We show the series of the Manufacturing Industrial Production Index compiled by INDEC:

SMEs 2016 2022 graphic.jpg

Without risk of being wrong, we can say that at least since January 2016 the level of activity, quantity of goods produced, in the industry is stagnant. We see it difficult to record increases in industrial activity in the second half of the year. The main causes of this are:

a-. Currency restrictions to pay for the supplies needed to produce, the Argentine central bank is not meeting its reserve accumulation targets and with the end of the second quarter heavy harvest the massive influx of commercial dollars has ended, the period of scarcity and tight currency management of the monetary authority.

b-. The increase in the use of the installed capacity of industries makes it increasingly difficult to increase production without incurring higher costs.

c-. Soon, the increase in electricity, gas and transport rates will be faced, mainly in the AMBA. This generates a negative income effect for users, since they will pay more for these services and have less money for other consumption.

d-. Very probably the FED and the European Central Bank will continue to increase world interest rates seeking to control world inflation, this cools the world economy and generates a flight of international capital to the US Dollar and Euro zones.

and-. Since 2017, investment in capital equipment and transportation has been falling, except for 2021, which is slightly above 2019 and 2020 (ultra-recessive years), this illustrates a fall in the production capacities of the industry.

F-. We do not know if the government is going to devalue the Peso more quickly or is going to restrict imports even more, in both cases, it generates a discouraging effect on activity, the greater speed of devaluation pushes prices and liquidates real income and the restriction of imports generates necks in the production process accelerating inflation

g-. Expectations regarding price stability and general economic activity are not good, so investments in the industrial sector will remain low.

This set of factors imposes a ceiling on the recovery of the industry, being even more restricted for small and medium-sized companies that have fewer economies of scale and greater financing difficulties.

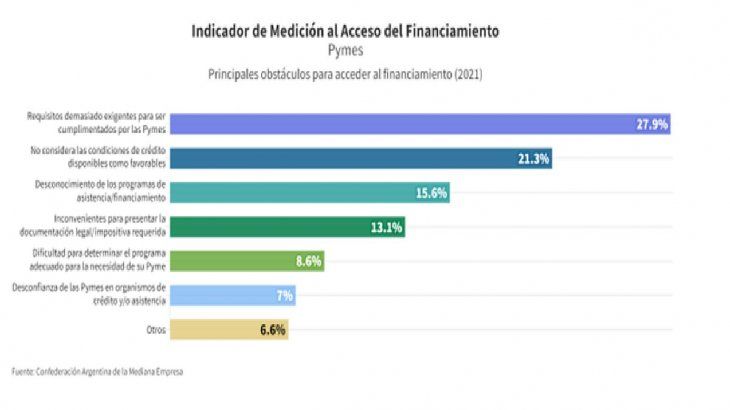

According to the Argentine Confederation of Medium-Sized Enterprises, we can see the main obstacles to access financing:

SMEs Financing Graphic.jpg

The three most representative obstacles for access to credit are:

- Requirements too demanding to be fulfilled by SMEs

- Does not consider available credit conditions as favorable

- Ignorance of assistance/financing programs.

Leaving the classic banking and financial circuit, in Argentina financing instruments for SMEs in the capital market are underutilized, which are of low complexity and many of which have better conditions than classic banking products:

Deferred Payment Check: The discount system for deferred payment checks in the capital market allows those who have checks to be collected in the future to advance their collection by selling them in the market; and who has liquid funds, buy these checks in exchange for future interest rates. Ideal to finance working capital.

Negotiable Obligations: Negotiable obligations are private bonds that represent debt securities of the company that issues them. This instrument was created so that SMEs can access the necessary financing for the development of their activities and projects, such as for investments or debt refinancing. Many companies use these bonds to increase their working capital, improve technology or implement research projects.

Short Term Values: This instrument was created so that SMEs can access the necessary financing for the development of their activities and projects, such as for investments or debt refinancing. Many companies use these bonds to increase their working capital, improve technology or implement research projects.

Stock market promissory note: It can be drawn in pesos or in foreign currency for a minimum amount of $100,000. Its term must be between 180 days and 3 years maximum and must be guaranteed by an SGR or guarantee fund for the total amount. We hope to have contributed to a better understanding of the current situation and provide some tools for financing SMEs.

Professor of the Diploma in Financial Advice at the Blas Pascal University (UBP).

Source: Ambito