David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.

Menu

The prognosis of “Blue Guru”: what will happen to the dollar and what to invest?

Categories

Most Read

Corporate security in the face of economic uncertainty: smart investment in times of budget pressure

October 8, 2025

No Comments

Argentine financialization and the feast of global crooks

October 8, 2025

No Comments

The labor reform must go to the link, not to the employment in the abstract

October 7, 2025

No Comments

Argentina, the startup of the collapse, seeks a new round of financing

October 7, 2025

No Comments

Retirement insurance: the challenge is not waiting, is to anticipate

October 6, 2025

No Comments

Latest Posts

Jürgen Vogel: Actor enjoys patchwork luck

October 11, 2025

No Comments

Lisa HarrisI am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor

SV Ried: Mark Grosse had to be taken to hospital with a concussion

October 11, 2025

No Comments

The SV Ried fans are excited to see Mark Grosse again soon On Monday, Mark Grosse was named the best player of the 2024/2025 second

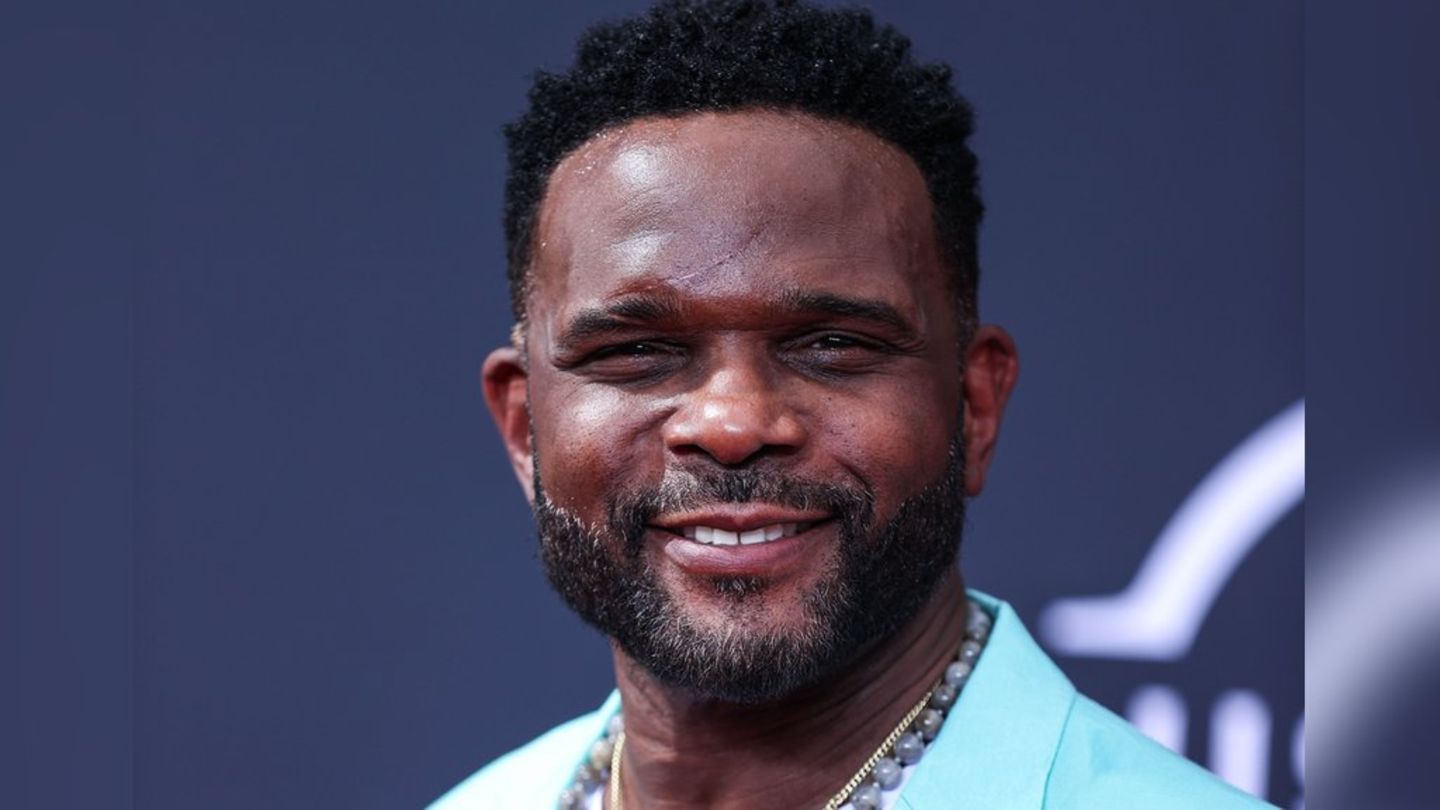

Darius McCrary: ‘All Under One Roof’ star arrested

October 11, 2025

No Comments

Lisa HarrisI am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor

24 Hours Worlds is a comprehensive source of instant world current affairs, offering up-to-the-minute coverage of breaking news and events from around the globe. With a team of experienced journalists and experts on hand 24/7.