Why did inflation accelerate? The causes respond “almost” entirely to currency imbalances in Argentina and “some” external inflation due to the conflict in Ukraine.

We know that monetary imbalances are usual currency in Argentina linked to the issue to finance fiscal deficit. Or without emission and distrust in the currency (fall in demand), inflation rises. Consequently, monetary imbalances have effects:

- Less purchase of dollars and growing inflation: effects that prevail in the situation.

- The graph summarizes the reserves effect. Few annual purchases reflect excess pesos. But a more buying BCRA is denoted in May (85% of the 738 million accumulated).

graphic 1.jpg

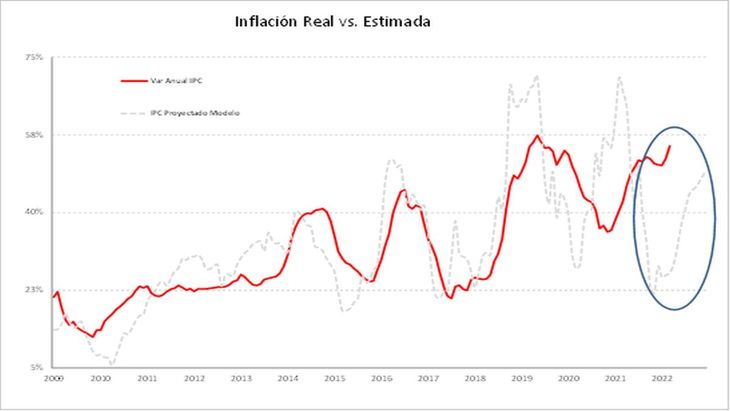

The expectation of acceleration of inflation was “easily” anticipated (not its magnitude) using an econometric model that explains the price dynamics (with 95% probability) using two variables:

- Variation of the BM (monetary base) lagged. Thus, what was issued in the second semester of last year hits a semester later; variable that explains 65% of inflation.

- Variation of the Exchange Rate At 3500; or monthly devaluation that impacts the prices of tradable goods (which explain 70% of the CPI). Thus, the BCRA went from 1% | average in the IIdo sem-21) to 4% monthly (May-22).

Thus, the path of higher inflation is the sum of monetary effects and the rate of devaluation.

The following graph allows you to see the real inflation and that projected by the model since 2009. Thus, the model “projected” an initial drop for 2022 and a strong subsequent acceleration. But this one advancement; reflecting the decline in demand for BM.

graph 2.jpg

Added to the dynamics of Argentina is external inflation in commodities: more than 15% per year in dollars (drop in supply: agriculture, oil and gas and difficulties in the production chain in China due to COVID). “This source of inflation is concentrated in food from the CPI, which had a 1 pp impact on March inflation; effect that would be higher in April.

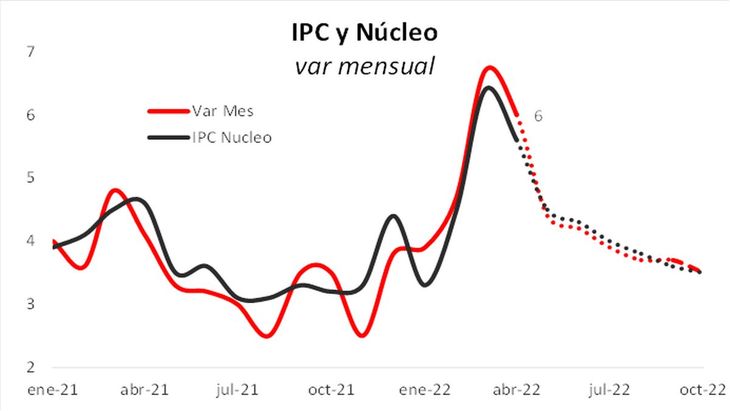

What can we expect? After the acceleration of the semester, he would go down some steps….

The economy operates without anchors to wait for a substantial drop of inflation. Why?

- The agreement with the IMF is not anti-inflationary.

- The devaluation of the BCRA would continue below inflation. But not for much longer; since the IMF audits the evolution of the real exchange rate.

- The costs go up. Wages with parities above 60%. In addition to the rate hikes with a strong impact on the regulated IPC.

- Being more relevant than el Fiscal imbalance and its financing.

- So the inflation can’t slow down much for Increasing real public spending relative to income leads to a primary deficit. Dynamics that leads to emission.

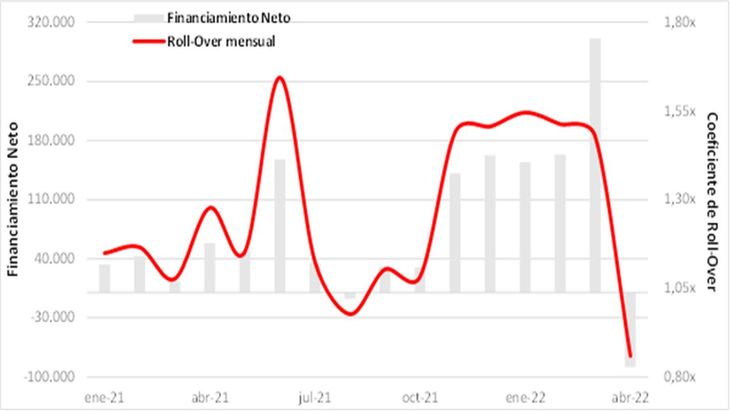

- More counting on the meager financing of April (roll over of 86%).

graphic3.jpg

- In this sense and for the 9th month, the REM raised the inflation expectation: it went from 60% to 65% for Dec-22)

Note: strong low inflation: Primary Surplus + Positive real rates: not very feasible….

