The elections find the government with a unique priority: reach October with the dollar under control. The monetary, exchange and fiscal policy was subordinated to that objective, even if it implies to stop the activity, tension the financial system, make credit and postpone public investment. The result is a real economy that absorbs the cost of the “anchor” would change while intervening with greater intensity in futures and pesos with high impact regulatory changes are aspired.

Since the disarmament of the Lefis, the monetary authority left the system without an explicit short -term reference. What seemed like an objective linked to the opening of external debt, ended in all cannons against the inflationary risk, far from the volatility of the country risk. The consequence was a volatility leap in endogenous rates (Caóción and Call), which in recent days moved intradiarily between 26% and 150% annual peaks in the very short term, disordering the funding of banks and tables. Reuters had already documented bands of 30–120% na after the departure of the letters; This week the market saw higher maximums. And reigns a mixture of uncertainty with arms tied by the lack of liquidity.

The regulatory nut rotation was given by the communication “A” 8302: unified lace in 50% and, key, daily measurement (no longer by monthly average). In addition, part of the requirement is integrated with treasure titles placed in restricted tenders for banks, which forces to channel surpluses towards these papers. Two extraordinary auctions in less than a month reinforced the mechanism (eg, the 18/8 awarded ~ $ 3.8 billion). The operating effect was immediate: at a certain time of wheel, the entities stopped taking pesos so as not to be exceeded in the lace cut, pushing the bond rate to intradiary ends.

Santiago Bausili Luis Caputo

Since the disarmament of the Lefis, the monetary authority left the system without an explicit short -term reference.

In parallel, the exchange intervention grew by derivatives. At the end of July, the BCRA accumulated a position sold in futures of USD 3,812 million – maximum of recent years -, in order to hold the “corridor” of the officer after July depreciation. In just one month two extraordinary tenders were made, forcing entities to overtur all excess liquidity to prevent it from pressing on the dollar. The exchange obsession tense to the financial system: it was noted in the bond rate that moved in the same 24 hours between 2% and 145% per year.

The consequences are clear. Forced pesos shortage triggers an unsustainable real interest rate: Personal credits pay an annual rate more than 25 points above inflation, while the effective Tamar annual rate of private banks climbed 70%, compared to expected inflation of just 21.1% (REM) for the next 12 months. The immediate result: more expensive and restricted credits, brake on investment and consumption. In return, the government achieves its only objective: limit the demand for dollars.

Far from compensating with expansive policies, public spending stabilized at low levels. According to the Argentine Grande Institute, based on IMIG, between July 2023 and July 2025, real public investment collapsed almost 85%consolidating a structural recessive bias in fiscal policy.

Capital expenditure (public investment) continues to be adjustment variable. The engine of public works and infrastructure remains in historical minimums. This allowed to sustain a financial surplus so far from 2025 (although Julio closed in red), but at the expense of deteriorating the state capacity to promote competitiveness, territorial integration and social sustainability.

The collapse implies less employment, more unfinished projects and an immediate impact on road infrastructure, transport, urban equipment and homes. In social terms, paralysis affects hospitals, schools and roads, more expensive logistics and increasing accidents.

The monthly financial result provides nuances: for the National Public Sector (SPN), the Treasury reported that Julio closed with primary surplus of $ 1.75 billion and financial deficit of $ -168,515 million (first red of the year for interest). In parallel, the Congress Budget Office (APN, accrued base) computed primary and financial surpluses in July. The difference is due to different institutional coverage and methodologies; In any case, the “anchor” is sustained by containment of primary expenditure and lower interests, not for investment.

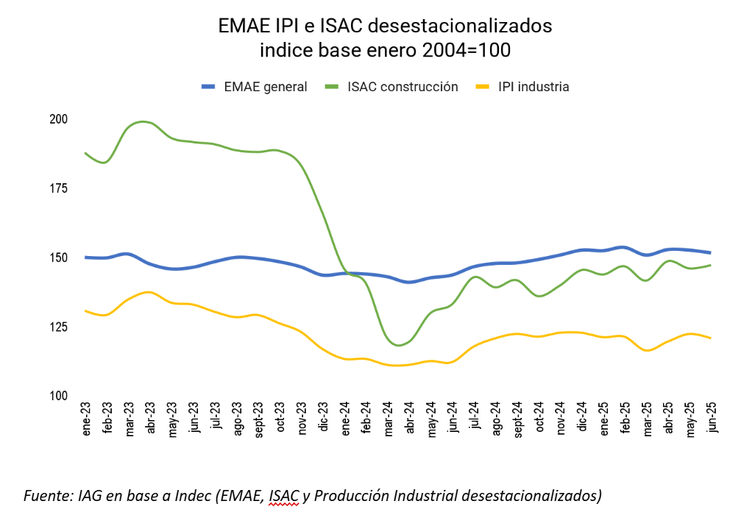

He EMAE June fell 0.7% monthly desestationalizedafter a drop of 0.2% in May. Although in the first semester accumulates a growth of 6.4% year-on-year, the drag of 2025 already shows weakness in the sectors that generate the most employment: construction (-15% vs. 2023), commerce (-9.4%) and manufacturing industry (-5.4%) (Source: IAG based on INDEC).

Under construction, our IAG indicator to July 2025 records a decrease of 5.6% year-on-year and 49% compared to 2023. The official June signal (ISAC) was +13.9% year-on-year with +0.9% m/m Desesting, but the trend-cycle remained downward-consistent with the brake of public works and credit ration. The economic and social impact is direct: less employment, paralyzed projects and deterioration of road networks, transport and urban equipment.

Social sensitivity to the exchange rate is maintained. In August, the consumer confidence index (UTDT) fell 13.9% intermensual, after a depreciation of the officer greater than 13% in July. It is not a causality test, but a reminder that exchange shocks impact on expectations and probability of consumption. Govern the dollar to govern the country.

Image

The official strategy – 50%daily conditions, tenders aimed at banks and record sales in futures – managed to limit the demand for currencies on the margin, but at the cost of: i) Volatility of very short -term rates; ii) Credit (actual high rate), and iii) persistent contraction of public investment. With activity weakening and expectations sensitive to the dollar, the risk is that the short -term exchange calm is bought at the price of greater damage in capital, employment and potential growth after October. The absence of an explicit reference rate and a guide on the real exchange rate consisting with recovery complicates the post-electoral transition.

Does it endure or not hold? Until October I could endure. It should even be assumed that the government will try to sustain it later, especially if it is doing well in the elections. But at a cost that is more difficult to reverse every day.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.