The last weeks were a roller coaster for Argentine assets. In this context of political war, Argentine bonds They discount a lot of pessimism. Are they a good idea?

The market does not forgive and the legislative in Buenos Aires felt strong: the actions collapsed, while the Bonds They endured something better, although they didn’t come out unharmed either.

Let’s look at the graph of the Tir of the To 30:

The TIR (internal return rate) From a bonus it is, in a nutshell, the performance that you are going to obtain if you buy it today at the market price and keep it up to the expiration, charging all the coupons and the final capital.

At the beginning of the year, only 11% annually (quite security and tranquility). The political uncertainty and the one pressed by the elections led him to shoot above 30% last week, before moderating and returning to current 20% levels.

It is a tremendous jump in a few months. When the bonds yield this high, the message is clear: the market discounts a very negative scenario. The market is afraid.

The question is to understand if fear is exaggerated or not. There lies the true opportunity (or threat).

In the middle of the fall, a key support appeared: Scott Besent, Secretary of the Treasury of USA and key figure in the government of Trump, He went back to Argentina. He said he spoke with Caputo to advance a Financial Swap, than the treasure “It will do what is necessary” and that the economic team will travel to Washington in the next few days to close the details. Good signal, without a doubt.

For now there is no fresh money, but a swap line, but the US political gesture is very worth a market that asked for signs.

The bonds reacted with slight climbs after the announcement, and although volatility still reigns, they are far from the minimum of two weeks ago. Let’s look at the A30 graphic:

Boggian 2

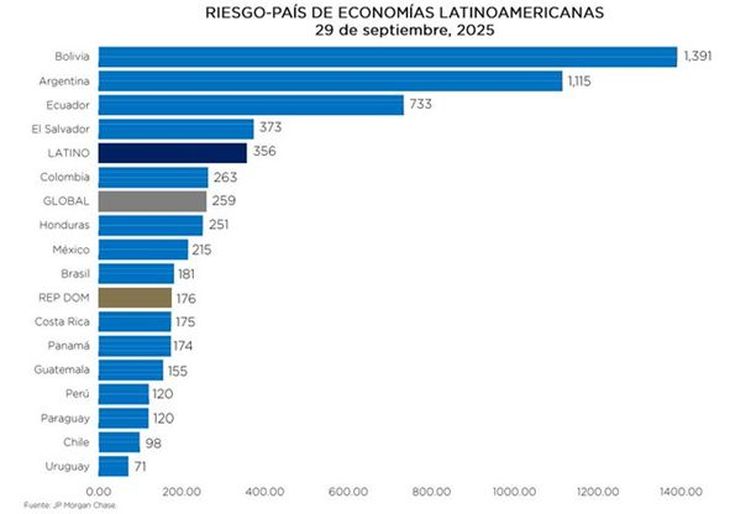

If we looked at the country risk, which exceeded 1,200 points, we see that Argentina is among the most punished in the region, only behind Bolivia. That talks about extreme fear that discounts the market.

Boggian

With a 20%IR, Argentine bonds offer a window of opportunity for those looking for a good risk/return relationship. Obviously it is not a trace for everyone: there is a lot of political noise, October still did not arrive and the stage is far from stabilizing. It is a trace of much risk, we must not forget it.

At these prices, bonds already discount a very negative scenario. If the policy does not continue to deteriorate and the US support materializes, there is room for important rates compression and, therefore, for interesting increases in the price of bonds.

It is clear: it is not a quiet path, but Upside’s potential is real. Bonds like Al30 offer difficulties difficult to find in the market.

The key to the coming weeks will be to see how reserves, gap and details of the swap evolve. All that will define whether bond rebound can be transformed into a more sustained recovery.

For now, with elections around the corner and a market with the nerves of Punta, Argentina again offers the usual: extreme volatility, but also opportunities for those who know how to look beyond noise.

If you are interested in continuing to deepen, see analysis, videos and exclusive content, I leave you here all together so that you choose what serves you most: Investor Club.

Note: The material contained in this note should not be interpreted under any point of view as an investment council or recommendation for the purchase or sale of a particular asset. This content has only educational ends and represents only an opinion of the author. In all cases it is advisable to advise with a professional before investing.

*CEO of Investor Club

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.