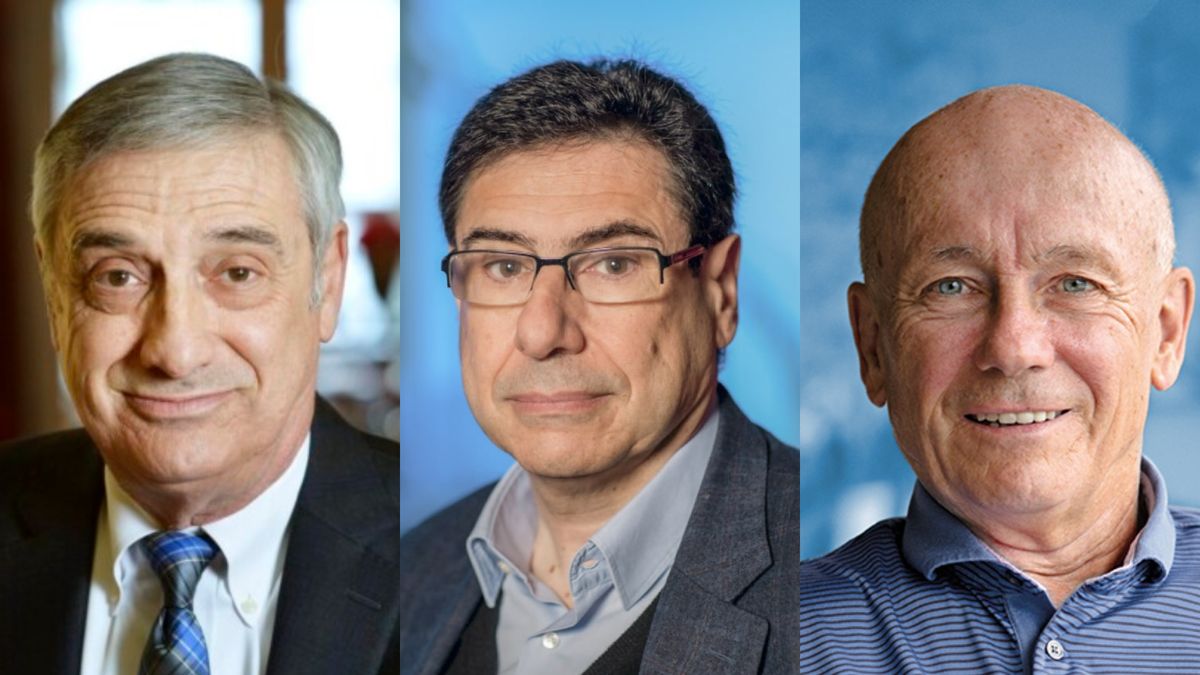

This year’s Nobel Prize in economics recognized Joel Mokyr from Northwestern and Tel Aviv Universities, Philippe Aghion from the College de France, INSEAD and the London School of Economics and Political Science, and Peter Howitt from Brown University, for his contributions to the understanding of economic growth based on innovation.

It is a stylized fact known for a long time that economic growth, understood as the sustained increase in output per inhabitant, is a modern phenomenon that has existed for just over two centuries, which in turn is mainly explained by the great progress in technology that occurred in the same period. What we did not know before the work of economic historian Joel Mokyr, who will receive half of the prize, is why before the Industrial Revolution born in Great Britain there was no economic growth.

In his vast work Mokyr proved that it was the interaction between science and technology reinforcing each other that allowed economic growth to take off. Obviously, before the Industrial Revolution there were numerous technological innovations. However, these inventions were sporadic and did not have a sustained impact on the expansion of production. How is this understood? Mokir’s answer is that the innovators didn’t know why their inventions worked: they had no scientific explanation.

