Before starting, I leave you the evolution of emerging bonds:

Bog1.png

What asset is the one on the chart? It is called Emerging Market Bonds (EMB). It is an ETF (fund) that replicates a sovereign debt index in dollars of emerging countries.

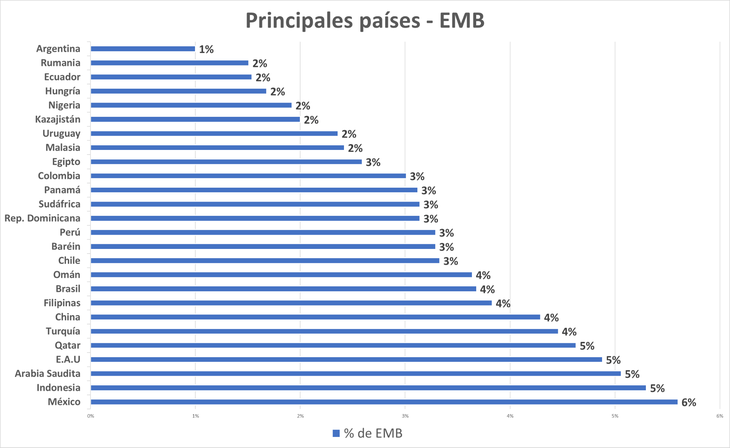

EMB is made up of bonds from 40 countries. The top 26 account for 85% of the fund, as seen below:

Bog2.png

The fund pays an average coupon of 4.8%. So, is it a good idea to take advantage of that performance? Of course not. And now that they are falling, bonds are yielding even more. So is it a good idea to buy now? Of course not. Surely your advisor will tell you the opposite.

The interest rate is rising sharply after decades. Inflation hit records around the world and the Federal Reserve was forced to take a more dovish stance.

For that reason, the capital of the bonds deteriorated. EMB fell 25% in recent months. This means that the loss of purchasing power of the capital exceeded the coupon of the bond by more than 5 times.

In other words, the coupon income does not cover, not even remotely, what is lost from the capital. Do not think of the bond as an investment until maturity. In any case, it is better to stay in cash and buy later, when the situation is different.

overall context

EMB is about sovereign debt in dollars, so the credit risk increases with the rise of the dollar worldwide. This means that emerging countries will need much more resources in local currency to pay off their debt.

Furthermore, Europe’s debt is on fire. Let us remember that the so-called PIGS countries have a high debt ratio in relation to their GDP: Portugal (127%), Italy (151%), Greece (193%) and Spain (118%).

In absolute values, Portugal’s debt is US$295 Billions; that of Italy, US$2.7 Trillion; that of Greece, US$ 381 Billions and that of Spain US$ 1.5 Trillion. Undoubtedly, Italy’s is the largest. And those that have exposure to the debt of these countries are the European banks, which generates a lot of fragility.

Recently, PIGS bonds have been falling sharply, thus increasing their yield. Italian bonds, for example, went from yielding 0.5% to 4% in a few months, levels not seen since 2014.

The remarkable thing is that the spread of these bonds against Germany is increasing, a clear case of credit risk, which comes to light again at the end of the injection of euros by the European Central Bank.

The concern about inflation and the expectation of increases in the interest rate explain this fall in the prices of bonds and, consequently, the increase in their yields.

The difference in bond yields between the PIGS (not so safe) countries and Germany (safe) is seen as a measure of stress in European markets and is closely watched by investors. Let’s look at the example of Italy:

Bog3.png

As can be seen, the gap widened sharply, towards levels not seen in the last 2 years. What does it mean? That the market is very concerned about the situation in Italy (of the PIGS, in general), since it considers that it will be difficult for it to pay its debt, which exceeds 150% of its GDP. For this reason, the bonds fall, thus increasing their yield and their spread with that of Germany.

If this situation of stress happens in Portugal, Italy, Greece and Spain, imagine what can happen in much less developed countries, such as emerging markets. The risk is huge and the beginning has already been seen: EMB fell by 25% in 9 months.

I have been warning for a long time about the danger of having bonuses. And even more so if it is low quality bonds. First of all, the recommendation is to always protect the capital.

To finish, I want to invite you to download for free a report that I prepared so that you can face this global crisis and have the tools to know how to beat the market. You can download it at this link: Financial Letter – Bonds.

Source: Ambito