Apple (market value: $2.3 Trillions), Microsoft ($1.8 Trillions) and Google ($1.4 Trillions) lead the market capitalization podium in the US.

2022 will go down in memory as a historic year. After decades of injection of money, inflation in the US set a record for the last 40 years, reaching 9.1% year-on-year.

In this context, the Federal Reserve had to raise the interest rate and the market (stocks and bonds) suffered a big drop.

However, stocks in Apple, Microsoft and Google have held up quite well, compared to other lesser quality companies.

Let’s see its returns during 2022, along with the S&P 500 and the Nasdaq:

Bog1 14-7.png

Apple (-19%), Microsoft (-24%) and Google (-23%) are outperforming the Nasdaq (-29%), their benchmark index. The S&P, meanwhile, is down 21% so far this year.

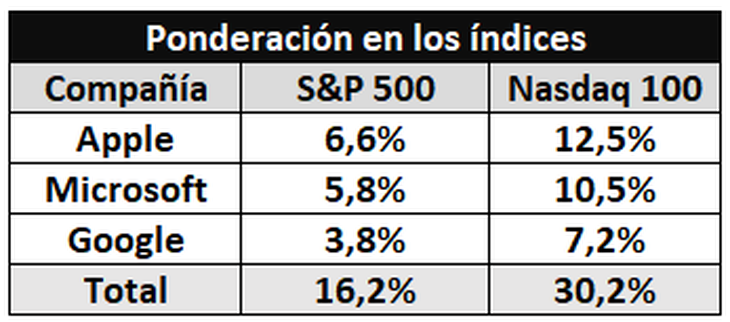

How important are they within both markets?

Let’s see its weighting within each index:

Bog2 14-7.png

Between the three, they account for more than 16% of the S&P 500 and more than 30% on the Nasdaq. For this reason they are the ones that push and pull the market.

This year has seen falls of more than 60% in shares of the S&P 500 and, especially, the Nasdaq 100. Why did the Nasdaq suffer more? Because the rise in the interest rate affects technology companies more.

However, Apple, Microsoft and Google did not have such spectacular declines. Due to their weighting, they are supporting the market as a whole. This means that if you break down how Nasdaq companies are doing, for example, the reality is that they are doing worse than the index.

Without a doubt, the main challenge will be to understand how the global context is affecting these companies.

This week the inflation data came out that set a new record. Now the question is whether the economy is finally headed for a recession and by how much future corporate profits will slow.

This information will be available soon with the presentations of the balances of Apple (07/28), Microsoft (07/26) and Google (07/26). The market will be very expectant to know this impact. In addition, he will be very aware of what the Federal Reserve does in terms of raising rates.

We have already seen a very complex start to the year for stocks and bonds, which were severely affected by the rise in interest rates. Now, the new story is the recession, which puts companies in check.

If the economy starts to show negative signs, Apple, Google and Microsoft will be hurt and could accelerate their decline. And if that happens, all the other smaller companies will end up falling like dominoes, due to the drag effect. Will it happen? We don’t know, but it’s a possibility. Therefore, invest carefully.

To finish, I want to invite you to download for free a report that I prepared so that you can face this global crisis and have the tools to know how to beat the market. You can download it at this link: Financial Letter – double capital.

Source: Ambito