The chosen economic scheme of amount of money, with dollar flotation and volatility of the interest rate, is facing its first great challenge. The exchange rate began to approach the roof of the band and did so in a context of interest rates that also operate at a very high level of real rate. The natural reaction of the economic team was to correct the amount of money. In the coming weeks we will see if a new balance is achieved and the implications that can be generated.

In the last week the pressure on the exchange market followed. The exchange rate came to an approximate range of 5% of the roof of the finish line. Under the current scheme, at the value of the ceiling (approx. $ 1,450), the BCRA should intervene selling currencies and removing weights to remove surplus liquidity. The theory implies that, with less pesos, a bullish impact on the interest rate and bassist on the exchange rate should be generated.

That is the logic of the model, but does not include a central factor that is the role of expectations. The problem is that when the exchange rate approaches the levels of the bands, the questions that begin to raise investors are different. They have more to do with the sustainability of the scheme in the time than with the real impact of the policies that will be applied in each case (floor or ceiling of the band).

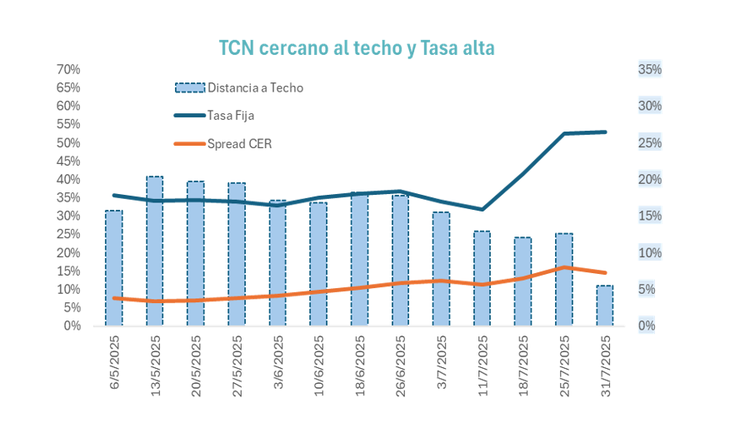

Precisely, that role of expectations is the one that explains that with the exchange rate approaching the band’s roof, real interest rates are at substantially higher levels than when they were on the band’s floor.

This is paradoxical, because while the exchange rate is close to the floor, The displacement range that it has to the roof of the band is much higher, therefore, the interest rate that compensates for that potential risk would have to be greater. On the other hand, near the band’s roof, if we assume that said ceiling is maintained, the level of rate necessary to ensure a specific return in dollars is lower.

megaqm1

For this logic of the exchange rate and distance in the ceiling rate of the band, the current situation is contradictory, close to the band of the band with rates levels, both fixed and real nominal, close to the maximums from the beginning of the flotation.

megaqm2

When this dissociation occurs between the level of exchange rate and the interest rate, You need to work on expectationsbecause clearly the instruments in pesos offer an expected yield a dollar well above the usual market (or leave an implicit exchange rate above the band’s roof). And still investors prefer to continue dollarizing. That implies that they can be doubting the sustainability of the band’s roof.

In these cases, the interest rate loses efficacy as a tool and these distortions occur.

The official answer: restrict the amount of money

From the theoretical point of view, if the demand for currencies increases much more than the supply, there is an excess of pesos that investors do not want to sustain and that the change rate of the moment prefer to dollarize.

The solution to those cases of stress is to shrink that surplus of liquidity. There are three direct ways of operating to achieve that result:

- Treasury tenders: That the treasure offers instruments in pesos so that investors can channel their surpluses there. In tenders these investors request the rate they need and the treasure decides the cutting level. The problem is that when these cases of greater stress occur, the offer is usually below the maturity level and a debt off Roll is produced. In other words, the treasure does not renew 100% of what expires and injects surplus weights again. When so, it is not even a price issue. This happened in the last week, where the banks, in need of liquidity per rise, offered less pesos than they beat him. That makes the BCRA unable to fulfill the objective of limiting the amount of money.

- Lace policy: As in the previous case, it is the market that chooses the level of weights it offers in each tender, there is a tool in which there is no that degree of freedom for counterparts. It is precisely the lace policy, because there is the BCRA that decides by issuing standards, what is the minimum cash requirement that will require for each type of deposits. That forces banks to channel liquidity there, reducing the monetary base level. That did in recent weeks, first with notice (time to frame) and yesterday again, but more surprisingly.

- Open market operations: The other alternative is that the BCRA is more active in the operation via secondary market of LECAPS, selling its Lecaps holdings there to withdraw surplus weights. Until now, it has been little active in that window or sporadically replaced it with repo operations.

What has been clear in recent days is that the official decision is to continue restricting the amount of money, so that the exchange pressures lower. But that not always the chosen tools have high levels of efficiency, sometimes expectations play a different role and make more complex achieve the desired results.

What implies restricting the amount of money?

If we go to a scenario of greater restriction of the amount of money, the interest rate can remain high in nominal and real terms. The problem of monetary aggregate goals / control mechanisms is usually the “lag” or lag with which they generate the desired results. To compensate for this effect, it is sometimes generated by overreaction, which implies reducing the amount of money to achieve a faster effect.

The decision of the economic team seems to have gone in several directions simultaneously to try to contain this pressure that is being seen on the exchange rate. One is the Restriction on the amount of money, which is the one that should give results in the medium term, but short has tried to generate news that changes expectations, to make the role of the high interest rate more efficient.

That change in expectations that is sought is to minimize the risk of exchange correction, giving signs of the strength of the band policy. For that, it has managed to unlock the review of the agreement with the IMF and with it the disbursement of US $ 1,350 million matters of maturities, but has also reduced the aliquots of retentions to generate a greater flow of currency supply. The last important point in that direction is the reduction of the meta of accumulation of reserves agreed with the IMF. This point is important, because it implies a lower requirement to buy currencies from the treasure and therefore a lower buying pressure in the exchange market.

In the coming weeks we will see if the combination of Raise rise, low withholdings, according to the IMF and expectations management are sufficient to achieve a balance between exchange rate, Distance to the roof of the band and more solid interest rate and that has no implicit changes in the band policy scheme. This is the main challenge and a few weeks after the legislative elections. The chosen path is the one that was defined for these cases and from the initial design of this phase III of the economic program.

Meanwhile, the surplus stock of pesos as a global measure (Treasury debt in local currency + remunerated liabilities of the BCRA) remains at the same level in relation to GDP as before the start of the program. That implies that the liquefied effect of these surpluses has been compensating with the lowest real rate. In case it is not enough to draw any conclusion, but if you turn on an alert signal about the amount of time that the treasure can be maintained by paying real interest rates.

Megaqm chief economist

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.