Inflation is a monetary phenomenon, therefore, we should closely follow the fiscal result in Argentina and how it is financed. To the extent that this result is negative and is financed with issuance, this would imply that we are going to a scenario of more inflation.

What happened to the deficit and the issue?

We will review it by semester:

Clipboard01.jpg

*The deficit for the first half of 2022 corresponds to the months of January to April 2022.

**The issuance of the first half of 2022 is the one measured until June 13, 2022.

Under the government of Mauricio Macri we had less deficit and less financing with monetary issue. In the government of Alberto Fernández, the deficit and the emission went hand in hand, what is striking is that the emission in 2022 doubles that observed in the year 2021 and is half of the emission of the year 2020, when The last fortnight of June is yet to be surveyed. The deficit for the year 2022 comfortably exceeds that of the year 2021 in nominal terms, and the results for the months of May and June are still missing, if it continues with the monthly rhythm it could double it.

Should we continue with high inflation with this issue?

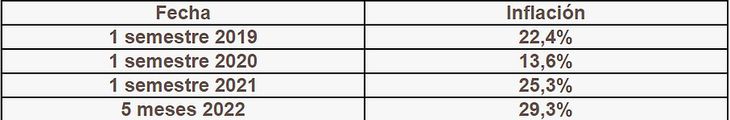

We can add the inflation data:

Clipboard02.jpg

Under the government of Mauricio Macri, inflation was high, although there was a low level of emission, in 2020 inflation was contained by the closure of the economy due to the pandemic, however, the exit of the pandemic with a supply restriction , cut of the supply chain, increase in the deficit and greater monetary emission was placing us in much higher levels of inflation, which in the year 2022 will exceed the figures of the year 2021. We expect an inflation higher than 70% per year. I don’t think it’s 3 digits and less hyper inflation.

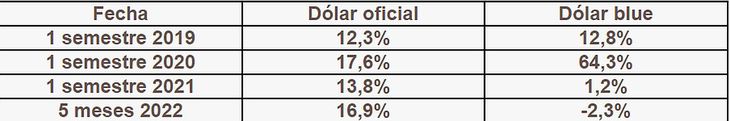

How did the dollar behave in these periods?

Very easy, we go for the official and the most popular, which is blue:

Clipboard03.jpg

The blue dollar grew a lot during the pandemic, while, after the pandemic, it could not be maintained since in Argentina it is a savings currency and the economic crisis forced it to be more offered than demanded. The crisis continues and there will surely be more sales.

Does this imply that the one who saved in dollars lost?

That’s right, in the last 2 years. It is also true that the government carried out a deliberate policy of delaying the exchange rate, inflation in the first half of 2021 was 25.3% and the official exchange rate increased by 13.8%. In 5 months of the year 2022, inflation was 29.3% and the rise in the exchange rate was 16.9%.

Are we delaying the exchange rate?

At a rate of 50% of inflation in the last two years. The raw materials that we export rise a lot, there is room to delay the exchange rate, this generates two very harmful effects, on the one hand, the exchange delay harms other products that are not soybeans, wheat and corn that increase in price, such as For example, beef, pork and poultry, which are not competitive with this exchange rate. On the other hand, a low exchange rate encourages the entry of products from abroad and increases the demand for imported products.

Why reserves fall?

Our exchange balance measured annually is negative, more dollars leave than enter. This is due to the double standard that we have to enter capital, you can do it with dollars that come from abroad and are exchanged in the capital market at a price of $ 242 (dollars enter from an investor whose counterpart is the outflow of dollars from another investor) or by the Single and Free Exchange Market of the Central Bank at a price of $122.90 (dollars enter that go to the reserves of the Central Bank and the counterpart is the Central Bank issuing pesos). It is clear that investors will choose the first path that is at a higher price and that finances the outflow of capital, this does not impact the reserves of the Central Bank.

How is it solved?

With a single exchange rate.

That will not happen with this government

Then it won’t fix it.

Will reserves continue to fall?

Everything has a limit, when you stop adjusting for quantity, you will start adjusting for price.

Is the devaluation of the official dollar coming?

Everything has a limit.

What is the problem with this economy?

The fiscal deficit.

If you don’t want to lower the deficit?

It is financed by issuing debt or issuing pesos.

If it is financed with the issuance of pesos?

The result is known by all, we will have a growing inflation. Every year we have more inflation, rise in interest rates and therefore economic slowdown, we enter into a dynamic of stagnation with inflation.

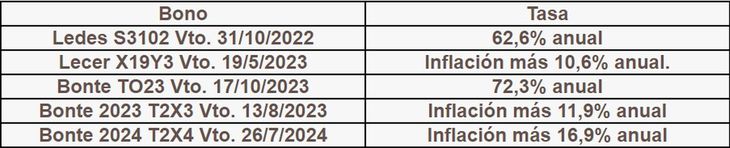

If it is financed with debt issuance?

