We have a double command, on the one hand, the president wants to align with the agreement with the IMF, while the vice president wants to increase the population’s income. The mix of higher spending over income ends up leaving us with a chronic deficit that is very difficult to finance.

How much do we need to finance?

With the genuine income of the last 12 months we only finance 80.4% of the total expenses plus interest, the rest must be financed.

What number are we talking about?

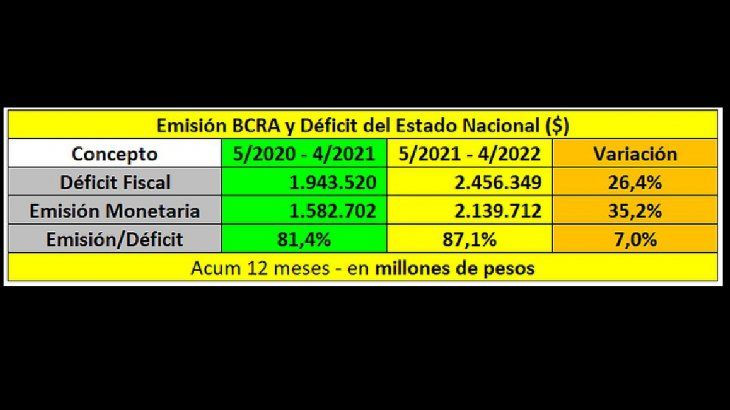

In the last 12 months, the deficit, measured in pesos, was $2,456,349 million.

How was it financed?

At 87.1% with monetary issue, a much higher percentage than what we had in the midst of the pandemic.

Income and Expenses May 2022 Graph.jpg

Can you explain it to me better?

Of course, in the 12 months between May 2020 and April 2021 the fiscal deficit was $1,943,520 million and of that total $1,582,702 was financed with monetary issue, this implies 74.7% of the total of the deficit.

Let’s keep going…

The deficit for the last 12 months, May 2021 and April 2022, was $2,456,349 million, and of that total $2,139,712 million was financed with monetary issue. This explains 87.1% of the total deficit.

What happens with that broadcast?

The Central Bank absorbs it and makes it a liability of the entity, places leliq and passes.

How much do the stock of leliq and passes add up to?

As of April, the stock amounts to $5,251,780 million, for that amount in the last 12 months interest was paid for a total of $1,495,588 million.

Then?

In the last 12 months, $2,139,712 million were issued and $1,495,588 million were paid in interest on Central Bank debt. An explosion of peso issuance that the only thing it does is boost inflation every month.

The sum of the issue and the payment of interest by the Central Bank is higher than the fiscal deficit

To put it in simpler numbers, the fiscal deficit for the last 12 months is $2.5 trillion. The sum of what was issued plus the rate paid for the BCRA debt is $3.6 million million.

BCRA Issue Chart May 2022.jpg

Impact?

The first consequence is that it will be difficult to lower inflation and contain the exchange rate gap with so much disorder in public accounts, higher issuance than in the pandemic, and disproportionate interest payments on BCRA debt.

What awaits us in the short term?

Inflation will be higher and higher, the Central Bank will be forced to raise the monetary policy interest rate, this rate is the one that is applied to the debt in leliq and repos, which generates a greater liability of the Central Bank and power to the rise in inflation and the exchange rate gap.

The Leliq rate fell to the lowest level since the BCRA implemented the new monetary program

It is a vicious circle

More deficit is equal to more issuance, this implies more inflation, rise in rates, increase in interest paid by the Central Bank and more exchange rate gap.

How is this vicious circle broken?

With a virtuous circle, this implies a fiscal surplus, there is no reason to issue currency, this calms inflation, we could enter a scenario of lower rates and the exchange rate gap could be reduced.

Argentina power?

The fiscal surplus is a necessary but not sufficient condition to get Argentina out of decline, we need an economic development plan, attracting investments with an eye toward locating the companies that arrive, investments should be oriented mainly to companies that export to generate more dollars that can finance the arrival of capital goods to continue growing, a considerable increase in employment and real wages.

Let’s go back to the situation…

In recent months there has been a strong expansion of public spending, especially in March and April with growth rates of 87%, while revenues rise at a rate of 75%, this implies that we are creating the conditions to increase the fiscal deficit , this would imply more inflation and exchange gap.

What projections do we have for the year 2022?

We are expecting inflation above 75% per year, this implies an interest rate greater than 60% per year and a devaluation of the official dollar of 55% per year.

How does this impact financial investments?

With these levels of inflation there are two products to choose from, purchase of the stock dollar and instruments tied to inflation. Official dollar-adjusted bonds may be an option, but with some considerations.

Let’s go by part, dollar bag?

The stock dollar today trades very close to the solidarity dollar and has a gap of less than 80%, we believe that the international and local conditions are given for this dollar to have a gap of around 100%. This implies that in the current situation it should be worth around $240 as a floor.

Bonds that adjust for inflation?

These bonds are under suspicion, since the next government could be forced to redefine this debt. Currently, these bonds represent a debt stock equivalent to US$73,231 million. If the State does not have a fiscal surplus and the debt cannot be liquefied, it is most likely that it will end up reshaping itself. That is why it is best to make fixed terms adjusted for inflation. Only short-term bonds, such as the TX 23 that matures on March 25, 2023 and pays inflation plus 1.65% per year. The TX 24 that expires on March 25, 2024 pays inflation plus 4.97% per year. The rate difference reflects time and risk (probable reprofiling). I would prefer to buy negotiable obligations or promissory notes from private companies whose capital is adjusted for inflation and are guaranteed by a mutual guarantee company.

Linked dollar-adjusted bonds?

Not to be scared by the names, they are bonds that adjust according to the evolution of the wholesale dollar. The State issued very few bonds, but in the private sphere there are promissory notes and negotiable obligations that adjust for the wholesale dollar and pay rates between 1% and 4% per year. Most of these private instruments are backed by a mutual guarantee company.

Conclusion:

You can build a good fixed income portfolio with dollar bills or global bonds from Argentina at 70%. Within global bonds we prefer 60% in LA30 and 40% in AE38. 20% in instruments adjusted for inflation and 10% in bonds linked to the evolution of the wholesale dollar. Portfolios have to begin to dollarize.

For risk lovers, buying global bonds in dollars at values of 30% parity generates high adrenaline, if the next elections are won by a pro-market president, what today is worth 30% tomorrow can be worth 60% without major inconveniences in a shorter term to 2 years. You can sing bingo in a short period of time. Attention!

Source: Ambito