We enter the final stretch. Only one missing market week for legislative elections. It has been a very extensive cycle, with pressures on the exchange market and on the interest rate for more than 4 months. The last wheels are turning with the United States Treasury (UST) selling presence in the local exchange market and with the return of rate volatility. Beyond the uncertainty that every electoral process implies, We think it is important to understand what prices tell us which are being operated in the market. Focus on points of indifference will allow us to understand What expectations do investors have? and how they manage it in these last wheels.

For investors in the local market there are four adjustment clauses which are what define the dynamics of the different assets. Those four reference clauses are: exchange rate, interest rate, inflation and exchange rate gap. Day by day one can know the value of each of these assets, but these prices, especially when it comes to assets with a longer maturity profile, also help us understand What implicit expectations are there? with respect to those clauses forward.

There is two references that help to understand what the market expects for the exchange rate. One is the implicit price in dollar futures contracts. Although behind this quote there is an issue of the level of interest rates, it gives a very clear idea of at what value can you buy forward exchange rate.

He Rofex contract October 2025 is operating in $1,440a figure that is below the projected ceiling of exchange bands. But of November onwards those contracts are already operating above those valuessomething that worsened with the rise in rates this last week.

In the case of the Lecaps (fixed rate bills)the performance of these titles applied directly to the current exchange rate allows us calculate a dollar price equivalent to expiration. That is, you can calculate a point of indifference what does it tell us At what price would the dollar have to be at the time of expiration?so that it is the same to buy dollars today or invest in pesos at a fixed rate and buy at maturity. It is a theoretical calculation that considers that the dollars are invested in a fund of Money Market at a rate of 2% per year.

This calculation shows that Lecaps allow obtaining returns that are well above futures contracts. Obviously the future contract provides a coverage that fixed rate instruments do not, but this generates a window of opportunity for the creation of synthetics (fixed rate pesos + purchase of futures).

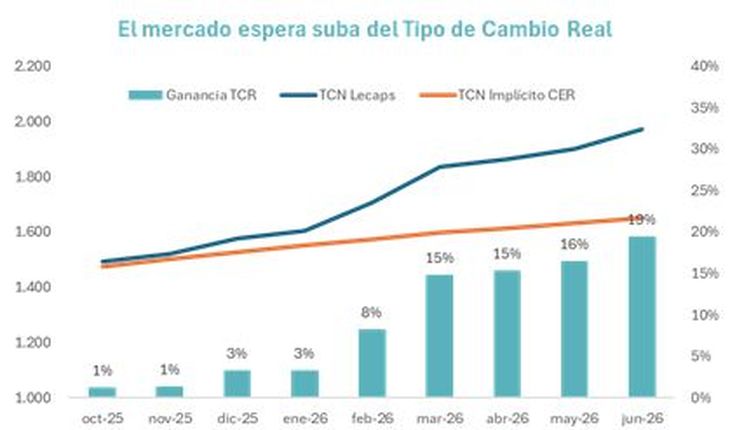

mega2

If we focus on the quarterly closings To understand where the price market has more risks of exchange rate movements, we see that in December is still limited and that just stops March and June 2026with longer periods of uncertainty and with a much higher incidence of the interest rate, the values appear more dispersed with respect to the ceiling of the band.

In short, the market today offers alternatives to take short-term exchange coverage aligned with the band ceiling and they are only higher if one seeks to cover a much longer period (almost 9 months). The longer stretch, especially May, looks very attractive to take hedging positions and especially to close synthetic operations.

And what do you expect from inflation?

As we saw in the previous section, in the short term the values of the dollar are aligned with the current price of the exchange rate. But towards 2026, scenarios are implicit in which there may be some movement in the exchange rate. This is reflected in the figures of inflation.

While there is still considerable agreement regarding the inflationary pace in the coming monthswith figures below 2% monthly and with a annual increase that would be somewhat below 30%.

The question goes through the expected inflation for 2026. The REM analysts (consultants that report to the BCRA) expect that inflation will continue to decelerate towards a range of 20% annually. This figure is equivalent to a monthly rhythm of the order of 1.5%. Instead, the arbitrage between curves in the fixed income segment leaves somewhat higher values. From that perspective, the Expected inflation for 2026 is 25%which is equivalent to a monthly rhythm similar to the current one (1.9%).

Does the market expect a higher real exchange rate?

This is perhaps the most important questionbecause it allows us to finish analyzing the implicit exchange rate expectation in the price of assets, the inflationary scenario and identify hedging and investment opportunities.

mega3

If we take June as referencethe market waits between 15 and 20 points of real exchange rate gain. The analysis considers both the exchange rate expectation implicit in Lecapslike the expected inflation and international inflation.

mega4

Just as the current real exchange rate ($1,440) is a 6% above the 2016-2017 averagethe value implicit in the curve arbitrations would take that level to be on average 25 points above that value.

Whether the values at which the market operates today going forward are balanced or not, we cannot know until we better understand what results the electoral process produces and, based on that, how the market changes going forward. The question is to begin to understand What is the flow of investments that can arrive and how many dollars does the Treasury need (with or without roll over). Those factors will have a substantial impact on the balance point and will serve to understand whether investors are they valuing correctly or can some correction be given.

What role do short-term interest rates play?

Meanwhile, the market continues a lot of volatility in interest rates. For several days we observed a certain liquidity stress which led to the overnight rate trade above long rates. This was partly sought by the BCRAwhich is ran from the simultaneous wheel in which it provided liquidity to let rates rise and funding become more expensive and that would remove exchange pressure. The problem is that when that happens, investors become they position hyper shortwith the pesos at one day and with much more room to put pressure on the exchange rate.

This new process of short rate volatility ended up generating less flow towards fixed terms and a very low roll over of Treasury debtbecause the banks sought rebuild liquiditysomething that cannot be missing under the new scheme of daily lace.

We wait for a last pre-election week in which these pressures can continue to be present. He true rate level we will understand it after 10/27. There the discussion will be focused on the exchange rate expectations, inflationary expectations and real equilibrium interest rates. For now remains to wait.

Chief Economist at MegaQM.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.