By disarming both trade flows between price and quantity, “the macroeconomic imbalance sneaks in” due to a greater fiscal deficit financed with issuance. In principle, the rise in import and export prices was similar at 22% (terms of trade were stable); however, the imported quantities rose 16% and the exported only 5%.

Coc1.jpg

Given the dynamics of the trade balance (mirror of the imbalance); nor did the BCRA buy private dollars.

In the April/July period, the income from the thick harvest or a greater flow of exports is reflected. Thus, between April and May of the previous year, the BCRA bought US$3,351 million private essentially from agriculture. This year only US$1,031 million private in the last two months. In a similar sense, in 5 months, the purchase of reserves (RIN) for 2021 was US$5,728 million; and accumulated in 2022 only US$1,051 million; 18% from the previous year.

Coc2.jpg

So there is a lower trade balance and lower purchases of private dollars by the BCRA.

Clearly there are two other manifestations of excess weight:

- The private sector seeks coverage against pesos; exporters retain exportable product and importers increase the “physical” quantity in their purchases (and includes purchases of energy / public spending).

- The retention bias was verified even with Ciaracec’s all-time record forex liquidation in May of $4.23 billion. It rose 19% year-on-year. However, prices grew more than 25%, and the historical monthly seasonality (May compared to April) reaches 18%. Consequently, the liquidation of foreign currency would have had to rise by 48% per month due to both effects (price and seasonality). They only rose 33% monthly compared to April. On the other hand, looking at shipment declarations (or loaded/exported grains) in the month, these fell about 20% monthly. So the entire record sale was just for prices. This would reflect strong retention of producers who do not want more pesos.

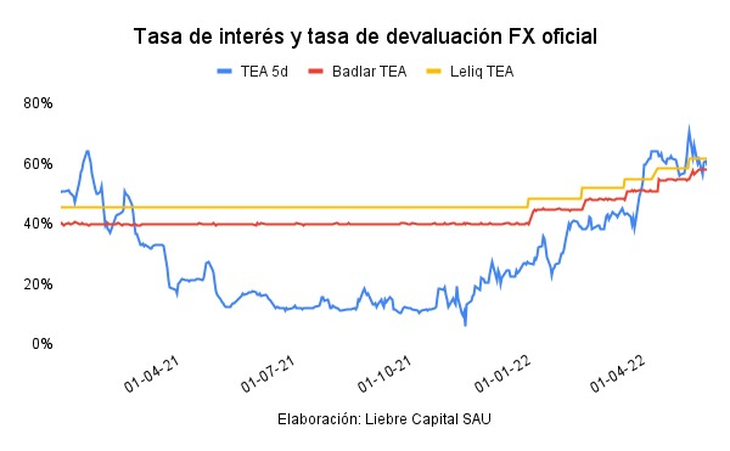

- Because given the BCRA’s rate policy: the pace of the devaluation rate is similar to that of the interest rate. Or without incentives to settle for the producer. Hence the low BCRA purchases of reserves.

Coc3.png

The excess of pesos (derived from a higher primary deficit and growing assistance from the BCRA), in summary, filters into different aspects of the economy:

- Fall in trade balance compared to 2021

- Lower BCRA private currency purchases

- Rising inflation: acceleration towards more than 5% monthly

In turn, the excess of currency puts at risk the fulfillment of the next goals with the IMF:

- After approving the goals of the 1st. quarter, those of the 2nd. trimester would be more difficult.

- The variation in net international reserves being the most compromised.

Has the excess weight ended? No, since we know that in the coming months the primary deficit would grow from the side of the goals with the IMF and due to the growing excesses of public spending by the national government (IFE payment and slowdown in activity).

Therefore, we maintain the ordering of the variables: inflation rate exceeds the interest rate (and a new increase projected by the BCRA towards mid-June) and “close” rate of devaluation of the official exchange rate.

Strategy

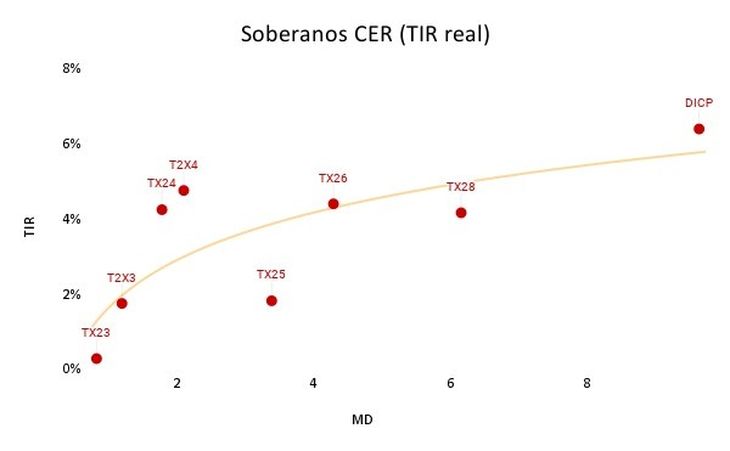

Beyond the respite of May, doing an analysis of total return in dollars, CER assets have been the winning asset class so far in 2022. With accumulated returns in dollars of 18/20%, they far exceeded the rest of the curves in pesos, and not to mention if the comparable ones are the global bonds/bonars u$s (-14%/-17% on average) or the Merval CCL (+8%). This in a framework where assets worldwide, both fixed and variable income, first world or emerging, present significant penalties.

