image.png

Tesla accumulates a 40% drop from its highs last year. He corrected on par with the entire market. Why? Because the Federal Reserve had to take a more restrictive stance, thus hurting the valuations of companies, especially technology ones.

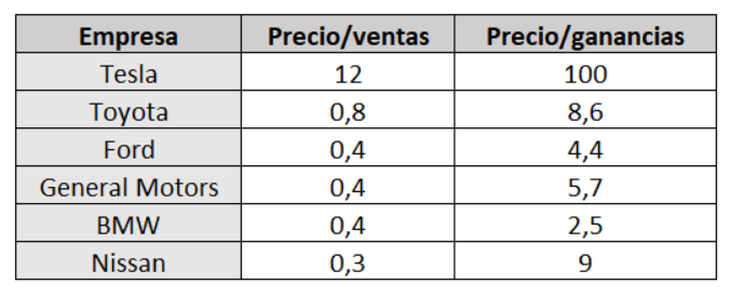

Clearly no one questions the benefits of Tesla as a company. The debate is about its valuation: Tesla is worth 12 times its sales and 100 times its profits. Is it sustainable? Unlikely.

The market does not classify Tesla as a traditional car company, since if it were, its valuation would have to be much lower.

For reference, we can see the valuation metrics of the world’s leading automakers:

image.png

The abysmal difference is incredible, beyond the fact that Tesla is not a traditional car company.

recent balance

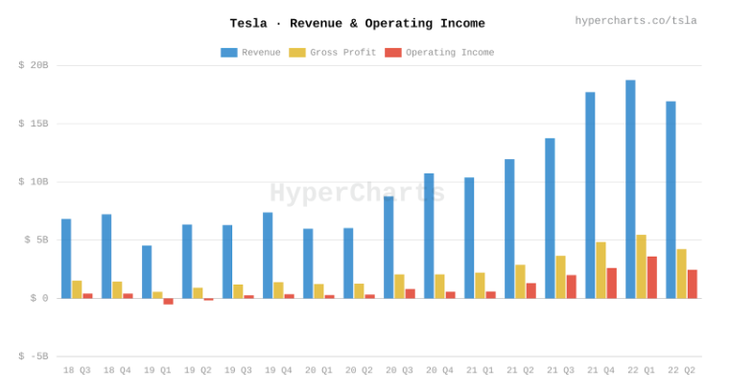

Tesla presented its quarterly results, with sales of USD 16,930M, in line with expectations.

Let’s see the evolution of their sales:

image.png

your sales (light blue bars) fell from the previous quarter and cut the streak of four consecutive quarters on the rise. Although it is worth clarifying that they grew by 42% year-on-year, a really remarkable figure.

Also, decreased its gross margin (yellow bars), mainly affected by inflation. Operating profit (red bars) was USD 2,260M, also lower than the previous balance, but much higher compared to the same quarter of 2021.

The market came out to celebrate the growth of Tesla, with a rise of 10% in its shares during Thursday, the day after the balance.

And your bitcoins?

Tesla sold nearly $1B worth of bitcoins in the last quarter. This figure represents 75% of its original holding.

Why did they sell? Because of the problems in the production of cars that they had in China, due to confinements by the Covid. So they prioritized having greater liquidity.

Logically, this had an impact on the price of bitcoin, which as soon as the news came out began to fall. Clearly, it’s not a good sign for bitcoin that Elon Musk’s company has divested almost all of its investment.

conclusion

Tesla continues to grow, but is already showing warning signs. In a world that may enter a recession and with increasingly fierce competition, Tesla may have a difficult path.

Despite its big drop from highs, Tesla continues to have very high valuations. The expectation is still great, that’s why you have to be careful.

To finish, I want to invite you to download for free a report that I prepared so that you can face this global crisis and have the tools to know how to beat the market. You can download it at this link: informe.cartafinanciera.com

Source: Ambito