As the days went by, the blue dollar paused the euphoria with which it had started on Monday, in full uncertainty. However, free dollars (MEP and Cash with Liquidation) reached $274 and $294, respectively, setting new records.

Status of stocks and bonds

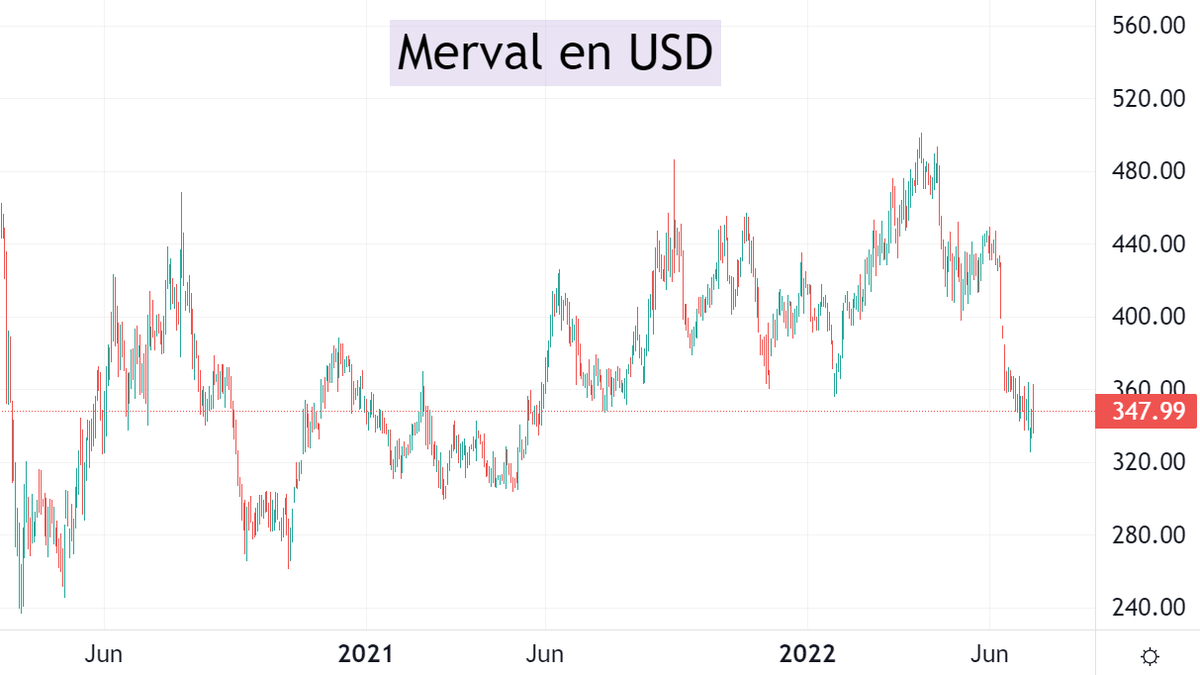

The Merval, measured in dollars, fell 2% so far this week. In just over a month, he erased all the profit he accumulated in 2022. Let’s see his graph:

Merval painting.png

Argentina, regarding its actions, came with a positive 2022, something remarkable in this international context. Those that pushed the most were energy, favored by high international prices. But, as is known, Argentina depends a lot on what happens at the political and economic level.

And this was the case: in June there were huge complications with the CER bonds, which generated mistrust about the government’s ability to pay. From there, the shares did not stop falling and the dollar accelerated its upward path.

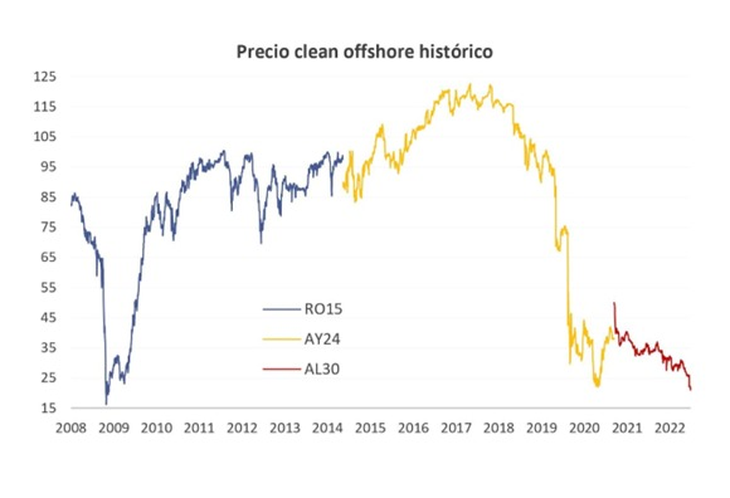

And the bonuses? Here is another story. Since the debt restructuring, dollar bonds have failed to find a floor. Let’s see the parity of Argentine bonds in the last 15 years:

Clean offshore.png

As can be seen, bonds are at extremely depressed parities. Even, the Argentine debt is cheaper than at the beginning of the Covid, before the debt restructuring. Only in 2008 did we see worse prices.

The bonds have an Internal Rate of Return that exceeds 40% per year. It is a very artificial estimate, since it is discounted that the bonuses will not be paid in a timely manner.

Then, does it make sense to buy? The answer is that it depends. The reality is that bonds are worth very little because nobody wants them. And they are getting more and more. Those who say that it is a good idea to buy Argentine bonds said so when GD30 was worth 50 cents. Then, when it fell 20% and was worth 40 cents, they also said so. From 40 cents it went to 30 and the reasoning continued.

And now that they fell 30% in a month and are worth almost 20 cents? The situation is already becoming more pleasant in terms of the risk/return ratio. In the short term, the parity can easily go to 15 or 10, which would imply falls between 25% and 50%. Someone conservative should not consider it.

However, despite the fact that the trend is down, the bonds have a recovery value. This means that they cannot go to 0. For this reason, there are many investors, with an aggressive profile, who are tempted to buy now, since the parity, in historical terms, is very low.

Even assuming a very aggressive haircut on the principal of the bonds, the return could be considerable. However, it is still a risky bet, because the government’s willingness to pay is practically nil.

Without a doubt, destiny will be marked by fire by the political course adopted by this government and the one that will come next year. Therefore, there is a lot of uncertainty.

Argentina moves to the beat of its political ups and downs. It can give juicy profits, just like in previous years, but you have to know how to wait for the moment.

For now, given global conditions and domestic issues, it doesn’t seem like a good idea to invest in Argentine stocks or bonds.

When the trend changes and the political landscape clears, we will have to be alert to take advantage of the opportunities, which will not stop being risky. Argentina is like that: silver or lead.

To finish, I want to invite you to download for free a report that I prepared so that you can face this global crisis and have the tools to know how to beat the market. You can download it at this link: Financial Letter – double capital.

Source: Ambito