The fundamental change occurred with the emergence of the Enlightenment, a pan-European phenomenon but which in the conditions of 18th century Great Britain allowed it to lead the Industrial Revolution. The advantage of Great Britain was that it had not only Universities and scientific societies, but also highly qualified craftsmen and engineers, which made possible this mutual interaction between scientific advances and business innovations. It is a change that permeated the entire society and made it open to new ideas. Mokyr also highlighted that technological innovation often causes conflict because it creates winners and losers, in other words, it is creative destruction, to use the term coined by Joseph Schumpeter more than 80 years ago. Consequently, to sustain technological progress and prevent losers from blocking innovations, institutions that manage conflict, such as Parliament, were needed.

The other half of the prize recognizes the joint contributions of Aghion and Howitt to the theory of economic growth based, precisely, on the creative destruction of innovations. The contributions of Aghion and Howitt are framed within the theories of endogenous growth, whose pioneer, Paul Romer, received the Nobel Prize in 2018. Both Romer, Aghion and Howitt, follow Schumpeter in identifying the innovative activity of companies that seek to maximize their profits as the engine of economic growth, and their need to have market power to be able to recover their investments, thus moving away from the paradigm. before dominant of perfect competition.

Romer, and Aghion and Howitt, also agree that economic growth in the free market equilibrium may be less than the social optimum because innovators do not fully appropriate the benefits they generate due to the existence of spillovers (positive externalities) of their technological knowledge to other companies, and because they set prices higher than the marginal cost of their products.

However, unlike Romer, as Aghion and Howitt also incorporate in their work the trait of creative destruction that innovation usually has, if the destruction were to be very high, it is possible that growth in the free market would be greater than the socially optimal level. This has important policy implications. The existence of positive externalities would justify partially subsidizing innovative (creative) activities, but the possibility of high destruction of investments in past innovations makes it advisable to compare both effects on a case-by-case basis, before granting subsidies.

The incorporation of creative destruction allows us to account for several empirical regularities. There are high positive empirical correlations between the creation and destruction of jobs, the creation and closure of companies, and productivity growth. The policy implication of these empirical regularities explained by Aghion and Howitt is that the mobility of workers and the creation of new firms should be facilitated. However, they add, this greater labor flexibility should be accompanied by good unemployment insurance and retraining so that workers can be employed in expanding companies. It is worth asking whether this “flexicurity” scheme implemented in several European countries is applicable in Argentina given the high levels of informality that exist.

In relation to fiscal policy, two consequences of Aghion and Howitt’s Schumpeterian approach should be highlighted. On the one hand, the implementation of countercyclical fiscal policies, that is, having a fiscal surplus at the peak of the cycle and a deficit in recessions to reduce the volatility of macroeconomic fluctuations, can raise the average growth rate, because recessions more intensely affect the innovation activities of medium and small companies that usually have liquidity problems to finance themselves. On the other hand, the impact of tax pressure on growth depends not so much on its level but on the quality of the public spending it finances (infrastructure, education, science, social protection, etc.).

An important implication of Aghion and Howitt’s approach for developing countries is that of growth based on imitation versus growth based on innovation. The policies and institutions required in each case are different. For countries far from the border, labor flexibility and free entry of companies are not necessary because there is much to be gained by imitating and adapting the technology of the most developed countries, and investing in basic and secondary education. Countries that are close to the technological frontier, in addition to facilitating labor mobility and business creation, should also promote university education, the development of the capital market and the protection of intellectual property, to boost innovation. Failure to adopt these latter policies, according to Aghion, could slow growth and lead to the so-called middle-income trap, that is, not being able to exceed an intermediate level of product per inhabitant, which is exemplified by the case of Argentina.

Finally, it is worth mentioning that Aghion and Howitt’s approach is not necessarily opposed to industrial policies. We will mention two examples. In collaboration with Acemoglu (Nobel 2024), Bursztyn and Hemous, Aghion demonstrates the need to subsidize clean innovations to meet the challenge of climate change. Finally, in a work with Dewatripont, Du, Harrison and Legros, Aghion studied the effect of production subsidies in China and found a positive effect on productivity in sectors where there was more competition and where subsidies were more widespread.

Professor of Economic Growth, Faculty of Economic Sciences of the UBA and researcher at the IIEP/Conicet

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.