The surprising defeat of the ruling party in PBA altered political and financial expectations. After the breakdown of forecasts, the markets remain volatile and attentive to the definition of 26-O and the extent of US aid. Suggested strategies for investors in the midst of high uncertainty.

The central question remains what will happen October 27 in the morning.

Depositphotos

The unexpected difference between the results of the provincial legislative elections on September 7 in Buenos Aires and what was anticipated by all political pollsters underlined a key principle: In politics and markets, what is relevant is not only what happens, but how it compares with what was expected. The just over thirteen percentage points differenceunfavorable to the ruling party and in favor of the Justicialist opposition, generated a latent disassembly of expectations.

The content you want to access is exclusive to subscribers.

This electoral process marked the Government, its allies and its electoral base, that the successful management of the disinflationary process It was not enough to meet the expectations of the Buenos Aires voter; that he cost of said processtranslated into high interest ratesgenerated pressure on critical variables such as economic activity and employment; and that the political agenda is as relevant as the economic oneso that the lack of openness to dialogue already building strategic alliances with related sectors has tangible consequences at the polls.

He change of expectations was immediately reflected in the financial markets. The volatility increasedespecially in the exchange marketwhere the Perception on the sustainability of the banding system and the growing demand for reserves put pressure on the dollar. From the September 22 High impact events have occurred:

-

September 22: First tweet of Scott BessentUS Treasury Secretary, supporting Argentina and mentioning possible ways to materialize economic aid; HE They eliminate withholdings on soybeans and other agricultural products until reaching sales of USD 7,000 million.

-

September 23: First Milei-Trump meeting in New York.

-

September 24: Second tweet from Bessent, from which it can be inferred that the US aid would depend on the October election result. They reach the US$7 billion in oilseed sales and the BCRA reduces the simultaneous wheel rate to 25%temporarily easing pressure on peso liquidity.

-

September 25: He agro-export sector starts the currency settlementincreasing the supply of dollars.

-

September 26: Implementation of the cross restraint on individualsreactivating the gap between official and financial dollar.

-

September 27: The gap exceeds 10%.

-

September 30: official announcement of Milei and her team’s trip to Washington DC for him October 14.

-

October 3: Caputo, Bausili and team travel to the US to negotiate the terms and conditions of North American aid, in a context of market attention on liquidity and sustainability of the monetary system.

-

October 5: In it political front, Espert renounces his official candidacyappointing Diego Santilli as its replacement; Milei meets with Macri in Olivos. These movements alter the local political perceptionincreasing the electoral uncertainty.

-

October 9: He US Treasury intervenes in the exchange market while confirming a swap for US$20,000 million with the BCRA. HE temporarily reduces pressure on the financial dollar.

-

October 14: Meeting in Washington of Milei and his delegation with the Trump Administration; comments about the aid conditionality regarding the electoral result they shoot a sell-off in local markets.

To the October 16the markets remain expectant. The rates remain erraticwithout finding its equilibrium point, while the local bonds and stocks segments operate in limited rangesconditioned by the proximity of the election and the interpretation that the Trump administration will make of said result.

The central question remains what will happen October 27 in the morning. Again, the answer depends on the distance between expectations and realityas well as the interpretation that the market makes of the US position. A favorable electoral surprise for the Government could generate a immediate bullish reactionreinforcing the expectation of continuity of US assistance and relative stability. On the contrary, a significant defeat I would question the concrete assistance from the US and the political capacity to advance structural reforms during the second half of the term.

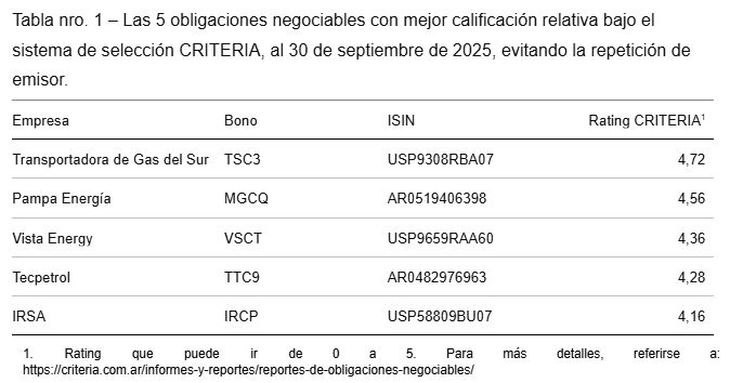

Until then, the recommended strategy for investors without positioning restrictions focuses on minimize exposure to volatility, maintain liquid positions in dollars and in hard currency negotiable obligations of companies with solid fundamentals and stable financial metricsas TGS, Tecpetrol, Pampa Energía and Vista.

criteria box

The box that we share summarizes the 5 strongest corporate bonds according to our third quarter report. The hard-dollar curve continues to be attractive only to investors with high risk tolerancegiven the conditions of political and electoral uncertainty.

Head of Research by Criteria

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.