China comes from climbing more than 34% so far this yearmore than triple what advanced the S&P 500 or Nasdaq himself.

Let’s make a little history, starting with the graphic of FXI, the ETF that replicates large Chinese companies.

After having fallen more than 60% from the maximum of 2021more than 100%already recovered. A rise that shows the magnitude of the rebound, but that It also opens the big question: is there a route?

Why did it fall so much China? The answer is mainly in government interference in the private sector. Surprise regulations against technological, limits to the growth of e-commerce giants, and measures that They sought to “discipline” companies like Alibaba or Tencent. To this was added the real estate crisis, with the collapse of Evergrande as a symbol, and the wear of the policy of “Covid zero” that stopped the activity completely.

That combo exploded in prices: International investors came out in mass and the Chinese market entered a negative spiral, which was already dissipating.

The interesting thing is that, after the storm, the Actions began to lateralize for 2023 and 2024. That is, they stopped falling and found a floor.

Then, The valuation was already extremely low: China It quoted 8 times future profits, something unthinkable for a market of that size.

Let’s look at the evolution of its ratio Forward Price-To-Earnings:

FXI China

This ratio measures how many times the market projected profits pays. The lower, the more “cheap” it is. In 2023-2024, with the P/E in 8x, the photo was clear: The market had punished too much and a huge safety margin was generated to enter.

Since then, the trend began to change: from lateral to Alcista. He FXI showed signs of recovery and began to “paste the turn”. That is, it began to rise, accelerating since September last year. In the last 12 months, more than 60%rose.

And now? Today the P/E is already around 13x Forward Earnings. That means that the market pays more for every dollar of profit, that is, it became more optimistic. China is no longer ridiculously “cheap”, now it is in line with other emerging. The difference is that the trend became clear Alcista and the flows entered again.

It is true that in recent weeks the movement became parabolic. But in financial markets, the strength of the trend is a factor that should not be underestimated. The attractiveness of China It no longer goes through how cheap it is, but by the Momentum: The recovery is underway and the market accompanies.

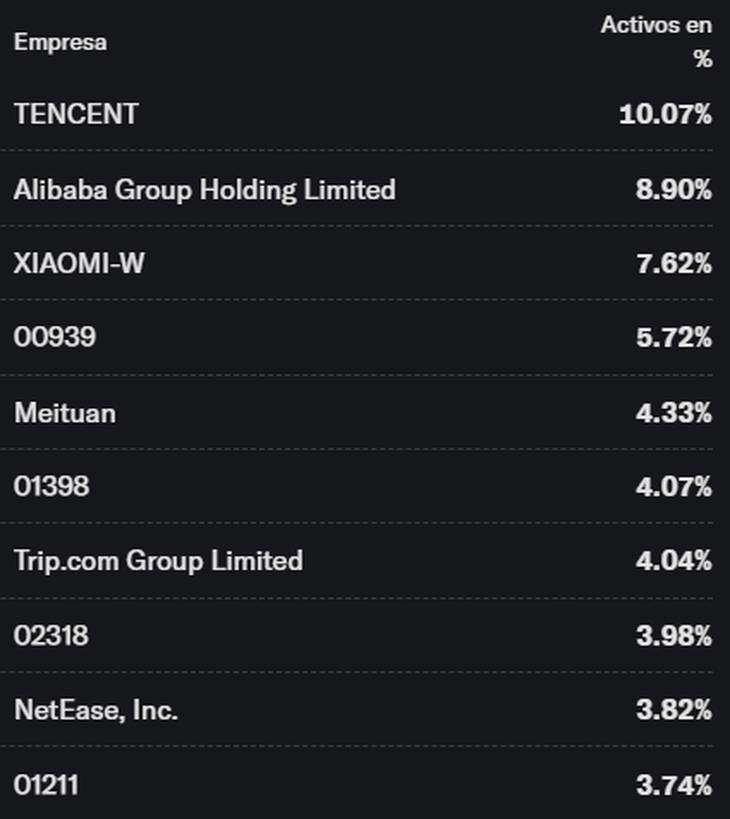

What is inside the FXI? Let’s see:

FXI

To understand what we are buying when we invest in the ETFyou have to look at its composition. The big players are:

- Tencent (10.1%): The Internet giant, gaming and digital payments.

- Alibaba (8.9%): referent of e-commerce and the cloud.

- Xiaomi (7.6%): Smartphones and electronics leader.

- Chinese banks (ICBC, CCB, etc.), which explain a good part of the index weight.

- MEITUAN (4.3%), the “Super App” of Services and Delivery.

- Trip.com, Netease and Byd, among others.

In summary: It is a commitment concentrated in technology, finance and internal consumption.

Is it still attractive? Yeah, China is still attractivebut not for what “Cheap” That was, but because the trend changed clearly. The market left the floor behind, validated a strong rebound and Today is marking maximums of the last four years.

Of course: valuation is no longer a gift like in 2023 and 2024. It is far from being extremely demanding (as in the US), but it is not at “auction” prices either.

Even the movement became quite parabolic and, in that sense, the entry point today is not the same as before, so you have to be cautious.

That said, the technical photo is overwhelming: the trend is clearly bullish, it accelerated very strong and the one that is purchased has to accompany. Risks? It is still China, with all that that entails.

If you are interested

Note: The material contained in this note should not be interpreted under any point of view as an investment council or recommendation for the purchase or sale of a particular asset. This content has only educational ends and represents only an opinion of the author. In all cases it is advisable to advise with a professional before investing.

Investor Club CEO

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.