While the indices remain close to historical maximums, a problem that few want to look: corporate bankruptcies.

So far this year, 446 large companies declared bankruptcya number that already exceeds a 12% 2020 levelsthe year of pandemic, and that could close in figures close to those of 2010, when the effects of the 2008 crisis were still felt.

US corporate bankruptcies

Julio marked a turning point. Only in that month, 71 Large companiesthe highest monthly record since July 2020. And the worrying thing is that the trend is accelerating.

What is happening? The main person is quite clear: interest rates. For 2020 and 2021, companies took advantage of a context of cheap credits to refinance debt at very low costs.

But that party ended. Since 2022, the Fed has been aggressively raising the rates to combat inflation, and 2024 and 2025 mark the beginning of a critical stage: the great Face refinancing. Many companies that had indebted 3% or 4% now face maturities that have to renew 7% or 8%with balances that do not support such adjustment.

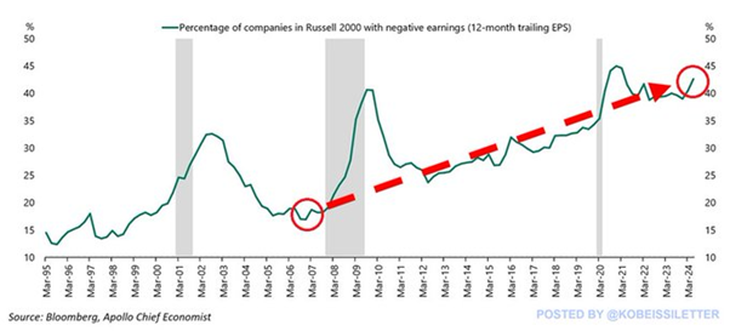

Another important fact comes from the hand of the smallest companies. More than 40% of the companies that make up the Russell 2000 today report losses.

Corporate bankruptcy graph

This is worrying because small businesses are a lot more sensitive to interest rate. When this segment begins to suffer, historically, the impact on the real economy does not take long to arrive.

The paradox is that, while all this happens, the S&P 500 is still close to historical maximums. Since April, the index added about U $ 7.7 Trillions In stock market capitalization, and the most impressive thing is that 54% of that rise came only seven actions: the famous “Magnificent 7” (Nvidia, Apple, Microsoft, Amazon, Google, Meta and Tesla).

In other words, the photo of the market is distorted: few global actions concentrate almost the entire capital flow, while the rest has other difficulties.

Historically, bankruptcy peaks like the current They usually anticipate financial stress phases that end up moving to the real economy. This does not imply that everything collapses, but You have to be much more selective when investing.

The market today seems to live in two parallel realities. On the one hand, the Magnificent 7 hold the indices at record levelsfeeding the feeling that everything is fine. On the other, under that surface, the economy Real Corporate shows a bankruptcy recordpressured margins and weakened consumption.

The last time we saw something similar was in 2007-2008. The difference is that Today the banking system is much strongerbut companies They load with debt levels that could become a problem Serious if the Fed keeps the high rates for longer.

Meanwhile, Inflation in the US press. The wholesaler went up 0.9% monthlythe biggest rise since 2022, and the nucleus inflation exceeded 3% per year. The Fed is trapped: The labor market weakensbut prices do not loosen. In the middle, Trump insists on lowering the rates.

Even so, the market awaits the first cut in September of this year, with a 25 basic points. But if the inflation rebounds in 2026, the Fed could be forced to upload them again, leaving companies in a face of face and more tight margins.

The conclusion is clear: for whom Invest in the US in the long termIt is not a very attractive entry point. Bankruptcy data and high value They are signs to pay attention.

If you are interested

Note: The material contained in this note should not be interpreted under any point of view as an investment council or recommendation for the purchase or sale of a particular asset. This content has only educational ends and represents only an opinion of the author. In all cases it is advisable to advise with a professional before investing.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.