The vetoed Financing Law of University Education and teaching salary, non -teaching and students are intended to guarantee the protection and support of university financing, through the update of the amounts for the operation of the system.

In addition, the Executive will have budget credits to ensure the continuity and efficiency of services, adapting budget items, Without impacting on the distribution of federal tax co -participation to the provinces or the contributions of the National Treasury (ATN). It stipulates that it can be financed with the increases in current income collected over budgeted amounts (or extended rather) as income (cf. OCP, 4/9/25).

It was estimated that what is requested budgetary by the year 2025, according to file CD-7/2025 (University Financing Law and Salary Relevation) will have a impact of $ 1,959,947 millionequivalent to 0.23% of GDP.

Therefore, it is striking that in the decree it is observed that the government estimates for the approved bill (that is, that it veto), a request for financing by financing by only $ 1,069,644 million. Although it seems excessive, there is a difference And it has to do with a lack of understanding of the law, either by omission or lack of expertise when making the information for the publication of said veto. Apparently, as well as they cannot even fight, either passports or patents, neither does they seem to make the most elementary sums and subtractions, since the draft bill vetoed (No. 27,795) requests as recomposition about $1,959,947 million.

Image

Such difference is a lot or little? The Government raises, this is between the Chief of Cabinet and the Minister of Economy, who has a Excessive cost Compared to what? Let’s do a simple exercise: the government Place debt in pesos that renews in every month and others are Short or long -term placements and generates interests who has to pay or they will pay while they accumulate later, For this government, do you have priority to pay debt interest in pesos over the education of future professionals, not teachers and teachers?

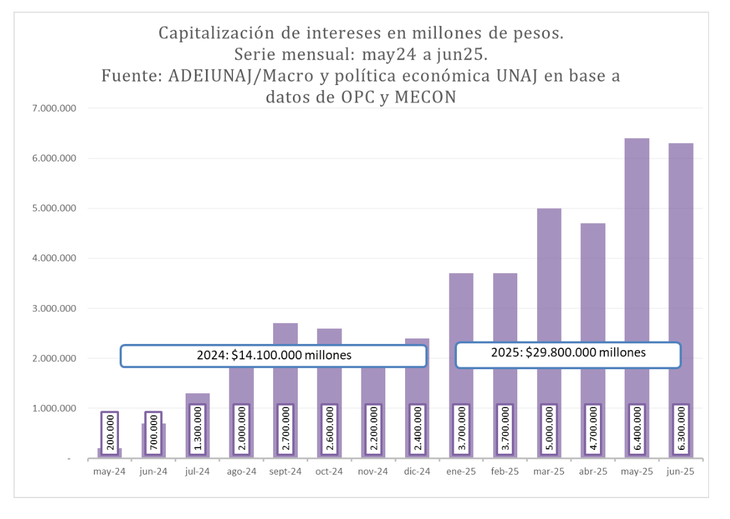

Next, in the joint work of the Association of Teachers, Extensionists and Researchers of the National University Arturo Jauretche (Adeiunaj) and the subject of Macroeconomy UNAJ, following the report of the Office of Budget Control of the Congress of the Nation on Public Debt Operations (June 2025), the Interest capitalization of LECAP, BANCAP, LEFI and PR17 that reached 6,368,578 million pesos represents the equivalent to three times more than what the bill 27,795 requested (University financing). Let’s clarify that these financial instruments (LECAP, BANCAP, LEFI and PR17) are designed to postpone The immediate impact of interest on the cash flowso they hide a growing challenge: a accumulation that, when winning could revert Fiscal achievements -present how Masterclass in the Three anchors– And press the sustainability of public finance.

The composition of Stock of the payable debt in pesos as of June 2025 is 55.1% adjusted by CER (Bancer, restructuring bonds 2005, 2010 and others); a 43.8% without adjustment (Lefi, LECAP, BONCAP, BONTE, BOCONCIES: PR17; DIRECT SUBSCRIPTION TITLES: BONTE, ARSAT, BONT 1% in dollars payable in pesos.

That almost 44% HE accumulates and It is not counted as part of financial result; instead, If we add them as those adjusted by CER, the financial deficit would reach -5 or -6%, which added to the rest would first give a Fiscal deficit instead of surplus which promotes the government. Only using a technicalism hide the crisis that has been growing. Just a gross burning to hide the damage caused and imminent risk.

Let us explain a little more how this technical ruse works (makeup of public accounts): the capitalization of interests with these instruments (LECAP, BANCAP, LEFI and PR17) accumulates interests to the initial capital, generating an effect of compound interest which is paid in its entirety at maturity. Thus the short -term fiscal result is made up. This advantage is accompanied by a cost: accumulated interests exponentially increase debt, Because the postponement of payment of interest transfers the future load. If everything had to be paid today-capitalized interest plus the scheduled matches-the economic authorities would have to choose between re-perfilar (with cessation of payments as Minister Hernán Lacunza made) or issue.

Currently, capitalized interests for 2024 (May to December) were $ 14,100,000 million in each placement of that year. In the first six months of 2025, the different renovations generated interest for the sum of $ 30,100,000 million, in total if we take end to end, some $ 44,200,000 million.

However, although capitalized interests have the cost of exponentially increasing the debt, between May 2024 and June 2025 They have already been paid for the concept of interests some $ 3,600,000 million.

So, if we consider that bill 27,795 requests almost $2,000,000 millionand if we take into account what was paid, the R had been paidsalary ecomposition as requests the law. In potential terms, in the face of the future, the Minister of Economy, the Central Bank and the National Executive Branch have about $ to date44,000,000 million in capitalized interests (44% of the debt stock) Who will pay them? These capitalized interests represent Law 27,795.

If we compare the Risks to have an asset as capitalized interests and human assets, or rather hundreds of thousands of people carrying out their cultural human rights such as education, science and culture through the university and scientific system that implies bill 27,795, which is less risky? For us it is more than clear that the inevitable law 27,795 in the future the positive balances generated by investment in the university system and that has a highly positive impact on the productive sector.

In short: Congress if it rejects the veto and sanctions the law will have determined the alternative between strengthening the production and the national economy through investment in science and education, or guaranteeing the wonderful privileges of high finance and economic groups and concentrated economic power, risking at the same time the results of national accounts (macro stability) to enrich a few at the expense of the loss of rights and suffering the suffering of the social Argentine productive system.

Image

* Ernesto Mattos. Economist (UBA). TEACHER UNPAZ-ADIUNPAZ/UNAJ.

The contributions and comments of Gabriel Delgado, lawyer (Uncuyo) are appreciated.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.