After 2023 and 2024 explosives, the actions of the Argentine banks corrected strongly. But beyond the price, the interesting thing is the valuation: the Price-To-Book ratio collapsed 50%. What does this mean?

What is the Price-To-Book Value?

The Price-To-Book Value ratio compares the market price of a company with its accounting value, that is, with the value of its net assets according to the balance. In other words: how much is paying the market for each weight/dollar of net equity.

- If an action is quoted with a P/BV of 1, it means that the market price coincides with the accounting value.

- If the P/BV is less than 1, in theory you are buying the “discount” assets.

- If it is greater than 1, the market pays more, probably because it expects good profitability, growth or quality of management.

This ratio is especially useful in banks, where the heritage balance has a central weight in the business.

In recent months, the average P/BV of Argentine banks fell from levels close to 2.5/3 to levels between 1.2 and 1.5.

Argentine banks

Why did this happen? Basically, due to the general correction of the Argentine market in a context of political and macroeconomic uncertainty.

Anyway, it is worth remembering the full movie. Let’s look at the case of Ggal, the biggest bank:

Argentine banks2

It came from accumulating a rise greater than 1000%. Yes, a thousand percent. And now? It is 31% below the recent maximums. That is not an alarm signal. It is simply how an asset of such volatility moves.

Does this recent fall reflect a structural change in business? That is the issue. And that is where an opportunity may arise.

Comparison with the region

To put in context the current valuation of Argentine banks, it is worth looking at what happens in other countries:

Argentine banks3

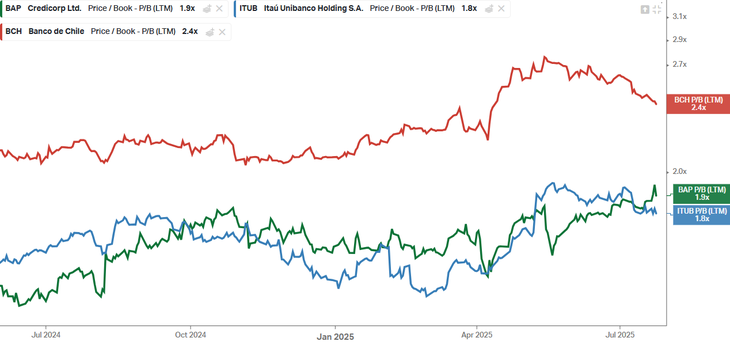

Regional banks such as Itaú (Brazil, Itub) quote with a P/BV of 1.8, while Credicorp (BAP), financial holding that controls the main bank of Peru, quotes around 1.9. Banco de Chile (BCH), meanwhile, has a ratio of 2.4.

These valuations show that, even in countries that are not first line, the market is willing to pay much more for their banks than what he pays today for Argentines.

That is, even in economies that also have challenges, banks quote between 50% and 100% more expensive than Argentines under this same ratio.

The conclusion is clear: in relative terms, Argentine banks are cheap. Either against your own history or compared against those of the region.

What are the Argentine market seeing?

Meanwhile, Argentine bonds (larger and more rational market) are giving different signs to actions and are close to historical maximums.

To this is added a key seasoning: the legislative elections that are coming in Argentina. Today everything indicates that freedom progresses has good chances of consolidating its political power. If that is confirmed, the market will interpret it as a validation of the current economic direction.

And as usually happens, the market does not wait for the news to be officers: it is anticipated. When the trend is clear, it is many times too late to get on.

Therefore, for those who have a more aggressive profile, these types of moments usually offer windows of opportunity.

And the long term?

In the background, the Argentine banking business has a problem (opportunity?): Credit in Argentina is very low. The Ratio of Loans on GDP is among the lowest in the world. That means that, if the macro is ordered, there is a huge growth potential.

If the country manages to consolidate a sustained low inflation and an environment of legal and monetary stability, the financial system will necessarily grow a lot. And in that case the banking actions will rise.

If you are interested

Note: The material contained in this note should not be interpreted under any point of view as an investment council or recommendation for the purchase or sale of a particular asset. This content has only educational ends and represents only an opinion of the author. In all cases it is advisable to advise with a professional before investing.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.