The uranium rally has nothing to envy at the best moments of gold or oil. And there are three uranium miners that have been rising strongly. What perspectives does the sector have? What happened to Trump this year?

2025 is becoming a historical year for uranium. It is not just a price issue: behind there is politics, geopolitics and a structural change in how the world thinks energy.

The global demand grows, the supply remains limited, and nuclear energy is the protagonist. In this context, some miners shot out.

Let’s go to the graph with the three best miners of the year:

URANIO BOG1

So far from 2025, the undisputed champion is Centrus Energy (LEU), with a rise close to +160%. It is followed by Energy Fuels (UUU) with +76%, and completes the Camco Corporation (CCJ) podium with a solid +48%.

On black line, we see the ETF Ura, which concentrates the main miners and accumulates a +40%. In other words, the three aforementioned actions strongly exceed the performance of the sector in general.

The difference is not less: Leu specializes in enrichment of uranium, a critical link with few hands in the world; UUUU has a strong presence in production and processing; and Cameco, the Canadian giant, is the historical leader and reference of the sector.

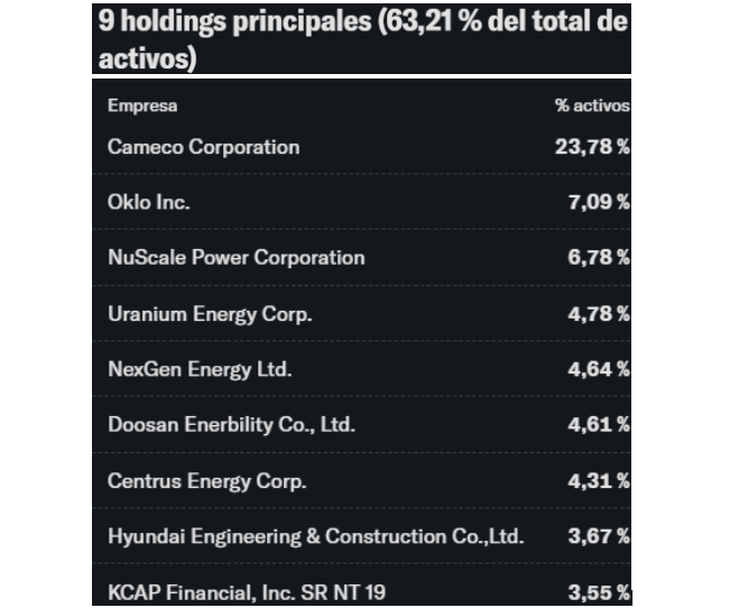

The ETF URA is the most direct way to expose itself to this sector without choosing a single company. Its main positions explain 63% of the total assets and include the following companies:

Uranium holding

URA is not only diversification: it also allows you to capture both the extraction business and that of nuclear technology and plant development.

What was happening with uranium this year?

The political trigger arrived in May: Donald Trump announced a plan to quadruple the nuclear capacity of the US to 2050 and reinforce the local supply chain. The Law “One Big Beautiful Bill” cuts subsidies to renewables and power incentives for nuclear projects.

The reason is clear: nuclear energy is clean, constant and reliable. In addition, the emergence of artificial intelligence is multiplying energy consumption, and companies such as Microsoft and Meta have already signed 20 -year contracts to supply their data centers with nuclear energy.

The offer, on the other hand, is limited. The conversion and enrichment chain depends largely on Russia and China, which adds geopolitical pressure. Japan reopens reactors, France advances with SMR (small modular reactors), and the US wants total independence in the uranium cycle.

Everything indicates that uranium demand will grow faster than supply. With a price in a clear bullish trend and a favorable macro and geopolitical environment, the sector is positioned as one of the most promising, although with a very high volatility.

For aggressive profiles, individual mining companies such as Leu, UUUU or CCJ can offer extraordinary returns, with greater risks. On the other hand, for the moderates, the ETF URA provides a diversified alternative to capture the trend without depending on a single player.

If you are interested in continuing to deepen, see analysis, videos and exclusive content, I leave you here all together so that you choose what serves you: https://clubdeinversores.com/main/linkhub-club-de-inversores/?utm_source=nota&utm_Medium=organico&utm_campaign=ambito&utm_content=18-08-Uranium

Note: The material contained in this note should not be interpreted under any point of view as an investment council or recommendation for the purchase or sale of a particular asset. This content has only educational ends and represents only an opinion of the author. In all cases it is advisable to advise with a professional before investing.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.