The report prepared by the BCRA on banks of the month of June exposed the impact of high rates on consumer loans.

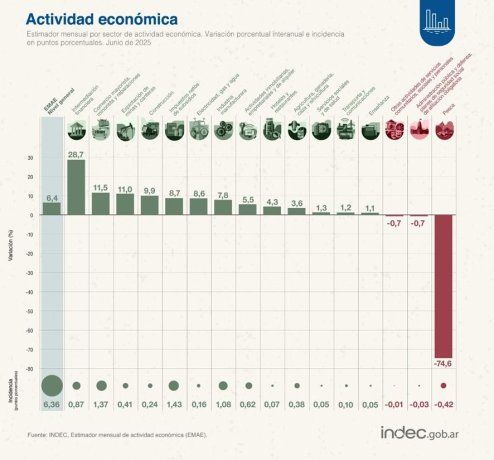

In a inflationary deceleration context and a renewed appetite for creditthe Argentine financial system has experienced a Notable growth in credit intermediation During the last year. However, this dynamism, which has promoted the financial sector as the one with the greatest expansion within the Monthly Economic Activity Estimator (EMAE)is accompanied by an alarming increase in the delinquency of the loans to familieswhich reached in June its highest level in 15 years. This phenomenon raises questions about the sustainability of Credit Boom and its implications for domestic economy and banking system.

The content you want to access is exclusive to subscribers.

A credit growth driven by inflationary deceleration

In June 2025, credit in pesos to the private sector grew a 4.2% In real terms with respect to the previous month, accumulating an interannual increase in 78.1%according to data from Central Bank of the Argentine Republic (BCRA). When considering both loans in pesos and dollars, families increased their debt stock in a 2.4% real in the month. The most dynamic lines were the mortgage loans, with a growth of the 3.8% realand credit cards, with an advance of 2.5% real. This vigor led the financial intermediation sector to register an interannual growth of the 28.7% In EMAE, consolidating as the most robust engine of economic activity in a context of inflation in setback.

INDEC Economic Activity

The credit in pesos to the private sector grew 4.2%.

INDEC

The increase in credit reflects, in part, a Greater confidence in macroeconomic stability. Inflation, which according to projections will be located between 25% and 30% per year In the next 12 months, it has allowed loans in real terms to win attractive. Banks, meanwhile, have responded with a more aggressive credit offer, especially in mortgages and consumption, although with still high rates. However, this positive panorama is fogged by a worrying fact: the delinquency of credits to families reached the 5.2% in Junethe highest level since 2010.

MORRESS: A growing threat

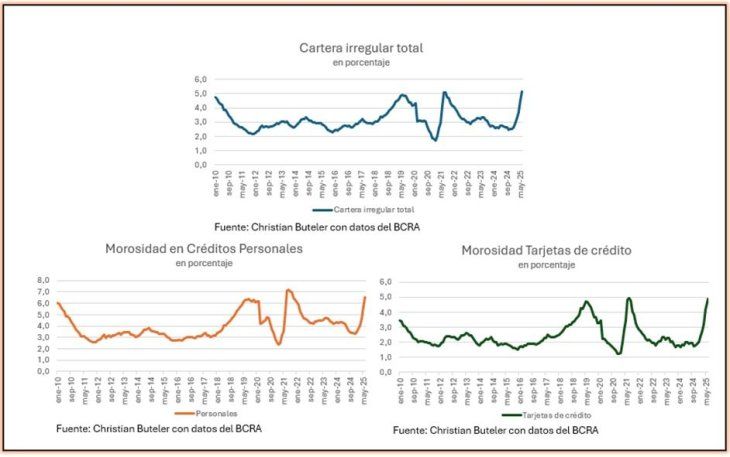

The increase in delinquency is not homogeneous among the different lines of credit. Personal loans have the highest breach rate, with a 6.5% of the portfolio in Mora, followed by the credit cards with a 4.9%. Prendal loans exhibit a delinquency of 3.9%while the mortgages, with a 1%They are the exception, showing an improvement compared to previous years.

This contrast suggests that Families are facing greater difficulties in fulfilling short -term obligationssuch as those associated with consumption, while long -term loans, such as mortgages, seem more resilient, possibly due to a more rigorous selection of credit makers. Two main factors explain this escalation in delinquency. First, interest rates, although nominally high, have not accompanied the inflationary deceleration proportionally. First line banks offer Credits with a total financial cost (CFT) that oscillates between 110% and 140% annualsignificantly above projected inflation. In the case of credit cards, rates are even more punitive, which aggravates financial charge for homes. In second place, Salaries have failed to follow the rhythm of these rates. While families grow at an annual rate of 20%the cost of credit is between five and seven times higher. This disparity reduces the ability to pay households, especially in a context where eThe indebtedness is no longer perceived as a tool to advance consumptionbut as a risky bet that can lead to insolvency.

Irregular Indec portfolio.

Personal loans have the highest breach rate, with 6.5% of the portfolio in default.

INDEC

A credit growth with ambivalent consequences

The increase in credit stock, which multiplied by 1.6 In the last yearcontrasts with the exponential growth of delinquency, which shot 3.07 times in the same period. This imbalance suggests that the credit boom, far from being a virtuous engine for the economy, is generating significant tensions. For many families, taking a loan in current conditions does not represent a financial solution, but a decision between facing immediate difficulties or postponing an inevitable crisis. Recent volatility in financial markets, with an increase in interest rates in the last 45 daysHe does nothing but aggravate this scenario. Banks, in response, have restricted access to credit, while households with existing debts, particularly on credit cards, They face their obligations.

The current situation is not new. In June, from this space, he warned about the prohibitive cost of credit in Argentinto. However, the consequences of this dynamic are already visible: a financial system that, although it grows, does so on fragile foundations. If the BCRA fails to moderate market rates to align them with projected inflation, and if banks do not adjust The conditions of your credit linesthe sector could lose its role as an engine of economic expansion. Moreover, a growing number of families will face difficulties in fulfilling their obligations, which could lead to consumption contraction and, therefore, in a negative impact on general economic activity.

Perspectives and challenges for the financial system

The challenge for the BCRA and the banking system is clear: to balance the Credit growth with the financial sustainability of households. A gradual reduction of interest rates, accompanied by policies that promote a more dynamic adjustment of wages, could mitigate pressure on indebted families. Likewise, banks could implement more effective segmentation strategies, offering preferential conditions to sectors with lower risk of non -complianceas mortgage loans.

On the side of investors, The increase in delinquency raises questions about the health of the banks of the banks. Although the Argentine financial system has demonstrated resilience in the past, a sustained deterioration in the quality of assets could negatively impact the profitability of the institutions and in the market confidence. Investors, meanwhile, observe with concern how credit, which should be a pillar of economic growth, becomes a risk factor in a context of high real rates and lagging salaries. Something that has already begun to verify in the presentation of balances of the sector.

In conclusion, the credit boom to families in Argentina, although it reflects a positive economic dynamismis accompanied by a worrying increase in delinquency. Prohibitive interest rates and the slowdown in real income have created a perfect storm that threatens to undermine the financial stability of households and the banking system. Without a decisive adjustment by the BCRA and the banks, Credit, far from being an engine of prosperity, could become a ballast to the Argentine economy. In an environment of growing uncertainty, the decisions made by monetary authorities and financial institutions in the coming months will be crucial to determine whether this credit boom translates into sustainable growth or a latent crisis.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.