Dollars out of the system

As stated by the recent INDEC report, there is the sum of US$360,082 million in financial assets held by individuals residing in our country, as described in the graph below according to the latest available Balance of Payments report. , international investment position and external debt as of the fourth quarter of 2021, dated 03/22/2022.

1.JPG picture

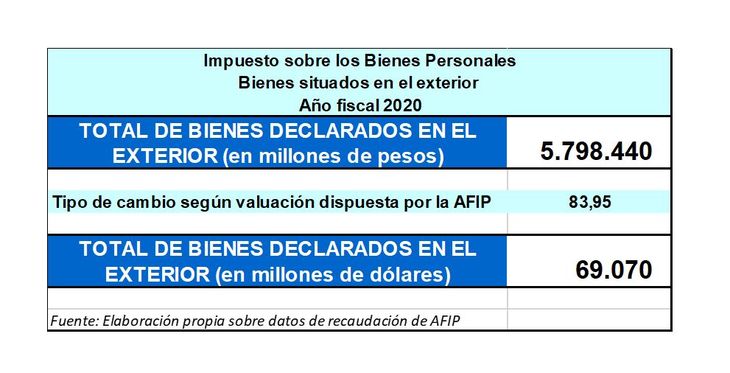

Now, if we consider the assets declared by Argentines according to the last declaration of personal assets as reported by the AFIP, the assets declared by taxpayers abroad barely reach US$69,000 million, as shown next.

2.JPG picture

Thus, if we discount the US$69 billion declared over the value of US$360 billion published by INDEC, we have some US$291 billion undeclared by Argentine residents outside the system.

In order to take dimension of what that figure means, let’s see:

- Undeclared Argentine dollars: US$291,000 (72% of Total GDP)

- Undeclared Argentine dollars: US$291,000 (more than 6 times the debt with the IMF)

- Undeclared Argentine dollars: US$291,000 (8 times BCRA Reserves)

What do those dollars mean in tax revenue?

A brief normative summary:

Our tax legislation (law 11,683) provides for a tax procedure when undeclared goods or assets are detected and the subjects involved cannot reliably demonstrate that said funds have originated from a declared income (taxed or exempt).

Thus, Law 11,683 provides some elements that upon the detection of undeclared assets, a concealed gain on said assets is presumed. The law titles it as “Unjustified patrimonial increases” either as goods or assets without declaring, non-existent liabilities, bank accreditations without due justification or differences in inventories, to mention the main ones. And in the case of funds from tax havens, it will be directly presumed that these funds are unjustified capital gains.

In terms of fiscal adjustment, Law 11,683 provides that said goods that have been detected and not declared, with their respective valuation plus 10% for income consumed, are taxed on Income and Value Added Tax (VAT).

If I also keep banknotes in a bank account or put them in an investment fund abroad or leave them deposited in a bank account in a tax haven or with low or no taxation, that amount would also be subject to wealth tax, which we know as personal property that the rate reaches 2.25% of the value of the property.

For the provincial administrators, it would also be a base or source of resources if those incomes were not declared correctly. In this field of gross income tax, you could allocate an average rate between 3% or 4% on the amount received.

In addition to this, our tax system establishes a compensatory surcharge for late payment and sanctions, which range from 100% to 600% of the tax not received, depending on the frame that is given to the conduct of the evader, whether it is mere omission or evasion. of the tax.

In numbers: A very simple example of the possible fiscal adjustment:

For an easy and simple reading we will develop an example. If a taxpayer collects about $100,000 in the country and does not issue the invoice and does not declare said income for a professional service or a commission obtained in his corresponding taxes, according to our national tax legislation, he could fit into the figure of tax evasion both of the tax to earnings (income) and value added tax (consumption).

If we want to quantify (using generic rates for easy reading) the tax left to enter the treasury, we have 35% for income tax, 21% for VAT, based on $100,000 plus 10%, that is $110,000, which totals income tax and VAT of $61,600. and with respect to the patrimonial tax on personal assets, 2% of personal assets and 3% of the provincial gross income tax, this only for the $100,000, that is, about $5,000.

All this totals taxes left to enter of $66,600, that is to say 66.66%. Now the main dish.

The exposed example is necessary to be able to understand the legal framework and thus quantify the possible tax left to enter the AFIP for the funds or dollars that are abroad without declaring or outside the system.

Following the legal tax scheme exposed, those funds that are not declared in the AFIP, which amount to US $ 291,000 million and that, if necessary, do not have documentation that can justify the origin of said funds with a declared profit or taxed or exempt, will be subject to the taxes described.

In numbers, the taxes not paid in allow us to presume a total evaded amount of US$194,000 million, only capital, that is, tax, which logically, would have to add the amount corresponding to compensatory interest and administrative fines and for cases that exceed the amounts of the criminal tax regime, be subject to the criminal sanctions provided therein.

In summary:

- Undeclared Argentine dollars: u$s291,000

- US$194,000 million in taxes not paid into the treasury.

Finally, let us remember that according to the analyzes carried out to penalize the contribution to large fortunes, it was estimated that the number of Argentines who could be affected did not reach 13,000 taxpayers. It would not be so far-fetched to think that these undeclared funds found abroad are in the hands of a similar or even smaller number.

These 190,000 million dollars, in order to be aware of what amount we are talking about, represents almost 50% of our GDP.

It is time once and for all for us to become truly aware, first of all, that Argentina does not lack dollars, but that they are abroad; and second, what fiscal deficit are we discussing if most of the fiscal resources are undeclared. The pandemic has generated not only in Argentina but in the world, the need for countries to rethink their tax schemes and focus on trying to eradicate evasion or at least to mitigate it, in search of taxing income right on.

I don’t think that the underlying discussion should go through a 1% or 2% deficit of the GDP, when we have almost 50% of the GDP that omits or evades the tax. The real fiscal deficit is abroad.

Juan Pablo Futten – Public accountant specialized in tax matters

Source: Ambito