The short part of the CER curve (LECER/T2X2/TX23) accumulates returns in dollars close to 20%, while in the long part (TX26/TX28/DICP) they are close to 18%.

However, the recent bailouts in the FCI CERs (and the increase in the money markets), reflect the fear of investors to stretch duration mainly to cross the presidential elections.

This makes us stop when it comes to putting together investment strategies. The lack of roll over in April and the scant net financing obtained in May – even offering the short CER titles that are most in demand in the market – leads us to be more cautious.

In this framework, we decided to add weight to Lecer for April/May by reducing duration with real Tires close to -1/0%, entry points that are much more attractive than weeks ago.

Coc4.jpg

Going forward, assuming our inflationary perspectives, we observe less competitiveness in the Ledes than in the Lecers –even after the rate increase of the last tenders to 52/53% TNA for terms until October 2022-.

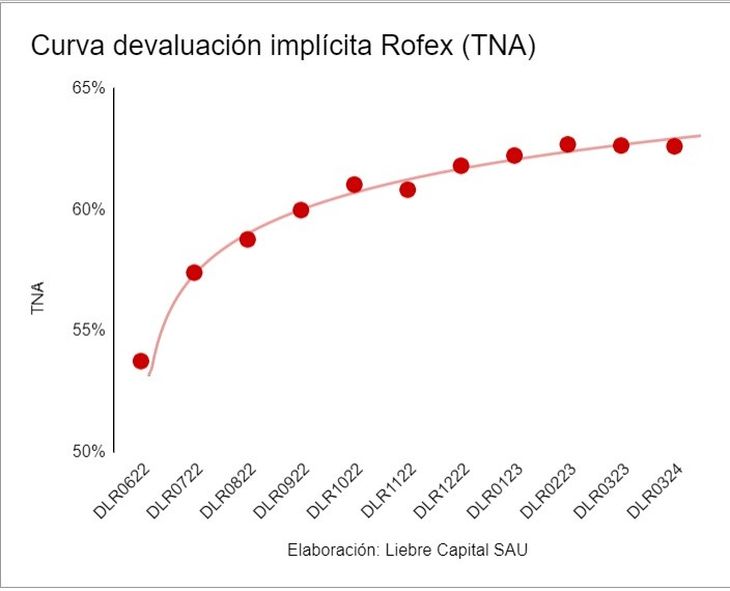

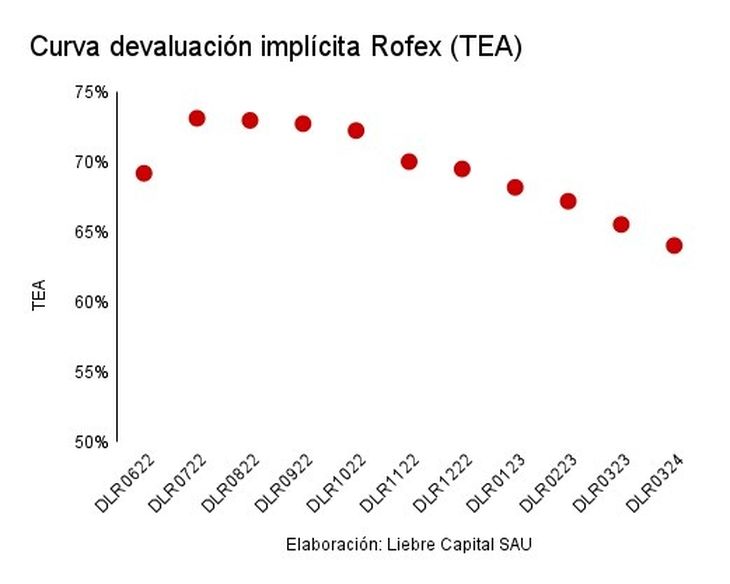

Meanwhile, we have been seeing some understanding in the implicit devaluation curve of the ROFEX market over the last few weeks. Without reserve purchases and without a slowdown in the crawling peg, this movement is largely justified by the increase in the BCRA’s selling position. In any case, we continue to see attractiveness in the long Dollar Linked / Short Rofex synthetic with TEAs close to 70%, widely exceeding sovereign fixed-rate yields on LEDs (60%) and Botes (62%), and much closer to the outlook for yields on short inflation-indexed securities.

We opted to build this strategy with corporate DL positions with maturities close to 2023 to Tires around 0/1% and the sovereign T2V2 (IRR -2%), together with selling contracts on Rofex for August/September (TEA 73%) .

Finally, to a lesser extent, we opt for Global US$ such as GD35 and GD38 assuming the low parities (28%/36%) and the current level of the CCL.

Coc5.jpg

Coc6.jpg

Lucas Yatche (Head of Strategy & Investments) and Marcelo Romano (Chief Economist)

Source: Ambito