In the early period of COVID, central banks and governments flooded markets with monetary and fiscal stimulus, causing private consumption, specifically spending on goods (rather than services), to soar as consumers found themselves unable to access the physical economy due to travel restrictions and health concerns. Before the pandemic, purchases of goods were around 31% of total Personal Consumer Goods Expenditures (PCE) in the United States, but now they have increased and remain above 35%. This increase in demand, coupled with bottlenecks in supply, has pushed up product prices, giving rise to the high inflation figures we have seen in recent months.

Inflation measured by Personal Consumer Goods Expenditure (PCE) in the US. (Source: US Institute for Economic Analysis, as of March 7, 2022. Percentage change in prices from prior period, in seasonally adjusted annual rates.)

Inflation due to Expenditure on Personal Consumption Goods USA.jpg

Inflation measured by Personal Consumer Goods Expenditure (PCE) in the US Source: US Institute for Economic Analysis, as of March 7, 2022. Percentage change in prices compared to the previous period, in seasonally adjusted annual rates .

Since then, the military offensive deployed by Russia in Ukraine has caused a sharp rise in the prices of basic consumer goods as countries reconsider their dependence on Russian raw materials, together with the shortage of supplies due to the conflict. Although the most visibly affected areas have been oil and natural gas, Russia is also a major supplier of metals, such as nickel, steel and aluminium. Russia and Ukraine are major exporters of cereals such as wheat and corn, as well as fertilizer materials such as potash and phosphates. A disruption to these supplies could significantly affect food security and crop yields (and thus prices) in the coming years.

The definitive effects and duration of the conflict remain unknown, but the sudden rise in the prices of raw materials (especially crude oil) could trigger a recession. Although the effects of inflation and the added disruptions to supply chains will spill over into the US economy in various ways, the resulting price increase will act as a tax on consumption, undermining the ability to spend on other goods and services. thus dampening economic growth. With markets falling, consumers could be further hit by the wealth effect as their assets depreciate.

The greater pressure exerted on consumers and the possibility of a recession will complicate the already difficult task of the US Federal Reserve (Fed), consisting of controlling inflation without disrupting the economic recovery. If the COVID situation continues to improve and supply chains can be remedied, we could see a moderation in prices and an increase in spending on services, more in line with pre-pandemic normality. However, the prolongation of the Russia/Ukraine conflict will continue to maintain inflationary pressure on goods.

salary inflation

At the same time, we believe that inflation stemming from lower wages will persist. Over the past few decades, globalization kept low-wage wages in the US at bay as we imported cheap goods and jobs moved to lower-paying countries. Recently, however, the United States is moving away from globalization and is in the process of reindustrializing, a phenomenon that has likely accelerated as the West disassociates itself from Russia. This, coupled with much lower labor participation rates due to the pandemic, has led to higher wages. Higher pay could be generally good for the US economy, as private consumption accounts for the majority of gross domestic product (GDP) and workers will have more money to spend. However, the secular adjustments of lower wages will work to the detriment of companies’ margins in the coming years.

Inflation and higher rates: what it means for growth companies

Over the next three to five years, we believe that inflation, like interest rates, will weigh on stock valuations growth. Since the global financial crisis, we have enjoyed an extended period of meager interest rates and inflation, during which investors have historically been incentivized to bid more on equities. growth, thus raising its valuation. This dynamic can change rapidly as interest rates (and thus discount rates) rise, especially for high-growth companies that are expected to generate cash flows for many years.

Stock prices vary based on earnings, their growth, and the multiples that investors are willing to pay for both. We are certain that if rates rise, earnings multiples will contract, so it will be increasingly important to identify companies that are able to escape that multiple contraction that we predict, thanks to their growth. Firms with pricing power should also be better able to withstand an inflationary environment, versus those that cannot raise prices when costs rise.

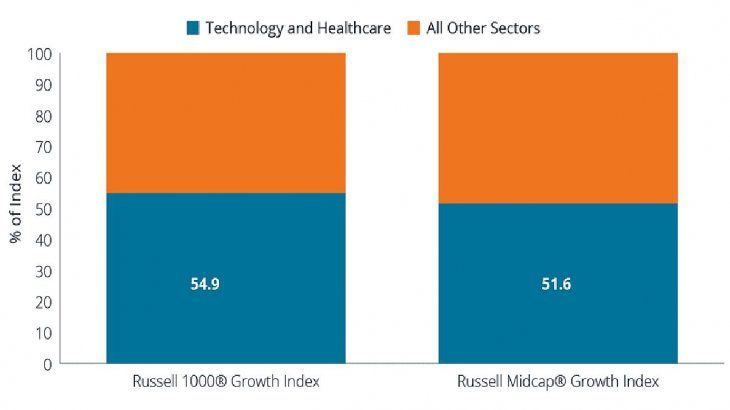

The US growth investment landscape is largely made up of healthcare and information technology stocks. In fact, more than half of the Russell 1000® Growth and Russell Midcap® Growth indices are concentrated in these sectors (Exhibit 2), which contrasts with the last relevant period of inflation (the 1970s), when the economy was much more commodity-based and industry-oriented.

Sector Weights in the US Growth Index (Source: FactSet, as of January 31, 2022)

Sector weights in the US Growth Index.jpg

Source: FactSet, as of January 31, 2022.

Certain companies integrated in these sectors are able to generate wide profit margins and operate with lower staff intensity than other market segments. So that, Although inflation will undoubtedly influence the profits of these companies, its characteristics described above could help mitigate its impact.

Investment issues in a changing environment

One of the lessons we learned during the COVID crisis is that direct digital relationships with customers are highly relevant. The companies that have succeeded in forging them have not only gained the ability to constantly communicate with their customers, but have also learned from them, for example, to better manage inventory, working capital, and other business functions. The omnichannel approach is readily visible in retail, but has also been adopted in office settings, telemedicine, Internet dating, and other areas. From an investment point of view, these digital relationships have provided flexibility and resilience, which has strengthened companies in different economic sectors.

Looking ahead, we see opportunities in other long-term themes. For starters, we believe there is still a long way to go for growth for the large cloud platform providers, even though these companies have already grown at an impressive rate. Semiconductors are laying the groundwork for a growing demand for cloud servers, but they are also key components in the transition to electric (and ultimately autonomous) vehicles. As manufacturers ramp up production of electric vehicles (EVs), demand will increase for essential chips and components that didn’t exist in internal combustion vehicles, but did exist in EVs.

Along the same lines, we have seen the growth of biopharmaceuticals, with protein-based therapeutics, gene therapies and, of course, mRNA vaccines. In parallel with the advancement of these technologies, pharmaceutical manufacturing costs are likely to increase dramatically, and companies selling the various components used in their production will be in strong demand over the next 10-15 years.

keep focus

In difficult times, it is important to ask yourself what is changing in the economy and in business. Just as COVID has reshaped markets in recent years, the military offensive in Ukraine has altered the global economic landscape, with effects that will last for a long time. Nevertheless, During this period of market transition, we maintain our focus on companies well placed for multi-year secular growth in areas that require a significant amount of investment. High-quality companies that are able to capture a disproportionate share of those advantages may be less exposed to external factors, since their growth stems more from capturing market share.

Janus Henderson Portfolio Managers.

Source: Ambito