October started with an extra dose of volatility in the Argentine markets. The political news, the announcements crossed with the United States and the uncertainty prior to the legislative elections reactivated both nervousness and interest in local assets.

In this context, the General Panel once again stood out with strong double-digit movements in several stocks that are quoted exclusively in pesos.

But before going to the ranking, a clarification is worth it. On the Argentine Stock Exchange, shares are grouped according to their liquidity and size.

The Leading Panel includes the largest and most operated companies in the market, such as YPF, Galicia, Macro, Pampa Energía, Central Puerto, Edenor.

The General Panel, on the other hand, includes smaller companies, with lower trading volume and, therefore, greater volatility. This means that they can move much more in the face of any change in expectations or relevant news.

That is why they are risky, but also attractive for those seeking to capture rapid increases in recovery contexts. Be careful: they have very little volume (liquidity), so you have to take that into account when deciding the size of the positions.

In this scenario, five stocks from the General Panel broke away from the rest and led in October: SAMI, BPAT, AGRO, BHIP and INVJ.

Let’s see his performance in October:

panel 1

And the Merval? Measured in pesos, for comparison, it rose 10%.

1) SAMI (+23.4%) – San Miguel

The Tucumán company dedicated to the production and export of lemons, juices and essential oils shone again. With a rise of +26.7% in October, San Miguel (SAMI) comfortably leads the General Panel ranking.

2) BPAT (+14.9%) – Banco Patagonia

Banco Patagonia was another of the stars of the month. Its stock rose more than +17% driven by the inflow to the banking sector after the US announcement.

3) INVJ (+14.3%) – Inversora Juramento

Inversora Juramento (INVJ), another company in the agroindustrial sector with a relevant weight in northern Argentina, completes the ranking with a rise of +14.3%

4) BHIP (+13.4%) – Mortgage Bank

Banco Hipotecario (BHIP) accumulated an increase of +13.4% in October, motivated by the recovery that all Argentine banks had.

5) AGRO (+12.6%) – Agrometal SA

Agrometal is an Argentine company dedicated to the manufacture of agricultural machinery, mainly seeders. It has its industrial plant in Monte Maíz (Córdoba) and more than 70 years of history in the sector. It advanced +12.6% in October.

There is a reason behind these rebounds: the announcement of a new US support package for up to USD 40,000M, a great sign of political and financial support for the Argentine Government.

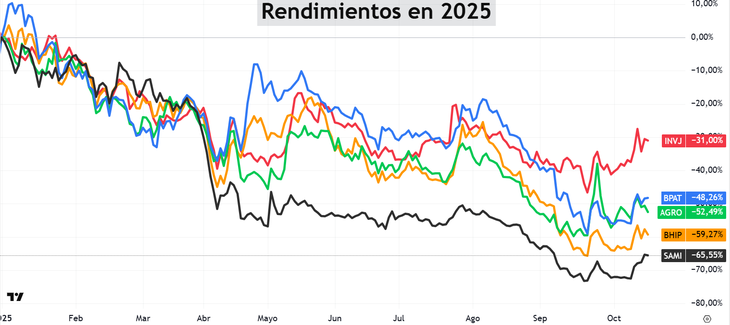

Why do I say “rebounds”? Because all these actions accumulate a very bad year:

panel 2

What can happen from here on out? The Argentine market is once again moving to the rhythm of politics. The legislative elections on October 26 will be a turning point: they will define whether the Government maintains power to advance its economic agenda or if it will have to face a more fragmented Congress.

In this context, the actions of the General Panel will be closely monitored by this result. With depressed valuations and limited liquidity, they are papers that can rise very sharply if the electoral result favors the ruling party and reinforces the expectation of continuity of the economic plan. But it must also be said: the risk is very high.

While everyone watches the election, there is a silent risk that may affect CERA accounts. In this free report I explain what can happen and how to protect yourself. Download it here: Investor Club – CERA account alert.

Note: The material contained in this note should NOT be interpreted under any circumstances as investment advice or a recommendation to buy or sell a particular asset. This content is for educational purposes only and represents the opinion of the author only. In all cases it is advisable to seek advice from a professional before investing.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.