Let’s look at the relationship between gold (orange line) and the ETF GDXwhich brings together the main gold miners (black line).

Image

Historically, both move quite even. However, in recent weeks the miners began to take off with metal.

GDX (main ETF of gold mining) marked new maximums while gold kept lateralizing. And that, in this sector, is usually a Alcista signal.

Why does this happen? The answer is in the profitability margins.

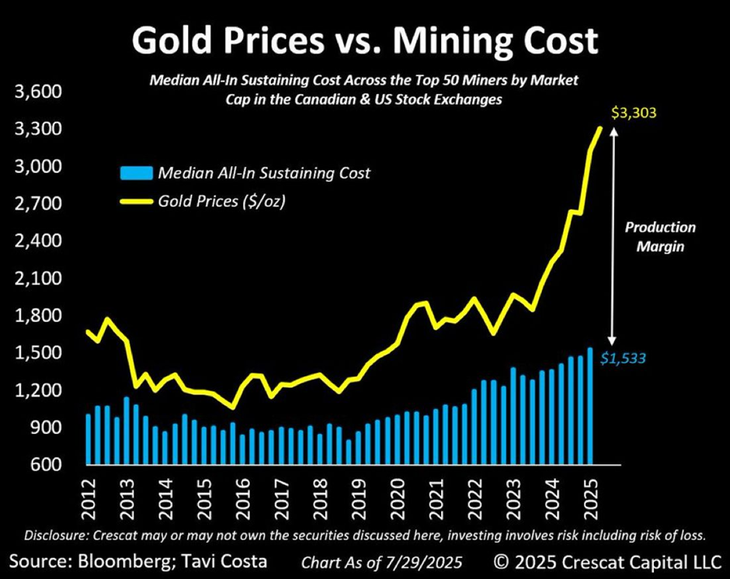

Image

There you see the comparison between the Gold price and the Average production cost of the 50 largest miners listed in Canada and the USA.

Today, gold quotes around U $ S 3,400 (A week ago I was closer to US $ 3,300 as marked by the graph), while the Average extraction cost is close to US $ 1,500. This means that miners are operating with 100% marginssomething historically unusual.

In other words, It was never as profitable to extract gold as now. And that is one of the reasons why miners can rise even more than metal itself.

In fact, in March of this year I commented on the investment that made the mostGold miners): https://www.ambito.com/opinions/la-inversion-que-hoy- has -mas-sentido-n6124061.

Gold has been showing for a long time Spectacular foundations to sustain a long -term bullish trend. That is now added Very powerful short -term factors who are acting like immediate catalysts.

On the offer side, the tariffwhich concentrates 70% of the world refining. This restriction generates Alcista pressure in a market that was already adjusted.

In macro, the market discounts fees of fees by the Fedin a context of persistent inflation and risk of stagflation. Historically, this scenario has been very favorable for gold as Active refuge.

Finally, the Central banks continue with gold record purchasesseeking to reduce its dependence on the dollar and protect against possible financial and geopolitical crises.

The signal is clear: record margins, bullish trend in gold, macro intact drivers and now an extra catalyst from the US commercial policy.

Even after the recent rally, it still makes sense to look at the gold miners as an investment with high return potential.

Either via ETFs as GDX (large miners) and GDXJ (Junior Miners) or choosing specific companies, the sector offers a Risk/benefit ratio That, today, it is very difficult to find in other assets.

If you are interested in continuing to deepen, see analysis, videos and exclusive content, I leave you here all together so that you choose what serves you:

Note: The material contained in this note should not be interpreted under any point of view as an investment council or recommendation for the purchase or sale of a particular asset. This content has only educational ends and represents only an opinion of the author. In all cases it is advisable to advise with a professional before investing.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.