The finance team went through the first three months of the year without major complications despite the large maturities. The amounts placed grew month after month, increasing net financing and improving the roll-over to 1.50x in the first quarter of the year compared to the last quarter of 2021 (1.34x) and even exceeding the ratio in the same period last year ( 1.14x).

Net Financing in Treasury Pesos

image.png

Source: Personal Investment Portfolio (PPI)

Given the closed international market, and the limitations of the IMF Memorandum and the BCRA Organic Charter on the monetization of the deficit, the financial program will depend considerably on the domestic market. At the end of the first quarter of the year, the Treasury has already obtained $638 billion (+605.7% compared to the first quarter of 2021). However, as we have been emphasizing, the financing obtained so far has not been free.

In the first place, in tandem with the BCRA, the policy on interest-bearing liabilities (elimination of the 7-day pass + limit on holding LELIQ28d) prompted the market to extend the duration of the BCRA debt or seek higher yields on the debt of the Treasure. In summary, Much of what was raised in the auctions came from the financial system that is swapping BCRA debt for Treasury debt.

Beyond a greater exposure of the financial sector to Treasury debt, Brigo’s team had to improve the conditions by offering titles with shorter duration and higher rates on the instruments. Meanwhile, the composition of CER-adjustable assets also increased markedly (taking advantage of market demand). In fact, 76.8% of what was raised in the primary operations of March was through assets that are adjusted by CER (vs. 45.1% in January). The best way to see both characteristics together is through the stock of bills, the composition of which turned upside down in LECER (71.7% at the end of March) in the last year.

On the other hand, the higher net financing came at the cost of shortening the duration of the titles offered in each of the auctions. 82.5% of what was placed this year was for a term of less than 12 months and even more than half of this proportion does not exceed 6 months in advance. The percentage of debt placed for less than one year increased +8.24pp compared to the October/December quarter of 2021 and +10.8pp compared to the same period last year. We expect that, as we approach 2023, the Treasury will find greater challenges in placing debt in pesos at longer terms.

The counterpart of the “successful” tenders of the first quarter

The dynamics of the auctions translated into a significant increase in the stock of sovereign debt in pesos. The stock had been growing at a rate of +3.1/4.3% per month at the end of last year, but picked up its pace in the first two months of 2022 (+4.6/5.6%) and jumped +8.4% in March. Thus, it closed the month at P$10.016 billion, showing an expansion of +19.7% in the first quarter.

Inflation-adjusted debt expanded +10.2% in March, explaining just over three quarters of the total stock (76.7%). The advance of this type of adjustment was the consequence of securities issued (P$733.3 billion of the total raised in March was CER) and the advance of the CER index that follows price dynamics. There were no Dollar Link issues, given the lack of demand for this segment, and a new variable rate bill was issued for the first time since September last year. Still, the Lepase tied to the 1D passive repo rate generated little interest in the market.

A problem looming on the horizon?

Here, The important issue for the holder of debt in pesos lies in the sustainability of this stock over time. It is clear that if the dynamics of these three months were repeated linearly going forward, we would reach a delicate situation in a short time. However, we believe that it is worth contributing some topics that enrich the current debate among investors.

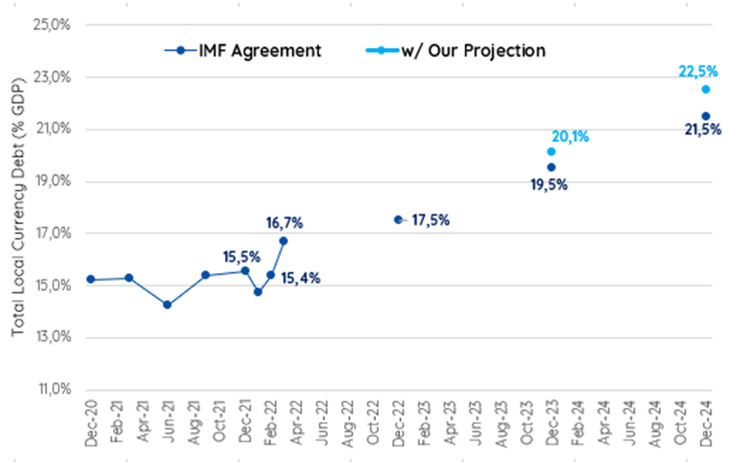

A positive point is that we start from total debt levels in pesos over GDP that are not abysmal (15.5% in December 2021), but that given the indebtedness of the first quarter would have reached a level close to 16.7%. In any case, we estimate that the participation of the private sector (where the refinancing risk lies) is around 53.9% of the stock, with which we are talking about practically half of those amounts when evaluating refinancing risks.

Another important issue lies in the Central Bank debt swap for Treasury debt that is being carried out by a large part of the financial system. The same translated into a dismantling of remunerated liabilities of the BCRA of -0.6pp of GDP in the first quarter of the year. If we take a comprehensive look at the consolidated public sector (Treasury debt + BCRA rem. liabilities), part of the rise in Treasury debt in this period (+1.2pp) is offset by the aforementioned drop. Specifically, this measure rose from 24.4% (of GDP) to 24.9%, which represents an increase of just over +0.5pp so far in 2022. Without a doubt, a less explosive magnitude, but one that would threaten independence of the Central Bank in the future.

Evolution of Total Sovereign Debt in Pesos (% of GDP)

image.png

Source: Personal Investment Portfolio (PPI)

A priori, the problem of the debt in pesos is a risk that will appear next year in the hands of a larger stock and doubts regarding the treatment that the next administration will give it. It would not be an imminent problem, as long as the fiscal framework of the agreement with the IMF is respected. Taking into account our numbers (based on the Memorandum with the IMF), we believe that the total stock of debt in pesos would end 2023 in the order of 19.5/20.1% of GDP. In short, the day the next government wants to remove the exchange CEPO, and the trapped pesos can choose other paths, everything will depend on real demand. Will the shock of confidence be enough to avoid a meltdown in the debt in pesos?

Head of Research & Strategy at PPI.

Source: Ambito