Nobody sees the future and nobody knows how the market is going to solve these violent falls that we see in bonds and stocks. But we are all clear that if we do not add a strategy that makes money in these scenarios, the capital losses can be devastating.

Pay close attention because there is still time to implement them in your portfolio and recover part of what you are surely losing.

I recommend that you read the note to the end. It contains information that no one is going to tell you.

The origin

The root of these strategies can be found among professional Black Jack players in the US in the 1970s. They designed a system for counting cards. They played only when the odds were in their favour. This means that, in reality, they were not betting but were working using statistics.

By counting cards (something that is no longer possible today because “you have to cut the decks” and a large number of cards do not play) those who used this technique became bankers and ended up winning over time. By counting cards they put the odds in their favor. The movie “21 Black Jack” tells this true story.

What are Managed Futures?

They are strategies in which statistics and programming are applied to find financial operations that offer a small probabilistic advantage.

They are executed manually or automatically in the futures markets, given their high liquidity and low transaction costs.

The successive repetition of these operations of probability in favor produces, over time, stable and positive returns, regardless of the direction of the markets.

To take into account: the approach of Managed Futures is different from that of fundamental analysis and technical analysis.

Characteristics

- Statistical approach: they operate according to rules and only with the probability in favor.

- They operate in the futures market

- They are moderate risk

- They have no correlation with traditional assets

- They have the best returns when there is high volatility

How have Managed Futures fared in other crises?

As I mentioned at the beginning of the note, in 2022 these strategies accumulate profits of more than +29%, while stocks and bonds had some of the worst starts to the year in history.

But let’s see how they behaved on other occasions.

In both the 2000 (dot-com) and 2008 (real estate) crashes, the S&P 500 fell roughly 50%, and these strategies gained 39% and 14.5% respectively in those same periods.

Here below I leave you the performance of the Managed Futures (in blue) in the 5 biggest falls of the S&P 500 (in red) of the last 30 years (not counting that of 2020):

bog1.png

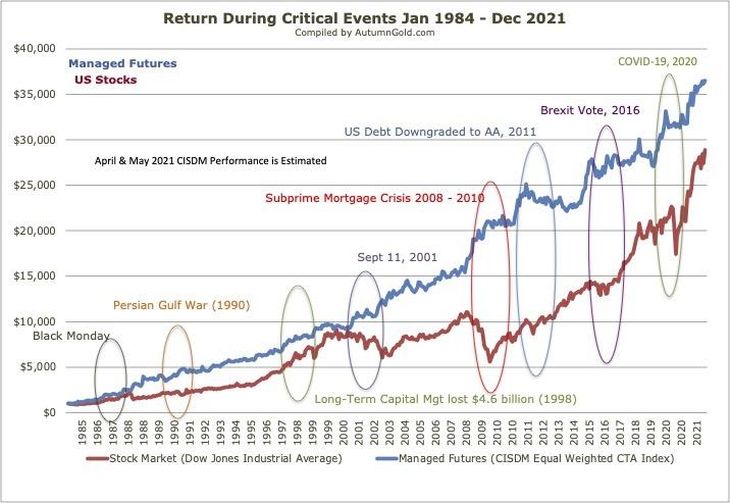

And here you can see the historical evolution of the Dow Jones index (red) compared to the index that measures the Managed Futures industry (blue):

bog2.jpg

It is clear that these strategies show consistent results over time and, furthermore, their best returns are obtained in times of crisis in traditional assets.

The inflationary situation and interest rates expose the shortcoming of the bonds, which cannot fulfill the role of protection as they did before. And global stocks are very risky when you consider their valuations.

One of the phrases that I repeat until the end: to earn money in 2022 you will have to do different things. Without a doubt, Managed Futures are today one (although not the only one) of the best investment ideas available.

Another thing I recommend is not to invest in something you don’t understand. That’s why here you have a great opportunity, since during the first days of May, there will be a conference in Colonia, Uruguay, where the best designers of this type of strategies will exhibit. Without a doubt, you should go. Devoting just three days to your investments, you will learn everything about the Managed Futures industry and how you can implement them.

Below I share a link where you can find all the information about this convention that will place you as an investor in a much higher category: Financial Charter.

Source: Ambito