict exchange controls and adopt a flotation scheme administered with intervention bands stabilized the weightbut failed to restore investor’s confidence. The market distinguishes between the growth of reserves for genuine purchases of the BCRA and reserves from loans or rest, the latter do not generate the same confidence.

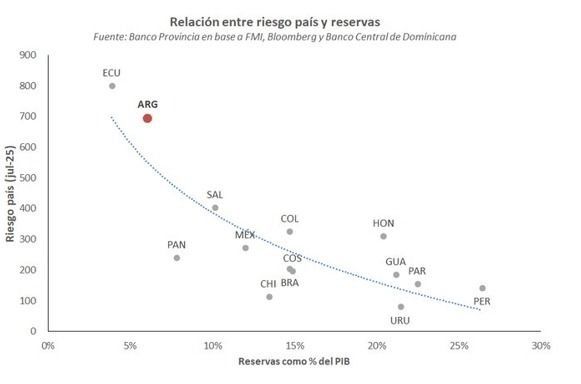

A comparative graph of emerging markets illustrates this dynamic: countries with greater reservations in relation to your GDP, such as PeruThey consistently present a lower country risk, even in contexts of political instability.

BUTTELER MARKET GRAPH 2.JPG

Source: Bank Province based on IMF, Bloomberg and Central Bank of Dominican

In the case of Argentina, reservations, promoted by an agreement of 20,000 million dollars with the International Monetary Fund (IMF) and loans from World Bank and the Inter -American Development BankThey have not managed to translate into a sustained reduction of the country risk.

Bonds and debt load

The Argentine sovereign bonds have reflected the restlessness of the market. Despite the successful debt payments in January and July, including bonds to 30 and GD46, prices have shown a descending trend. The imminent “debt wall” in foreign currency, mostly in the hands of external creditors, underlines the magnitude of the challenge. With a country risk of 700 basic pointsArgentina remains virtually excluded from international credit markets, which complicates the refinancing of its obligations. A country risk above 600 basic points It practically closes access to global bond markets. Without access to affordable credit, refinancing becomes a titanic task.

Political and economic winds against

The second semester of 2025 promises more volatility, driven by mid -term elections and weakening signs in economic results. The balance of payments, an indicator External Health Keyshows tensions, with net exits in services and interest payments by 3.9 billion dollars in the first months of 2025.

Political setbacks, such as the recent Defeat in the Senate From a key legislation that affects the fiscal result, they have added uncertainty. October elections could amplify volatility, a solid result for ruling could restore confidence, but a fragmented scenario could deepen sales.

What follows?

The six -month pause in the markets reflects more than a correction after the rally; points out a broader reevaluation of the Economic path of Argentina. Investors are expressing skepticism about CGovernment’s apacity to navigate a complex landscape of political risksexternal debt obligations and winds against global. The 25% fall of the Merval, the erratic performance of the bonds and the inability of the country risk to resume its bassist path indicates a market that requires clearer sustainability evidence.

For now, Argentine financial markets are at a crossroads. A decisive electoral result could revive optimismcarrying the country’s risk return to the minimums of 2024. On the contrary, not to address the quality of reserves, the sustainability of external debt or political volatility could consolidate the current discomfort.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.