The results are very negative, because the market does not want to validate the taking of the State’s debt, for example, this is the trail of rates that were paid on Friday:

Clipboard04.jpg

The State is financed at very high rates, inflation in the last 12 months is 60.7% per year, and either nominal or inflation-adjusted rates are above inflation in the last 12 months. This implies that with such high rates it is probable that the investment will not appear.

Can you explain it to me better?

Yes, for putting money to July 2024 in a bond like the T2X4 you get paid 16.9% per year above inflation, this implies that if we project a future inflation of 60% per year (being very optimistic) for staying drinking mate in your house you take 76.9% per year. This is the opportunity cost of the investment, if with a venture you do not earn more than 16.9% per year above inflation, no one will invest a peso in this economy.

Why does the rate go up so much in 2024?

The market believes that it will not be possible to pay the debt in pesos adjusted for inflation, therefore, there would be a re-profiling for a longer term, that is why those who buy this debt, take care of their health and ask for a higher interest rate.

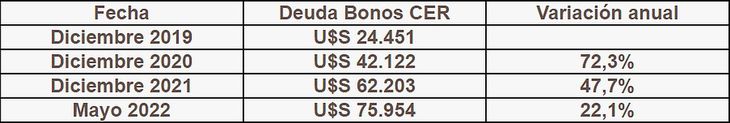

How was the evolution of that debt?

I show it in dollars so that it can be comparable:

Clipboard01.jpg

The debt in pesos of the CER bonds is expressed in dollars

At this rate of indebtedness, at the end of Alberto Fernández’s mandate, this debt could be around US$135,000 million. Currently, the placement term for these instruments, measured as of April 2022, is 25 months, with which Payment is almost impossible if a restructuring or voluntary renewal of debt for a longer term has not been achieved.

conclusion

The government does not have enough reserves to contain alternative exchange rates, which is why it raised the fixed-term rate to levels of 53% per year. For the dollar to beat the interest rate, it would have to trade, at the end of the year, well above $300, it does not seem impossible, but it seems unlikely.

The rise in fixed-term rates will take the dynamics out of alternative exchange rates. The rise in lending rates will take activity away from the economy. In Argentina, people save in dollars, therefore, with rates on the rise and less economic activity, it seems likely that the dollar will not continue to grow at the rate of the last wheels.

The equilibrium dollar is located at $ 235, it is at the intermediate point between what the dollar counted with liquidation and the stock dollar or MEP are worth. The blue dollar is still behind due to the greater supply in the market.

The government should, in the coming months, reduce the fiscal deficit, if this does not happen we will revise upwards the projections for the price of the dollar and inflation.

If the Central Bank fails to rebuild reserves, the possibility of a devaluation of the wholesale exchange rate is left open and everything gets complicated there.

The field is selling soybeans at a good pace and accelerated sales in recent days. That does not mean that he has put a price on the merchandise he sells. For example, the producer sold 42% of the soybean crop (the exporter takes it and exports it), but only put a price on 23% of the total crop. The exporter sold the merchandise that was delivered to him, which is why the income of dollars from the harvest is a record. The producer has already sold 56% of the corn crop, but only put a price on 42% of the total crop. In wheat, 92% of the 2021/22 harvest was sold and 83% of the total harvest has a price.

The producer sold the wheat, is selling the corn and is selling the soybean, but he does not put a price on it, leaving it as a reserve of value, before an upcoming campaign in which the weather forecast could be drought.

The price of grains is very high, but if there is a drought in the United States, it could be higher. That is why selling soybeans, wheat and corn is a great option, but just in case buying a call so as not to lose the raise if there were one. For example, July corn is worth US$252 a ton, a call corn July 2022 base US$ 252 is worth US$ 3.5. It is worth doing this coverage. In July 2022 soybeans are worth US$ 414.50 per ton, a call soybean July 2022 base US$ 412 is worth US$ 5.70.

For 2023 values, you can sell corn in April 2023 worth US$244.50 and buy a call April 2023 base US$ 260 is worth US$ 13.50, you are sold and you cover yourself against a possible rise. You can sell soybeans in May 2023 worth U$S 382.50 and you buy a call May 2023 base US$ 432 at US$ 9.0 per ton, you are sold and you cover yourself against a possible rise. the market of call It has little liquidity.

There are many possible combinations to cover you, whether in Argentina or over Chicago, it is time to resort to these tools, since the probability of a drought scenario over the United States and Argentina is possible.

Source: Ambito