A dollar depreciated marked the course of the global markets. After the first semester of the year we observe a depreciation of the American currency Regarding the wide spectrum of world coins. This had its correlation in the performance of the different kinds of assets where Global actions and emerging fixed income in local currency were clear winners. In the current environment, risk management remains preponderant in the construction of the portfolio.

The scenario of a weaker dollar is materialized

Transmitted the first semester of the year we observed a dollar that lost land globally compared to the broad spectrum of world coins. At the close of last week, the Dollar Index It accumulated a fall greater than 10% in the year, being the worst record in a first half for that currency in the last 30 years.

However, and against initial fears, this weakness does not seem to respond to a massive capital exit of the US market, which continues to show strength, particularly in its shareholding segment. The corporate credit spreads, both in the stretch of investment and speculative, remain limited and the data of the US Treasury Department indicate a renewed foreign demand for government bonds of that country.

Foreign demand on American assets is firm in the current year Source: Apollo

Image

When finding the reasons of the movement, short -term, the weakness of the dollar could be accentuated by a greater coverage activity, since foreign investors after decades without covering their investments in the United States began to protect their exposure to the dollar due to greater volatility. This coverage, through sales in futures markets adds bearish pressure on the currency.

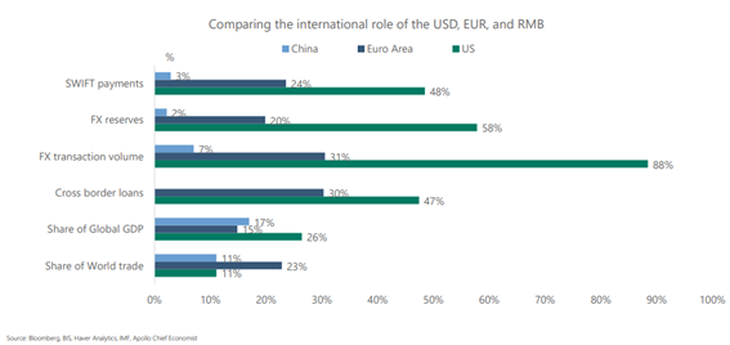

With a more long -term look, although the dollar will continue to be the main reserve currency due to its global use in trade, finance, and their ease of conversion, factors such as instability in economic policy with sudden changes in terms of its direction, together with the continuous and broad deficits (fiscal and current account), erode confidence in its value.

The fiscal unbalance (the main cause of the current account deficit), appears as the knot of the problem, and continues to be the main concern of the market. The recent approval of the new budget reveals a higher fiscal cost originated in the extension of tax exemptions. Thus, although the project does not aggravates the fiscal trajectory, it prevents its correction.

The US dollar is the world reserve currency

Image

The imposition of import tariffs that return to levels not seen in 90 years, added to the uncertainty about their duration and the eventual reprisals from other countries, deteriorates economic performance, causing a fall in the confidence of consumers and entrepreneurs. On the other hand, the hardening of immigration policy raises labor costs and restricts the expansion of production.

As a consequence, the risk of recession grows. According to Bloomberg data, the probability of recession has risen to 35%, since 20% at the beginning of the year. If this situation comes true or causes at least one drop in the activity, it could force a rate cut, eroding part of the dollar’s yield advantage against other currencies.

What was the impact on markets?

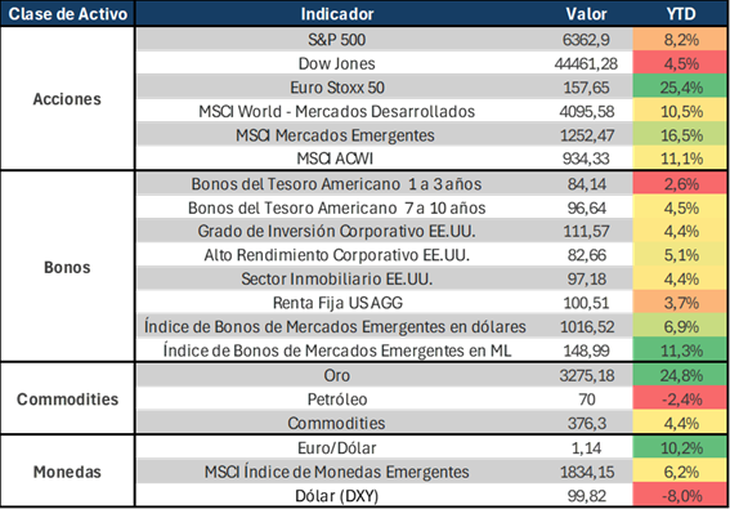

The weakness of the dollar promoted a strong portfolio rotation. Within the particular income, the emerging debt was highlighted in local currency and in the share markets the attraction was out of the US (with Europe measured in USD at the head). In another year of strong bullish trend, gold and silver continued to shine with tours of more than 25%.

Performance in USD accumulated to July 2025 of the main markets

Image

Source: Criteria based on market data

Portfolio management: caution and risk management in search of opportunities

After the shaking of Liberation Daythe S&P 500 resumed its upward path and reached new historical maximums above 6,300 points. In this context, increasing exposure at those levels looks unattractive against other options. However, we maintain our constructive vision on the segment of large capitalization and high growth companies, Large Cap Growthdriven by artificial intelligence, solid balances and businesses less exposed to commercial conflict.

Given the increase in macro uncertainty inherent in the style of President Trump, risk management remains preponderant in the construction of the portfolio. The least attractiveness observed about the dollar forces us to continue prioritizing progressive diversification towards assets called in other currencies. Without losing sight of the fact that the dollar remains the global account unit, the objective is to improve the returns expressed in that currency.

We maintain a positive vision on the emerging debt in local currency and on the debt securitized by mortgages in the US. In terms of equity we adopt a neutral exposure in terms of region for shares, with bias to the high growth sector in the US.

Thus, the objective is to anticipate possible structural changes and position the portfolio accordingly, prioritizing effective diversification that allows mitigating risks and capturing new opportunities both in the world of fixed income and variable income.

*By Nicolás Max, ASSET Director Management of Criteria

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.