Projecting variables

After inflation of the order of 6% in April, the increase in the REM for the next semester (from 3.7% to 3.9% monthly) we expect the BCRA to rise for the 5th consecutive time between 2/2.5 pp.

graph 4.jpg

In this framework, there is still a strong upward risk of inflation (and its negative impact on the demand for money) towards an environment of 4% per month in the coming months given the growing uncertainty:

- Economic: due to the treatment of tariffs, reaction of the IMF in the revisions of “weak numbers” of the government (accumulation of reserves and use of accounting creativity to “measure primary results”. Added to the pressure of raising pensions and minimum wages (affecting plans)

- Politics: crisis in the ruling alliance.

Strategy

Expectations of high inflation and negative real rates push investors/FCIs to overweight their portfolios in CER assets. Cumulative new flows entering FCI CER are approaching $300 billion YTD. This explains the successful roll over of 150% in the first quarter and the negative net financing in April in the absence of Lecer. At the same time, we highlight the growing spread between short and long rates of the BCRA as another explanatory factor in placements and the magnitude of Treasury financing.

The Treasury’s strategy of de-indexing the debt in pesos (reducing the “non-liquefiable” CER debt), in line with the IMF’s intentions, could bring forward a problem that is avoidable in the very short term. We see little political incentive for that to happen.

It is clear that beyond the inflationary hedge, the market seeks to reduce exposure to the risk that the treatment of the debt in pesos would imply after the presidential elections next year (empirical evidence and current flows justify this). This is reflected in the yield differential of the TX24 and TX23 bonds, which managed to reach a maximum of 11% two weeks ago, and although today it is close to 7%, it remains above average. In this framework, the offer of titles that Mecon presents on Thursday 5/19 will be of the utmost importance (probably the composition will be published on Tuesday 17).

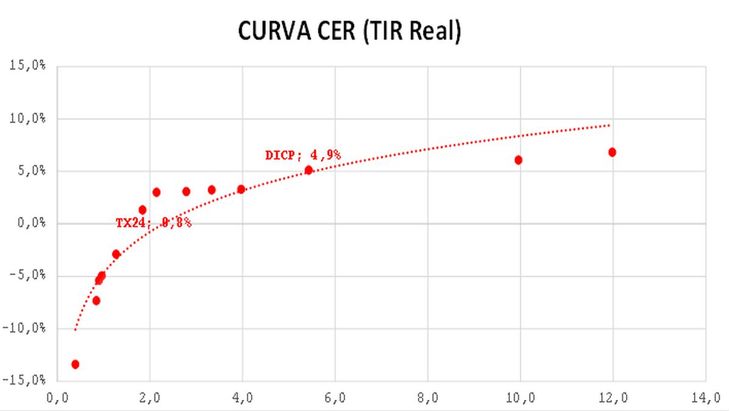

graphic 5.jpg

graphic 6.jpg

We have been recommending the CER curve for a long time. With Real Tires so negative (-15/-20%) it is difficult for us to add new positions in the short part of the curve. We opted to add duration and position ourselves in the middle/long part with bonds such as TX24 (IRR 1%) and DICP (IRR 5%) and wait for the primary tender looking for a prize vs. the secondary one in the event that the Lecers reappear.

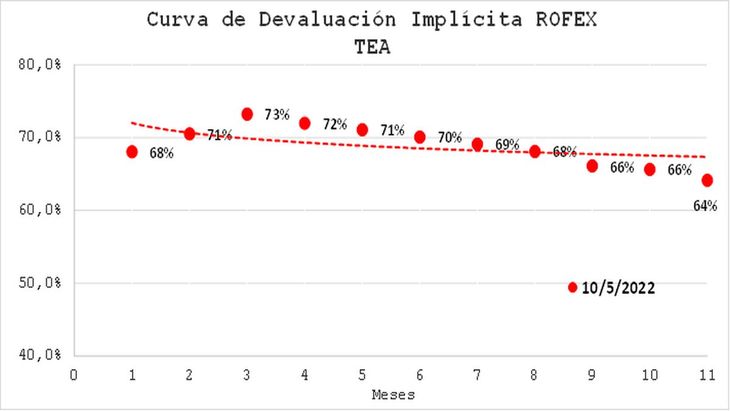

At the same time, we see it as attractive to add participation in the synthetic long Dollar Linked / Short Rofex. We opted to build this strategy with diversified DL positions between ONs with maturities in 2023 with Tires close to 0% (loans such as Vista and SAMI) and the sovereign TV24 (IRR +1%). We seek to position ourselves with short positions within the middle part of the Rofex curve with August/September contracts (TEA 72%). This synthetic widely exceeds the rest of the sovereign fixed-rate instruments such as Ledes (55%) and Botes (58/60%).

Lucas Yatche, Head of Strategy and Investments at Liebre Capital, and Marcelo Romano, Chief Economist at Liebre Capital

Source: Ambito