2022 started with many novelties: persistent inflation in the US, a rise in Federal Reserve rates and an upward explosion in commodities, influenced by the conflict between Russia and Ukraine.

Let’s see the performance of DBC, an ETF that replicates an index of commodities, made up of oil, natural gas, soybeans, corn, wheat, sugar, aluminum, copper, gold and silver, among others:

Bog1 17-7.png

We can see how the rise accelerated at the beginning of the year, since the war. However, commodities have not stopped falling for weeks, affecting one of the main strengths of emerging countries. Many depend on them.

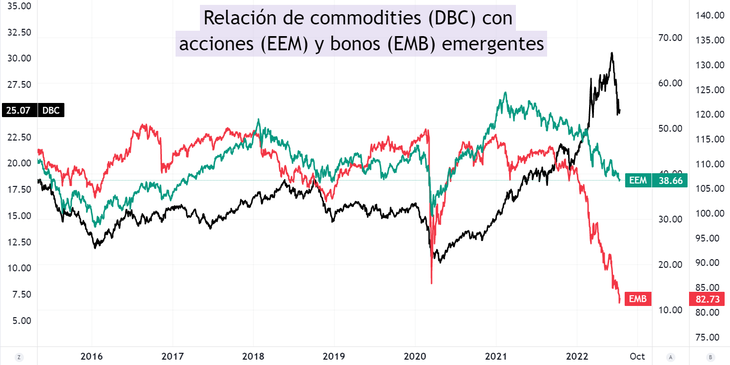

Let’s see the relationship between commodities and the stocks and bonds of emerging countries, measured through the DBC (index of commodities), EEM (ETF of emerging stocks) and EMB (ETF of emerging bonds):

Bog2 17-7.png

The behavior of commodities, shares and bonds of emerging countries was very similar during previous years. There was a great correlation, explained by the dependence that these countries have.

However, the big decoupling occurred at the beginning of 2022: while EEM and EMB started to fall, DBC rose strongly. Why? Due to the consequences of the war between Russia and Ukraine.

Something remarkable was what happened for several weeks. Commodities (black line) began to fall. This accelerated the fall in emerging stocks and bonds, which already had a very complicated 2022, along with the entire market.

What happened to see such a drop in the price of commodities?

It could be summed up in just one word: recession. It is worth clarifying that the US is not yet in a recession, but the fears are visible. Since June, the fall is brutal: soybeans (-11%), corn (-14%), wheat (-24%), oil (-17%), natural gas (-25%), copper (-26%) , to name a few examples.

High inflation in the US forced the Federal Reserve to take a more restrictive stance. In addition, this week a new record of 9.1% year-on-year was confirmed, which raises more suspicions about a more aggressive rate hike.

In this context, the US dollar strengthened globally, generating a devaluation of emerging currencies. This further harms the performance of commodities and makes it difficult to repay the debt in dollars that these countries have. Lethal combo, right?

So, while at the beginning of the year there was talk of inflation, the outlook for commodities (and therefore for emerging countries) was positive. But the story was mutating towards stagflation: inflation with recession.

In this new context, the inflation expectations expected by the market calmed down, marking a new low (2.3%) in recent months. How can it be that the market waits 10 years for inflation that is so much lower than the current one? It is simply explained by the fear of a recession: this would calm demand, helping prices fall.

In a world that is more risk averse, the stocks and bonds of emerging countries are suffering dramatic falls. Furthermore, if the signs of a recession begin to confirm, it could only be the beginning. To be careful.

To finish, I want to invite you to download for free a report that I prepared with three simple secrets to discover winning actions. You can download it at this link: Financial Letter – commodities.

Source: Ambito