Every bubble starts with price increases, of course. But that factor is not enough. The real gasoline comes from artificially cheap credit, due to low interest rates.

Who promoted this? The Federal Reserve (and the other central banks) have injected liquidity into the market to combat the previous crisis of 2008 and generated a huge monetary expansion, thus inflating the prices not only of stocks, but also of houses.

Let’s look at the mortgage rate, which is undoubtedly the most important graph in the real estate market:

Boggiano 1.jpg

The average interest rate for 30-year mortgages reached 5.49%, marking a record since 2011.

With every increase in home prices and mortgage rates, more potential buyers are out of the picture. At some point, the regular buyers also start to decline. And that is what is happening now.

Also worth noting is the following: The Federal Reserve holds about 24% of all residential mortgages in the United States. If the reference rate continues to rise, mortgage rates will continue to rise. And that would make houses even more inaccessible, further fueling the possibility that the bubble will burst.

unavoidable consequences

The increase in interest rates and mortgages have direct consequences on the real estate market. And the data shows it.

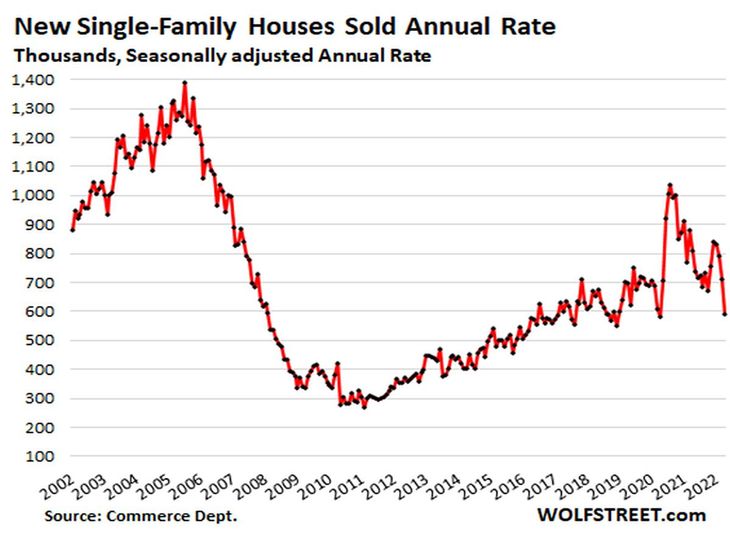

Sales of new single-family homes fell 16.6% in April compared to March, and 26.9% compared to April 2021. This drop is the worst since the mass closure due to the start of the pandemic, in April 2020 .

Let’s look at the graph that shows the number of houses sold (in thousands):

Boggiano 2.jpg

The fall was dramatic and it is a bad sign about what can happen. But it’s not just that. In addition, the inventory of new unsold homes continues to grow.

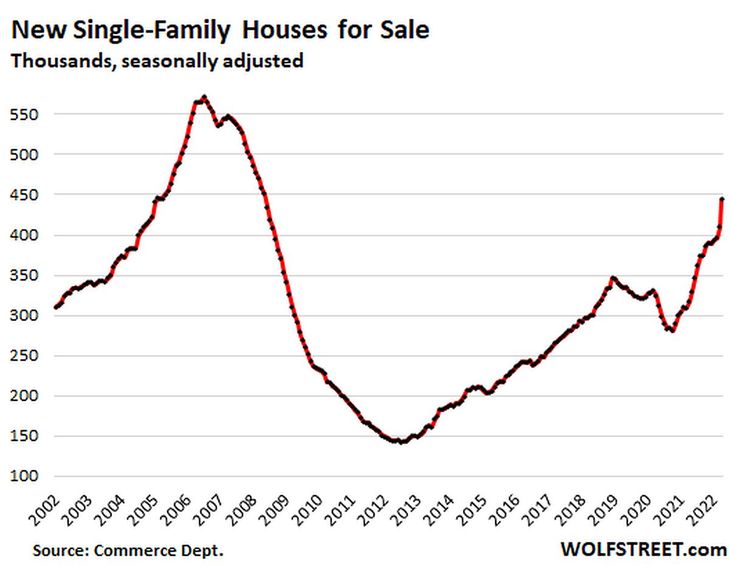

Boggiano 3.jpg

As seen in the graph, unsold new home inventory has risen by 127,000 units in the last 12 months, reaching a total of 444,000 today. This jump, in quantity and percentage, was the highest recorded in history.

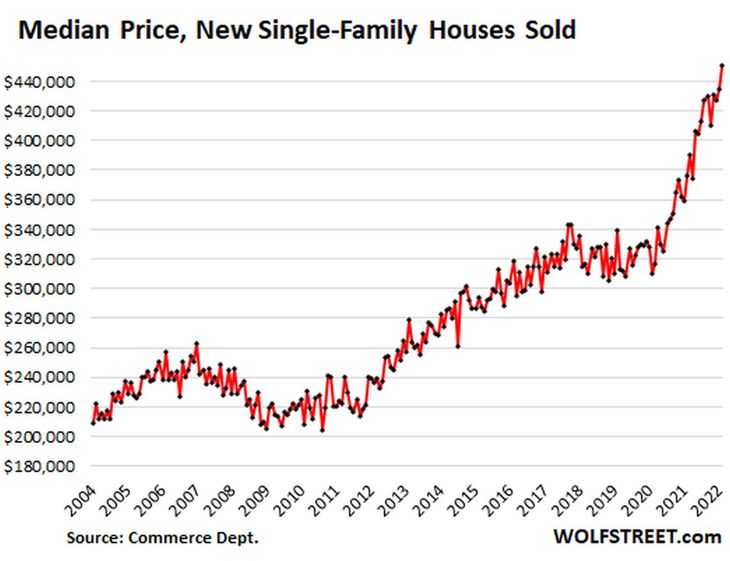

Like any bubble, prices also do not stop growing. Let’s look at the median price of new homes sold:

Boggiano 4.jpg

The average price reached USD 450,600, 19.6% higher than a year ago.

conclusion

Buyers are battling rising mortgage rates, which are making home prices more unaffordable. With each new increase in rate and price, thousands of people leave the market and the volume sold plummets. This is the situation that is being experienced today.

In addition, homebuilders face the worst inflation in history in terms of construction costs. Not only that, but there are also shortages of materials and labor.

Construction company stocks are suffering dramatic declines so far in 2022. DR Horton (-39.6%), Lennar (-38.5%), Merit (-37.2%) are some of the examples. Bad augury?

The real estate market is in bubble mode again. Will it explode? No one knows, but the odds are high. Undoubtedly, inflation and what the Federal Reserve does or does not do will be decisive. To be careful.

To finish, I want to invite you to download a free report that I prepared so that you can face this crisis and have the tools to know how to beat the market. I think it will be very useful to you. You can download it at this link: https://informes.cartafinanciera.com/

Source: Ambito