1.jpg

You don’t have to be a magician to realize the great growth that the stock had, which has risen 1200% since 2020. But, is this rise and the current valuation sustainable? Let’s see.

Here I think it is important to clarify that we are not saying that Tesla is a bad company. What is in question is its valuation. Tesla is worth 19 times sales and 208 times earnings. The expectation that the market has in the company and, especially, in Elon Musk is clear.

Its market capitalization is equal to the sum of the 20 largest automakers combined. Curious, right? Even more so if we keep in mind that Tesla has only a 1.5% share of the global automotive market.

Tesla cannot be described solely as a traditional car company, of course. But the reality is that he doesn’t have any significant patents in terms of electric car technology either.

It does not have what Warren Buffett calls a “moat”: a competitive advantage that protects its position in the market, such as the formula for Coca Cola.

Quite the contrary, a myriad of big-name competitors have emerged in the field, such as Volvo, BMW, Volkswagen and Porsche, as well as other Chinese automakers. Even the electric models of these companies sell more than those of Tesla.

On the other hand, security in this type of market is vital and is another weakness of Tesla. The Chinese government has forced thousands of Tesla models to be recalled over a dangerous suspension defect that the company spent years trying to cover up.

Recently, Tesla has been the subject of a class action lawsuit in the US for the same defect. In addition, he also sold cars that he knew were fire hazards and did the same with solar systems.

Meanwhile, the massive number of lawsuits, of all kinds, against the company continues to mount. Without a doubt, it is his Achilles heel.

Another important point to note is about Tesla Energy, Tesla’s clean energy subsidiary, which develops and sells solar power generation systems, electric batteries and other related products.

Many investors believe that Tesla is really an energy company. If that were true, it would be very complicated. Just look at its results: in the last quarter of 2021, its sales fell by 8.5% compared to the previous year, and it systematically loses money.

Those who believe that Tesla will sell 20 million cars a year should do the math right. Tesla sells approximately 1.3 million units annually. And to meet that auspicious goal, it would have to add an extra 1 million in new factories in Germany and Texas, as well as build 35 new factories that produce 500,000 cars a year, at 100% production. This would mean opening practically a new factory per quarter, for 10 years. Complicated, right?

It should be noted that in the first quarter of 2022, Tesla delivered 310,000 cars, a figure below expectations.

How much should your shares be worth?

Without a doubt, this is the million dollar question. While these estimates are difficult, a good exercise is to compare Tesla’s valuation with its competitors.

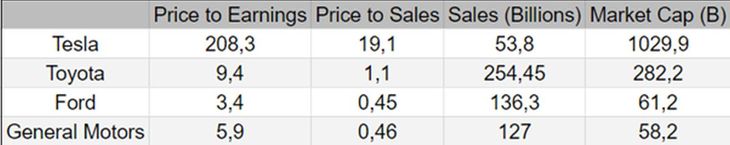

Below we see the comparison of some metrics with the following three automakers with the highest market value in the US stock market:

2.jpg

If Tesla had a valuation equivalent to the average of its competitors in terms of Price to Earnings (price over earnings) or Price to Sales (price over sales), your shares should be worth between USD 31 and USD 36. That is -97% compared to their current price.

Even if we believe that Tesla is much more than these industry giants and assign a valuation 5 times higher, its share price would be between 155 and 180, values much lower than today.

conclusion

No one doubts the ability of Elon Musk and Tesla. They have revolutionized the world with their innovations and will surely continue to do so.

The question is the enormous expectation that the market has on Tesla, and this is demonstrated by its valuation and its balance sheet numbers.

Attention: The market usually accommodates valuations, sooner or later.

To finish, I want to invite you to download for free a report that I prepared so that you can prepare for 2022. There you will find 7 other specific ideas with truly surprising alternatives, which present a great risk-return ratio.

By now it should be clear that, to make money in 2022, you are going to have to do different things. You can download it at this link: Financial Letter.

Source: Ambito