David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.

Menu

Between monetary absorption and sustainability: the bet to contain the market

Categories

Most Read

The Argentina of 27.27% and the invisible triumph of abstentionism

October 27, 2025

No Comments

Leading teams, from knowledge to the courage of leadership

October 26, 2025

No Comments

The market’s expectation at the time of the elections: in standby mode and with an eye on Washington

October 25, 2025

No Comments

Argentina validates the dollar, which tends to be displaced by gold

October 25, 2025

No Comments

From consensus to immobility: collective bargaining in the face of the challenge of modernization

October 25, 2025

No Comments

Latest Posts

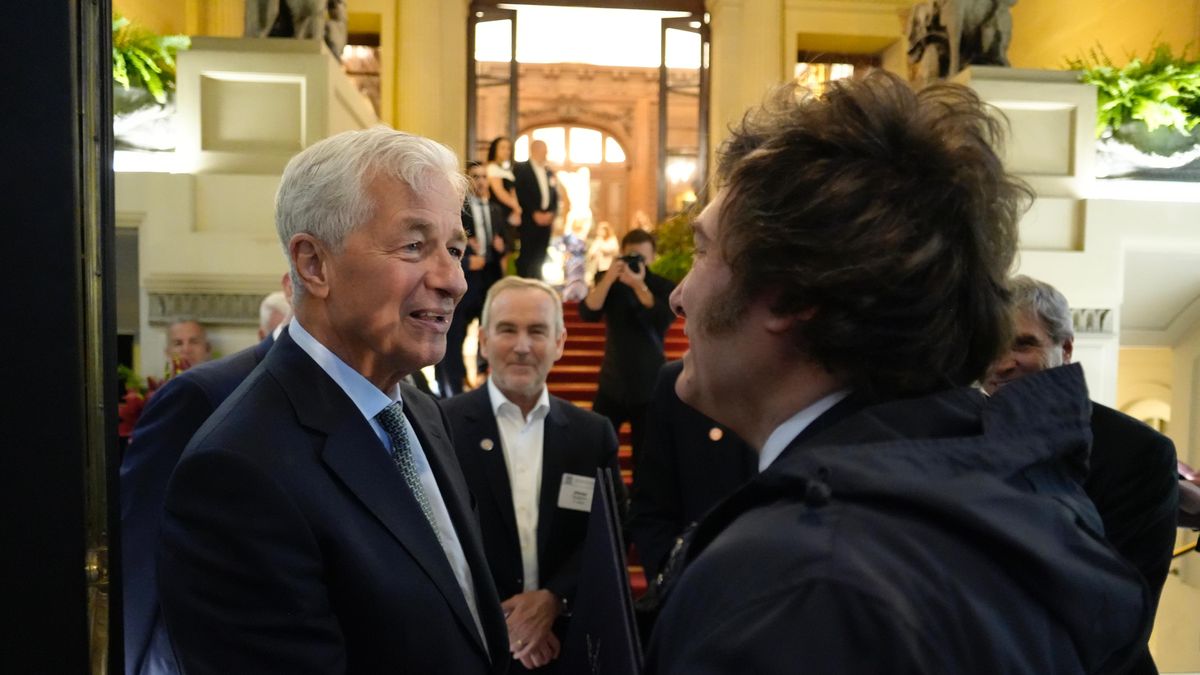

Javier Milei’s triumph: to what area will the country’s risk go down and what “upside” do bonds have according to Wall Street

October 27, 2025

No Comments

He strong advance of La Libertad Avanza (LLA) in the legislative elections has transformed the Argentine political landscape into a immediate catalyst for markets. With

The blue dollar suffered its biggest daily fall in two weeks and pierced $1,470

October 27, 2025

No Comments

October 27, 2025 – 16:21 Get to know the blue dollar quotes, the official one, the MEP and the CCL. Depositphotos He blue dollar low

a message of peace and unity

October 27, 2025

No Comments

October 27, 2025 – 16:14 The trip will include ecumenical meetings, interreligious events and tributes in historical places. Vatican News He Pope Leo XIV will

24 Hours Worlds is a comprehensive source of instant world current affairs, offering up-to-the-minute coverage of breaking news and events from around the globe. With a team of experienced journalists and experts on hand 24/7.